The frenzy surrounding US election cycles often causes investors concern about how their portfolios will fare under a Democratic or Republican administration. Perceptions, including beliefs about which political party will be better for investors, may overshadow their investment strategies. But a long-term look at the performance of the S&P 500 Index can help investors maintain perspective. Here are 10 reasons to consider staying the course during the next election.

|

It takes a village – The president is one of many factors that influence the market, and other influences may be stronger. Macroeconomic (macro) factors, such as interest rates, inflation, economic outlooks, policy changes, and wars may have more impact than who resides in the White House. |

|

Profits can be prophets – Yes, politics and policies can impact the stock market, but business profitability is a strong gauge that shouldn’t be ignored. Increased demand for goods and services boosts company profits and, ultimately, stock prices. Look to profitability to foreshadow what’s to come in the market. |

|

The Fed – The US Federal Reserve (Fed) controls interest rates. Interest rates are another key underlying factor, so watching what the Fed does will provide important information. When the Fed lowers rates, it makes it easier for companies to borrow and expand, which may help boost stock prices in the long run. |

|

Innovation is an influencer – Innovative companies can be even more of a force in the market than the White House. For example, the Magnificent Seven,1 a small group of large-cap technology companies, accounted for about 75% of the S&P 500 Index’s growth in 2024.2 |

