- Individual Investor? Learn More Individual Investor? LEARN MORE >

-

ACCOUNT ACCESS

- FOR FINANCIAL PROFESSIONALS

- Mutual Fund Accounts

- Smart529 Accounts

- FOR INDIVIDUAL INVESTORS

- Mutual Fund Accounts

- Smart529 Accounts

-

CONTACT US

Pre-Sales Support

Mutual Funds and ETFs - 800-456-7526

Monday-Thursday: 8:00 a.m. – 6:00 p.m. ET

Friday: 8:00 a.m. – 5:00 p.m. ETPost-Sales and Website Support

888-843-7824

Monday-Friday: 9:00 a.m. - 6:00 p.m. ET- PHONE US MAIL US

- ADVISOR LOG IN

-

Products

- INVESTMENT RESOURCES

- Systematic ETFs

- Model-Delivery SMAs

- The Hartford SMART529 College Savings Plan

- VIEW FUNDS BY ASSET CLASS

- Taxable Bond

- Domestic Equity

- International/Global Equity

- Tax Advantaged Bond

- Multi Strategy

-

Insights

- Market Perspectives

- Equity

- Fixed Income

- Global Macro Analysis

- Strategic Beta & ETFs

- Investor Insight

- The Future of Advice

- Navigating Longevity

- Investor Behavior

- See all Investor Insights

- Investment Strategy

- Global Investment Strategist

- Fixed-Income Strategist

- Informed Investor

- Practice Management

- Resources

- About Us

-

-

A separately managed account (SMA) is a portfolio of individual securities managed independently on your behalf by a professional asset-management firm. With an SMA, investors benefit from direct ownership of securities versus investing in a mutual fund or ETF, where your money is pooled with that of other investors.

With a traditional SMA, you invest directly with the asset manager who tailors a portfolio to meet your individual investment objectives. A models-based SMA allows you to invest in SMA programs available at third-party managed account platforms. With this structure, the asset manager provides a portfolio model to the managed account provider, who takes on full responsibility for trading and reporting.

Your financial professional can help determine the investment that is right for you.

Key Differences Between Separately Managed and Pooled Accounts

SMA Mutual Fund ETF What Investors Own Individual securities Shares of the pooled fund Shares of the pooled fund Transparency Robust access to holdings and transaction history Governed by prospectus Daily holdings access Minimum Investment Typically $50,000 to $250,000 Typically $2,000 The price of the ETF’s shares Oversight Asset Manager/ Managed Account Provider Board of Trustees Board of Trustees -

