2023 Financial Professional Social Security Webinar Poll Results

46%

of financial professionals initiate Social Security conversations with clients1

82%

of financial professionals are not very confident providing Social Security guidance2

Top 3 Questions Clients Ask About Social Security1

When should I file for benefits?

70%

How do I maximize my benefit?

13%

How much will my spouse get?

8%

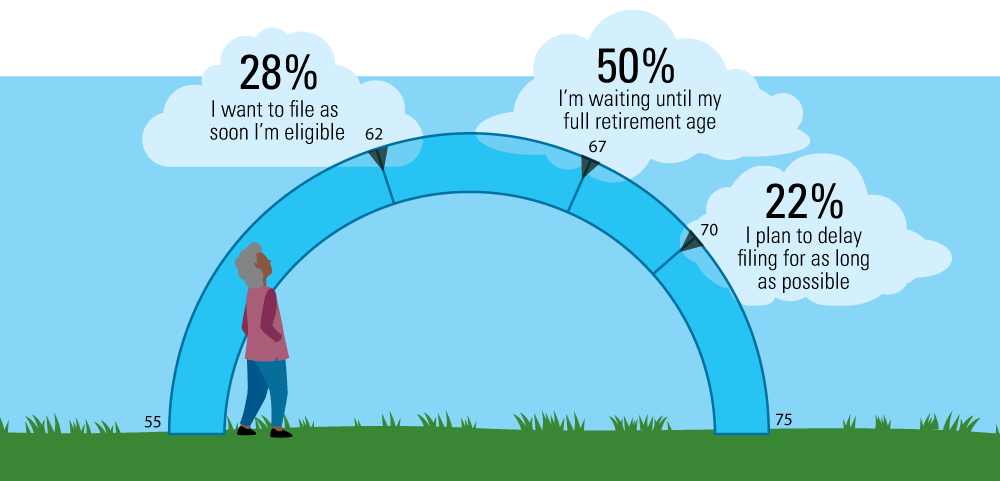

What Characterizes Most of Your Clients’ Attitudes About Filing For Social Security?2

of clients would change their financial professional if they couldn’t help the client maximize their Social Security3

of consumers failed a

basic Social Security quiz4

How to Start a Social Security Conversation With Clients

A 2022 survey found that a whopping 75% of clients would change financial professionals if they couldn’t help them maximize their Social Security retirement benefits. Many clients have no idea how much money they can count on from Social Security once they retire. So, chances are, your clients would like you to provide Social Security guidance. But many financial professionals are reluctant to discuss Social Security with their clients because these conversations can quickly become complicated.

Let’s discuss how using the my Social Security website is an easy way to have Social Security conversations with clients without drifting into too much complexity.

First, What’s my Social Security?

It’s a free and secure Social Security website that provides clients access to their personal Social Security information, including their earnings history and estimates of their current and future benefits. Plus, clients they can get estimates for their spouse’s benefits too.

Second, How Financial Professionals Can Use It

Before you introduce the my Social Security website with clients, check it out for yourself. Create an account and look around.

Once you’re familiar with the site, mention it to a client.

Ask your client:

Do you use the my Social Security website?

If they have, congratulate them since most people aren’t familiar with it. Ask these clients if it’s helped them think about when they’re going to file for their Social Security benefits.

If a client hasn’t set up a my Social Security account, ask:

Do you want to check it out? It’s cool. It’s got a neat little gadget that shows what your monthly Social Security benefits could be based on various ages you could choose to file for benefits.

It also shows your earnings history. Make sure that’s accurate, because your earnings history is used to calculate your benefit amount.

If your client is interested, help them set up their account.

Once they log in, focus on the Eligibility and Earnings section. You might say:

Let’s check out your earnings history. (Click on the link “Review Your Full Earnings Record Now.”) Does everything look accurate?