|

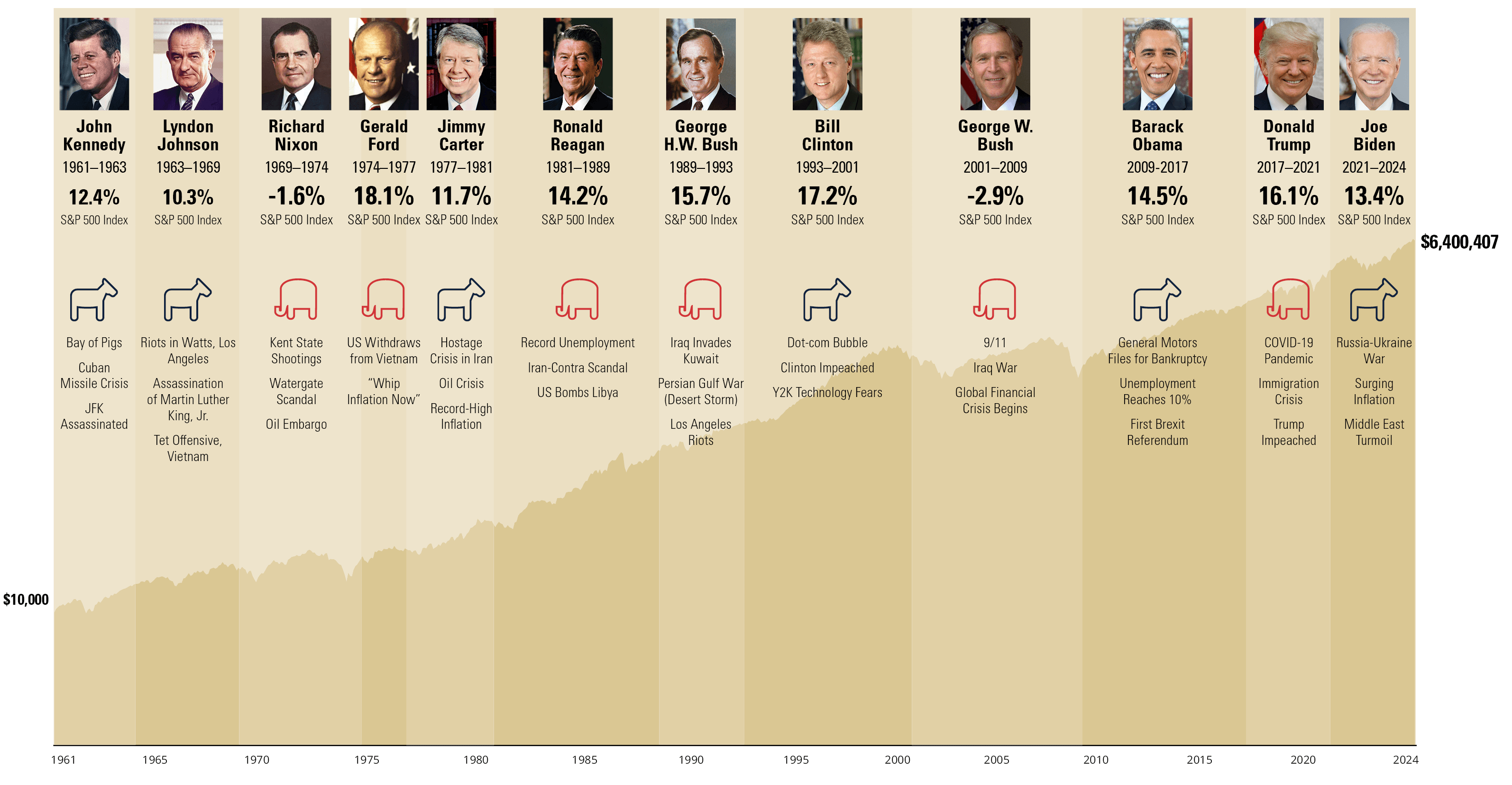

It’s not party time – Past performance in the market when a particular political party is in power doesn’t mean the same results will occur the next time that party is at the helm. In fact, this is one of the most common misconceptions about politics and the market. Stocks have done well in the long term with a mix of Democratic and Republican administrations (see below). |

|

Diversification is a powerful tool – Rather than trying to time the market around an election or political party, a diversified portfolio can help you build long-term wealth regardless of who’s in the White House or Congress. |

|

You play a role – When big events such as an election take place, they don’t automatically trigger market changes. Rather, the way investors react to the big news and the actions they take (or don’t take) can set in motion a sea of change. So it’s important to evaluate whether a new president or a party change in Congress will really cause dramatic market changes, or if other macro factors are more likely to influence the course. |

|

Policy changes take time – Proposed legislation must pass through the US House of Representatives, the US Senate, and be signed by the president to become law—a process that can take up to a year. A lot happens in the market in a year. |

|

History speaks – Election cycles, especially recent ones, are fraught with misperceptions, personal biases, and bad information. Dire predictions that a candidate’s policies will negatively impact a particular sector often prove to be wrong. The Affordable Care Act was expected to harm the healthcare sector, and healthcare stocks sold off as a result. In reality, the healthcare law created a new set of winners and losers within the sector on which astute investors were able to capitalize. |

|

Prudent investing is a healthy habit – Decisions made during election cycles can be driven by emotion rather than facts. Your financial professional can help you tune out the noise and make decisions that align with your financial goals so you’re better positioned for long-term success. |

Market Performance and Party Affiliation

A hypothetical $10,000 investment in the S&P 500 Index in 1961 would have grown to more than $6 million as of December 31, 2024.

A financial professional can help you build a portfolio that’s right for you regardless of what’s happening in Washington, D.C.

S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks. Past performance does not guarantee future results. Indices are unmanaged and not available for direct investment.

1 The Magnificent Seven stocks are a group of high-performing and influential companies in the US stock market: Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla.

2 Investopedia, “What To Expect from the Magnificent Seven in 2025,” 1/2/25.

Important Risks: Investing involves risk, including the possible loss of principal. Diversification does not ensure a profit or protect against a loss in a declining market.

This information should not be considered investment advice or a recommendation to buy/sell any security. In addition, it does not take into account the specific investment objectives, tax, and financial condition of any specific person. This information has been prepared from sources believed reliable but the accuracy and completeness of the information cannot be guaranteed. This material and/or its contents are current at the time of writing and are subject to change without notice.