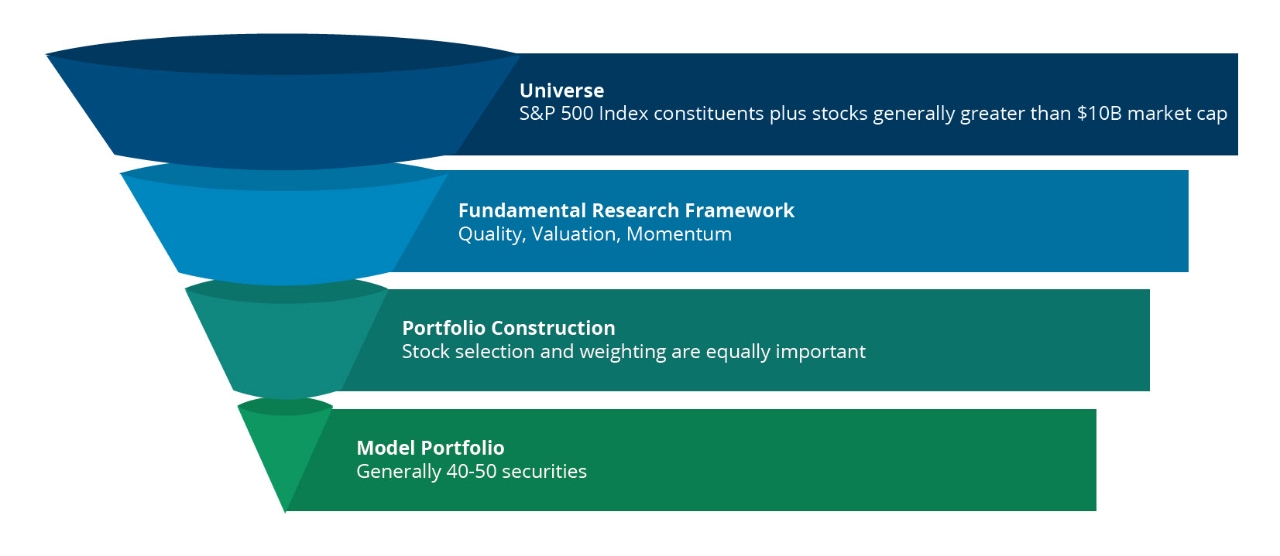

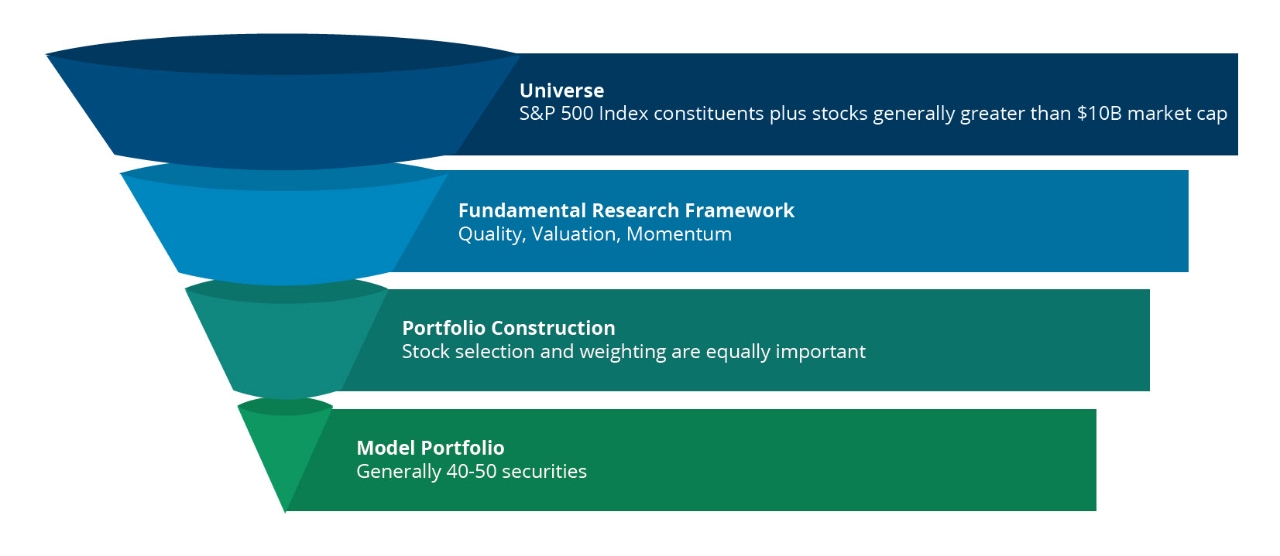

Hartford Core Equity SMA Strategy seeks growth of capital by investing predominantly in US large-cap stocks. The strategy is available in a model-delivery format at select third-party managed account programs.

The strategy’s investment philosophy is based on the following core beliefs:

• Improvement in the quality of company fundamentals is often a powerful signal

– Company is becoming more competitive

– Growth and profitability are experiencing a positive inflection

– Company is typically earning higher returns• Fundamental improvement tends to persist

– Business momentum can lead to a cycle of innovation

– Taking a longer view helps capture this improvement• Individual stock outcomes are typically wider than expected

– Need to incorporate into position-sizing decisionsInvestment Process

Central to the investment process is in-depth, fundamental research focused on uncovering companies with improving quality metrics, business momentum, and attractive relative valuations.

Model Guidelines

• Maximum exposure to an individual company is generally the greater of 5% of market value, or its weight in the S&P 500 Index plus 2%.

• Targets a lower risk profile compared to the S&P 500 Index.

• Sector exposures are unconstrained. Generally seeks to maintain at least a 2% cash position, implemented at the time of model trade recommendations.

• Will not utilize primary market equity issuance (IPOs) or any illiquid securities.

Investment Management

Hartford Funds Management Company, LLC offers non-discretionary security recommendations in the form of model portfolios. The strategy is managed by the following team from Wellington Management LLP, which serves as the Model Provider.

