The Origins of Retirement

It wasn’t so long ago when a completely different idea of aging was taken for granted in the United States. Our current story of “old age” began in the second half of the 19th century. Though it was first told in a much different world than we live in today, it’s still the measuring stick we use.

The Union Army Pension, instituted in 1890, provided payments to American Civil War veterans and their wives when a recipient hit his 60s. Prior to its existence, retirement was not something aging workers looked forward to very much. It meant you weren’t too far away from death.

This pension provided the first indication that this norm might change and a subset of the population would voluntarily stop working before they were physically unable to continue.

A Problem to Solve

Society’s collective decision was to create a narrative in which there was a natural time for you to essentially get off the grid. For the younger people who were jockeying for your job, the notion was that only young, able bodies were needed to have a productive factory. Society was run the way you’d operate a mill.

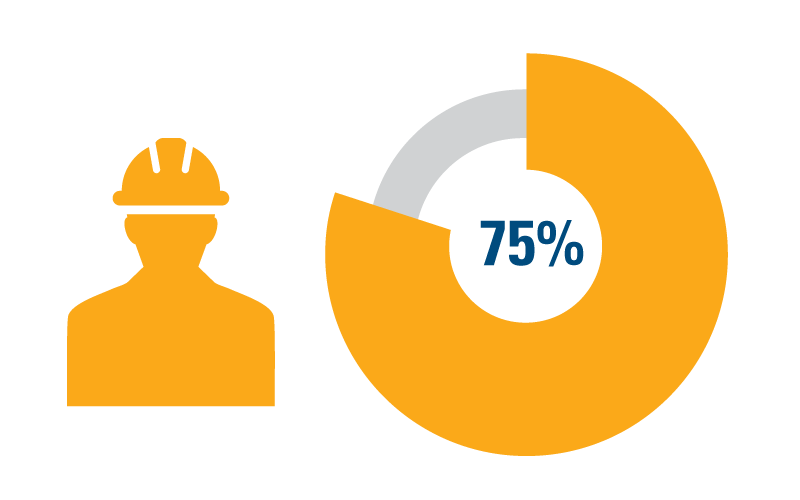

Business, industry, and the government wanted to justify moving people out of the workforce to make space for younger workers, so they started to create things, such as an official retirement age. This is when there began to be a scaling back of work, typically in a person’s early to mid-60s. This worker mindset continues today for all occupations.

Second, How We See “Old Age” Today

By the dawn of the 20th century, once you’d become visibly older, no matter your apparent health, no matter how sharp your mind seemed, all you could hope to do was withdraw and rest, saving your vitality for as long as you could. Crucially, you could no longer work; “old age” now changed you from an economic producer into a consumer.

This since-debunked idea soon wormed its way into every aging-related institution we now take for granted: the first government pensions, corporate retirement policies, and dedicated old-age homes.

Living Someone Else’s Story

As we started living longer, there were suddenly a lot more aging adults living on past their prime working days. The idea that this group is supposed to be consumers of ideas, work, products, and culture, but never producers of them has survived well into the 21st century. They’re always takers, never givers according to this story.

Aging adults now included people with time and money, so marketers created a desirable vision of leisure, travel, and retirement communities. And today, we still want that, because there is no equally compelling alternative. Despite the fact that we’re living longer and in more functional health than ever before, we’ve kept this story of “old age” going.

Retiring the 20th Century Vision

Because many of us can plan on two-plus decades of healthy life after we turn 60, full retirement is likely not going to arrive for a long time. Living 20 or 30 years after we totally stop working demands more than an occasional cruise or family visit.

Those who report positive well-being in retirement do far more than window-shop and sip coffee. They often work part-time, volunteer, or serve as mentors. Making such a world possible for more aging adults will demand a great deal.

We have to start thinking of aging differently, more expansively. Unfortunately, it’ll be a tough road ahead. Aging adults are a coveted target for marketers who want to sell their cure for “old age” over and over again.

Third, How You Can Create Your New Story

Good stories are constructed with five basic elements. These fundamental building blocks are necessary in creating a compelling narrative. The one you write about the rest of your life will be no different.