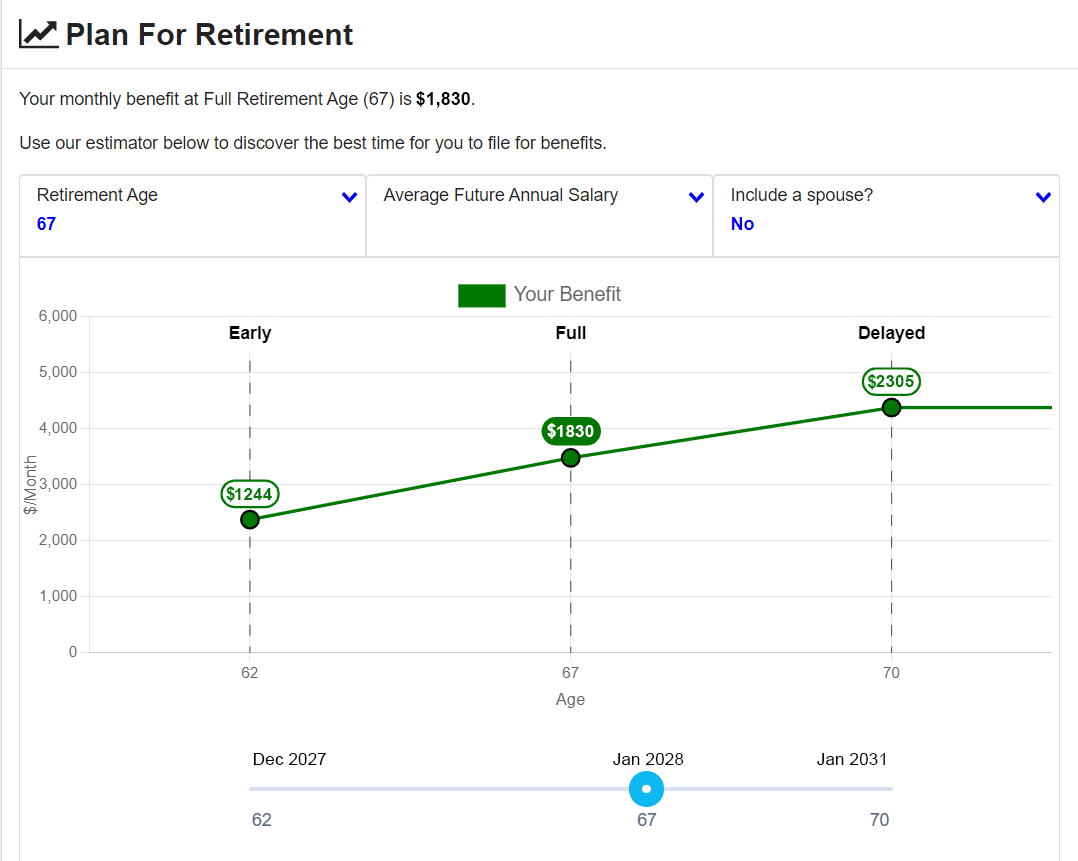

Then go to the “Plan for Retirement” section (see screenshot below). Provide explanations for Early, Full, and Delayed benefits:

We can drag this slider to see what your individual benefit would be depending on the age you file. That’s cool.

After you’ve shown them how their filing age impacts their benefit amount, discuss how the different benefit amounts would fit into their retirement financial plan. For example:

In the past, we used ballpark Social Security benefit estimates in our financial planning tool. Now that we have benefit estimates from this source, we can plug one of these benefit amounts into our planning tool to see how it affects your financial plan.

You can also show the client the effect of their other benefit estimates.

Taking the time to go through this process with a client shows you’re interested in helping them tailor their Social Security benefits to their individual circumstances.

Using this interactive tool in my Social Security, clients see various benefit amount benefits based on when they choose to start their benefits. You can drag the blue circle at the bottom left or right to see how starting benefits earlier or later affects their benefit amount.

Note: Numbers above are hypothetical

Third, What to Do if You Don’t Have an Answer to a Client’s Question

If a client has questions or brings up scenarios that go beyond your level of Social Security expertise, it’s OK to tell them so. But let them know you can help them find the right resources to help with their questions.

You could refer them to a trusted tax professional or let them know they can call their local Social Security office. They have people that can help with complex Social Security questions. You can find your local office info by Googling “Social Security Office Locator.”

Ask three clients this week if they’ve used the my my Social Security website.

1 Hartford Funds Social Security webinar poll, Feb. 2022

2 Hartford Funds Social Security webinar poll, Feb. 2023

3 Now is the time to optimize Social Security planning, Nationwide, June 2022

4 69% of people either failed or barely passed this Social Security quiz. Test your knowledge before you claim, CNBC, 2/2/23

All information provided is for informational and educational purposes only and is not intended to provide investment, tax, accounting or legal advice. As with all matters of an investment, tax, or legal nature, you and your clients should consult with a qualified tax or legal professional regarding your or your client’s specific legal or tax situation, as applicable.

The preceding is not intended to be a recommendation or advice.

This information does not take into account the specific investment objectives, tax and financial condition of any specific person.

This information has been prepared from sources believed reliable but the accuracy and completeness of the information cannot be guaranteed. This material and/or its contents are current at the time of writing and are subject to change without notice. This material may not be copied, photocopied or duplicated in any form or distributed in whole or in part, for any purpose, without the express written consent of Hartford Funds.

Hartford Funds does not control or review non-Hartford Funds sites nor does the provision of any link imply an endorsement or association of such non-Hartford Fund sites. Hartford Funds is not responsible for and makes no representation or warranty regarding the contents, completeness or accuracy or security of any materials on such sites. If you decide to access such non-Hartford Funds sites, you do so at your own risk.