Senior Managing Director

Equity Portfolio Manager

Professional Experience Since 1996

The portfolio managers are supported by the full resources of Wellington

-

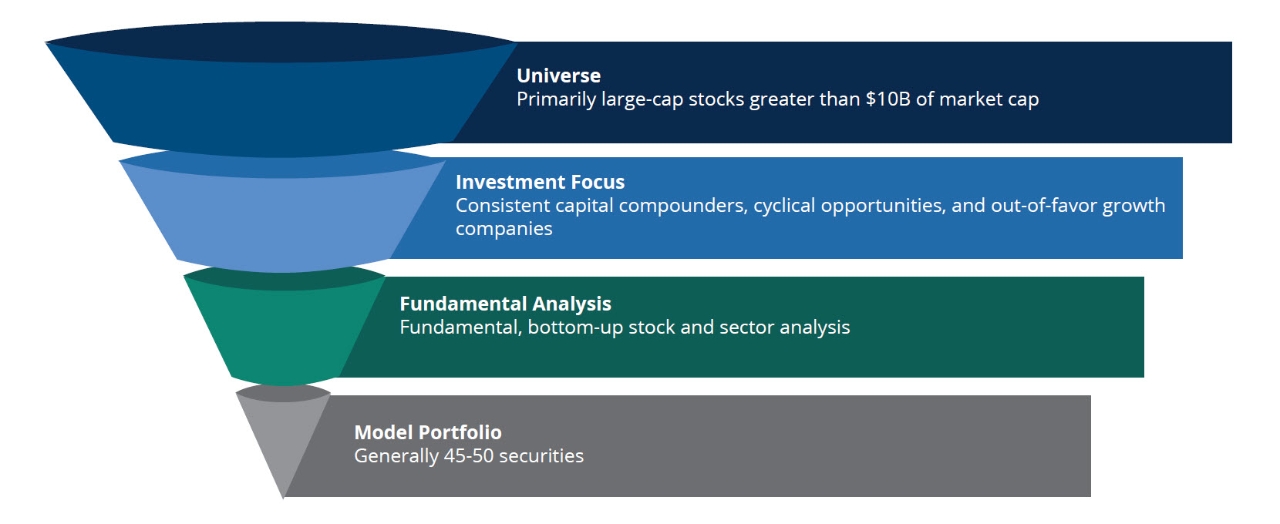

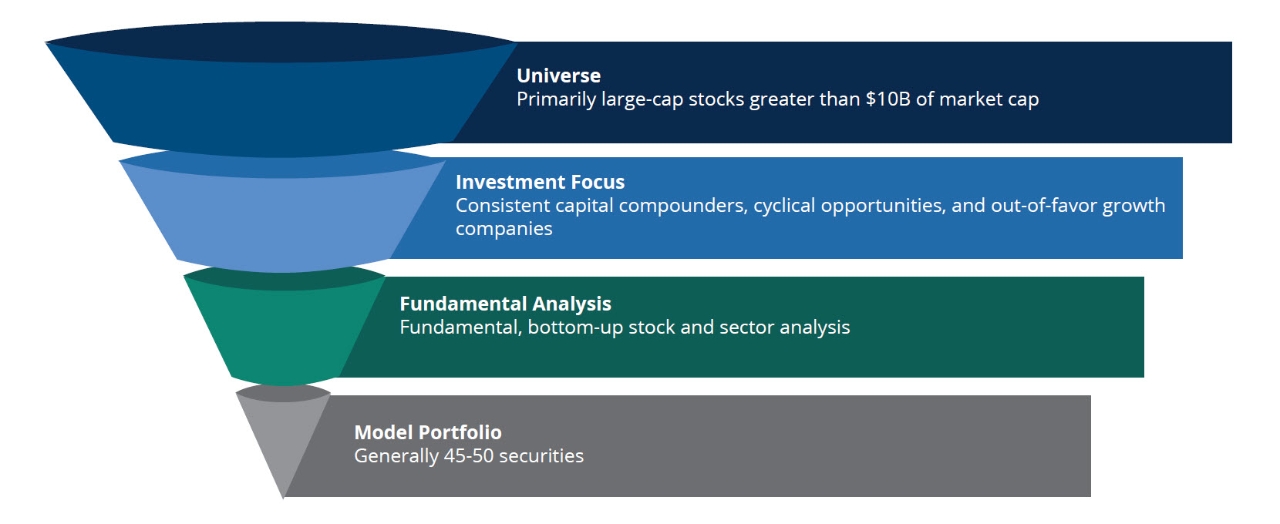

Hartford Dividend and Growth SMA Strategy seeks a high level of current income consistent with growth of capital. The strategy is available in a model-delivery format at select third-party managed account programs.

The strategy's philosophy is based on the following core principles:

• Emphasis on stable and growing free cash flow and capital return allows the managers to identify companies with future value creation potential

• By placing greater focus on the potential of future cash flows, the investment team can attempt to take advantage of price weakness caused by short term disruption

• Limiting downside volatility may be achieved by avoiding areas of speculation which are categorized by cyclical peaks, abnormally high returns, or stretched valuations

Investment Process

The managers seek to identify large-cap, quality companies through fundamental, bottom-up stock and sector analysis.

Model Guidelines

• Initial position size is typically 1-3%; maximum position size is generally 6.5%

• Sector exposures are generally +/- 10% or <2 times the weight of the S&P 500 Index.

• Generally seeks to maintain at least a 2% cash position, implemented at the time of model trade recommendations.

