- Individual Investor? Learn More Individual Investor? LEARN MORE >

-

ACCOUNT ACCESS

- FOR FINANCIAL PROFESSIONALS

- Mutual Fund Accounts

- Smart529 Accounts

- FOR INDIVIDUAL INVESTORS

- Mutual Fund Accounts

- Smart529 Accounts

-

CONTACT US

Pre-Sales Support

Mutual Funds and ETFs - 800-456-7526

Monday-Thursday: 8:00 a.m. – 6:00 p.m. ET

Friday: 8:00 a.m. – 5:00 p.m. ETPost-Sales and Website Support

888-843-7824

Monday-Friday: 9:00 a.m. - 6:00 p.m. ET- PHONE US MAIL US

- ADVISOR LOG IN

-

Products

- INVESTMENT RESOURCES

- Systematic ETFs

- Model-Delivery SMAs

- The Hartford SMART529 College Savings Plan

- VIEW FUNDS BY ASSET CLASS

- Taxable Bond

- Domestic Equity

- International/Global Equity

- Tax Advantaged Bond

- Multi Strategy

-

Insights

- Market Perspectives

- Equity

- Fixed Income

- Global Macro Analysis

- Strategic Beta & ETFs

- Investor Insight

- The Future of Advice

- Navigating Longevity

- Investor Behavior

- See all Investor Insights

- Investment Strategy

- Global Investment Strategist

- Fixed-Income Strategist

- Informed Investor

- Practice Management

- Resources

- About Us

-

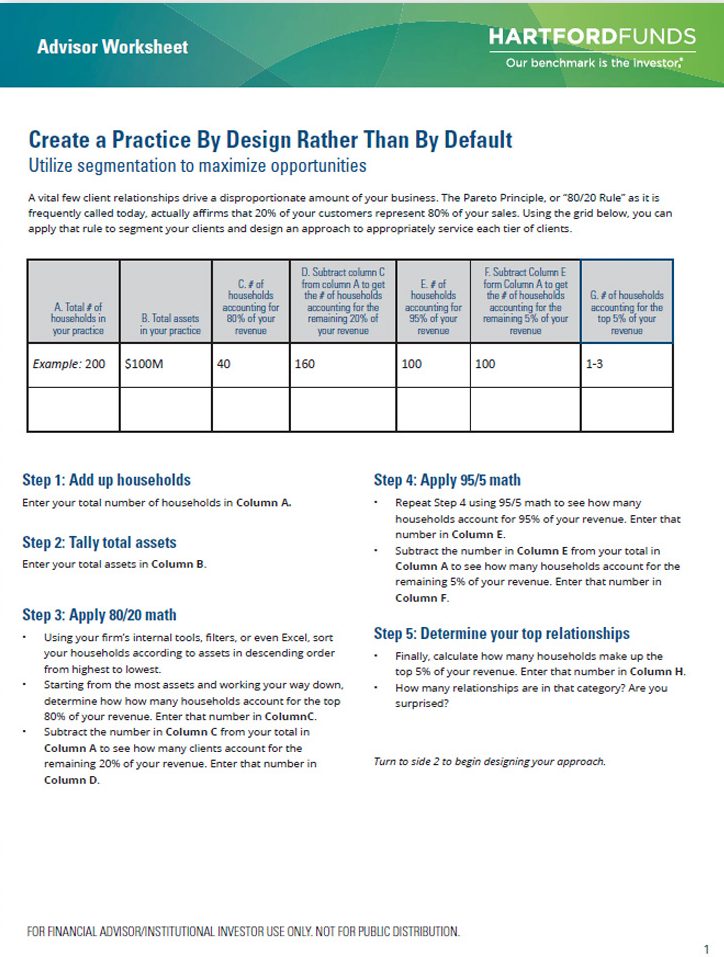

The 80/20 rule

In your practice, a vital few of your clients drive a disproportionate amount of your business. The Pareto Principle, or “80/20 Rule” as it is frequently called, affirms that 20% of your customers represent 80% of your sales. You can use this rule to your advantage to retain your best clients and acquire new ones, ultimately increasing your revenue.

Tip the scales in your favor

Many financial professionals build their practice by default—it just happens. But by leveraging your practice’s specific strengths, you can design, or redesign, your practice to create growth and retention. The first step is recognizing the 80/20 rule and creating a proactive, tiered service plan. You can do this in three ways:

- Playing Defense by protecting your biggest and best relationships—the "vital few"

- Playing Offense by replicating those vital few relationships

- Targeting and developing your most viable prospects, or "MVPs"

How to get started

Download the financial professional worksheet below. It will help you see if the 80/20 rule holds true for your practice. You can even take it a step further using the 95/5 rule, to see how many households account for 95% of your revenue. The worksheet will help you recognize your most valuable clients, which will help you design a tiered service plan. This in turn will help you to retain your best clients and acquire new ones.

Next Steps

| 1 | Download the Create a Practice By Design Rather Than By Default worksheet |

| 2 | Complete the grid on side 1 of the worksheet |