Investment Management

Hartford Funds Management Company, LLC offers non-discretionary security recommendations in the form of model portfolios. The strategy is managed by the following team from Wellington Management LLP, which serves as the Model Provider.

Senior Managing Director

Equity Portfolio Manager

Professional Experience

Since 1995

Senior Managing Director

Equity Portfolio Manager

Professional Experience

Since 1998

The portfolio managers are supported by the full resources of Wellington

-

A separately managed account (SMA) is a portfolio of individual securities managed independently on your behalf by a professional asset-management firm. With an SMA, investors benefit from direct ownership of securities versus investing in a mutual fund or ETF, where your money is pooled with that of other investors.

With a traditional SMA, you invest directly with the asset manager who tailors a portfolio to meet your individual investment objectives. A models-based SMA allows you to invest in SMA programs available at third-party managed account platforms. With this structure, the asset manager provides a portfolio model to the managed account provider, who takes on full responsibility for trading and reporting.

Your financial professional can help determine the investment that is right for you.

Key Differences Between Separately Managed and Pooled Accounts

SMA Mutual Fund ETF What Investors Own Individual securities Shares of the pooled fund Shares of the pooled fund Transparency Robust access to holdings and transaction history Governed by prospectus Daily holdings access Minimum Investment Typically $50,000 to $250,000 Typically $2,000 The price of the ETF’s shares Oversight Asset Manager/ Managed Account Provider Board of Trustees Board of Trustees -

Hartford Core Equity SMA Strategy seeks growth of capital by investing predominantly in US large-cap stocks. The strategy is available in a model-delivery format at select third-party managed account programs.

The strategy’s investment philosophy is based on the following core beliefs:

• Improvement in the quality of company fundamentals is often a powerful signal

– Company is becoming more competitive

– Growth and profitability are experiencing a positive inflection

– Company is typically earning higher returns• Fundamental improvement tends to persist

– Business momentum can lead to a cycle of innovation

– Taking a longer view helps capture this improvement• Individual stock outcomes are typically wider than expected

– Need to incorporate into position-sizing decisionsInvestment Process

Central to the investment process is in-depth, fundamental research focused on uncovering companies with improving quality metrics, business momentum, and attractive relative valuations.

Model Guidelines

• Maximum exposure to an individual company is generally the greater of 5% of market value, or its weight in the S&P 500 Index plus 2%.

• Targets a lower risk profile compared to the S&P 500 Index.

• Sector exposures are unconstrained. Generally seeks to maintain at least a 2% cash position, implemented at the time of model trade recommendations.

• Will not utilize primary market equity issuance (IPOs) or any illiquid securities.

Investment Management

Hartford Funds Management Company, LLC offers non-discretionary security recommendations in the form of model portfolios. The strategy is managed by the following team from Wellington Management LLP, which serves as the Model Provider.

Senior Managing Director

Equity Portfolio Manager

Professional Experience Since 1996

The portfolio managers are supported by the full resources of Wellington

-

Hartford Dividend and Growth SMA Strategy seeks a high level of current income consistent with growth of capital. The strategy is available in a model-delivery format at select third-party managed account programs.

The strategy's philosophy is based on the following core principles:

• Emphasis on stable and growing free cash flow and capital return allows the managers to identify companies with future value creation potential

• By placing greater focus on the potential of future cash flows, the investment team can attempt to take advantage of price weakness caused by short term disruption

• Limiting downside volatility may be achieved by avoiding areas of speculation which are categorized by cyclical peaks, abnormally high returns, or stretched valuations

Investment Process

The managers seek to identify large-cap, quality companies through fundamental, bottom-up stock and sector analysis.

Model Guidelines

• Initial position size is typically 1-3%; maximum position size is generally 6.5%

• Sector exposures are generally +/- 10% or <2 times the weight of the S&P 500 Index.

• Generally seeks to maintain at least a 2% cash position, implemented at the time of model trade recommendations.

Investment Management

Hartford Funds Management Company, LLC offers non-discretionary security recommendations in the form of model portfolios. The strategy is managed by the following team from Wellington Management LLP, which serves as the Model Provider.

Senior Managing Director

Equity Portfolio Manager

Professional Experience

Since 1995

Senior Managing Director

Equity Portfolio Manager

Professional Experience

Since 1998

The portfolio managers are supported by the full resources of Wellington

Important Risks: Investing involves risk, including the possible loss of principal. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies. ● For dividend-paying stocks, dividends are not guaranteed and may decrease without notice. ● The securities of large market capitalization companies may underperform other segments of the market. ● To the extent the strategy focuses on one or more sectors, the strategy may be subject to increased volatility and risk of loss if adverse developments occur. ● Value and growth investing styles may go in and out of favor, which may cause the strategy to underperform other equity strategies. ● Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political, economic and regulatory developments.