The 80/20 Rule: A Key Ratio For Business Owners

In the late 19th century, in Italy, economist and philosopher Vilfredo Pareto observed that 80% of Italy's land belonged to just 20% of its population. Then that 80% of its healthy pea pods came from 20% of its pea plants. Obsessed with this ratio, he investigated industry and found that the principle stuck. Generally, 80% of output is generated by 20% of input. This principle holds true today.

In your practice, 80% of your revenue comes from 20% of your clients. In other words, a vital few of your clients drive a disproportionate amount of your business.

Skeptical? Apply The Ratio Yourself

While many financial professionals are aware of this rule, but they're not tailoring their practice to fit. Use your firm’s internal tools, filters, or even Excel to sort your households according to assets, in descending order, from highest to lowest. Starting from the most assets and working your way down, determine how many clients account for the top 80% of your revenue.

Next, subtract the number from your total number of clients to see how many clients account for the remaining 20% of your revenue.

Does the 80/20 rule hold true in the context of your practice?

The 95/5 Rule

Even if you have applied the 80/20 rule to your practice, you may not have gone to the second iteration of the rule—the 95/5 Rule.

If you peel back the layers more and apply the 95/5 rule, you will notice that, generally speaking, the top 50% of your clients account for 95% of your revenue, while the bottom 50% of your clients account for 5% of your revenue. Furthermore, your top one to three relationships will likely account for the top 5% of your overall revenue.

Did you notice a pattern? Regardless of the ratios you use, there is an imbalance of life’s outputs and a limited amount of inputs.

Play Defense: Protect The Top 20%─Or Your “Vital Few”

Because so few of your clients make up such a disproportionate amount of your business, it’s critical that you protect your biggest and best relationships. Here’s how:

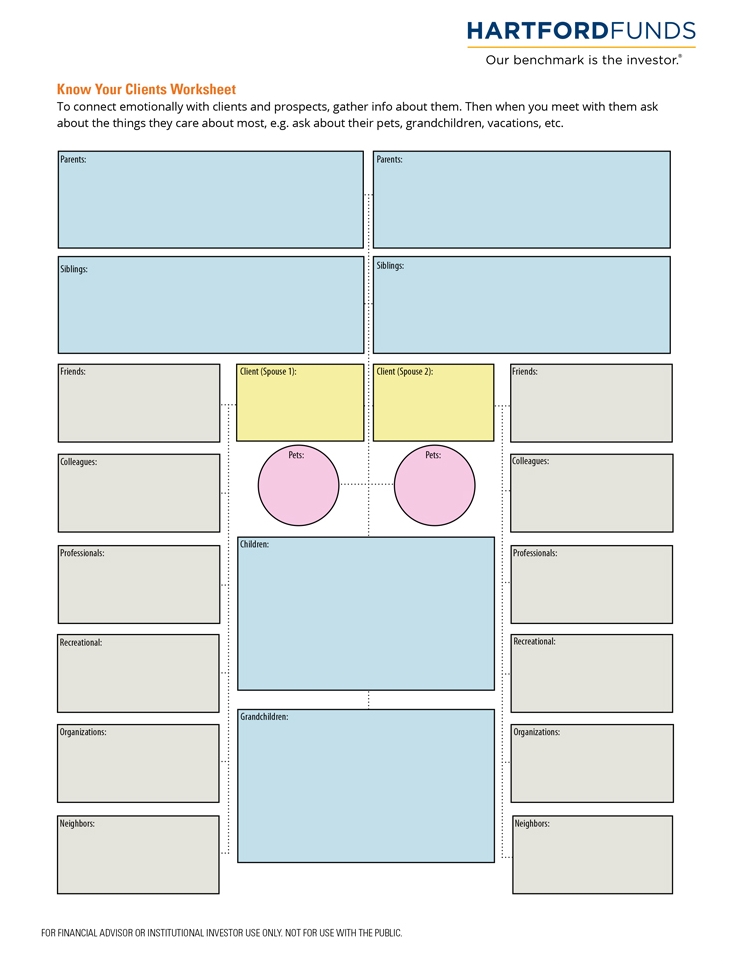

- See your clients as people first, not just customers

Remember the acronym “FORD.” It stands for Families, Occupation, Recreation, and Dreams. These are the things that matter to your clients and are central to their lives, and you should know what they are for each client. Work with your team to ensure there’s a system in place to capture and collect this type of information, and incorporate it during subsequent conversations.

It’s often said that that people don’t care how much you know until they know how much you care.

- Stay in touch

Continuously and consistently communicate with your top clients, assuring them that you’re prepared for whatever the markets may bring. When headlines are ominous or the markets become rocky, you don’t want clients calling you first for reassurance. Instead, reach out and remind them that together you already have a strategy in place to weather the storm. Also, contact your top three clients consistently in a non-sales format.

- Strengthen your relationship with beneficiaries

Your book of business is aging. Do you know your clients’ children or beneficiaries? If not, ask your clients what they think would be the best way for you to meet them. If your client is comfortable, consider engaging these beneficiaries in planning conversations, or simply let them know you’re an available resource. Begin to establish those relationships and begin to position yourself as a trusted, dependable financial professional now or when the inevitable wealth transfer occurs.

By segmenting your clients in this fashion, you can begin purposefully servicing each tier.

How Use The Ratios To Your Advantage

Employing the ratios in your practice will help you play Defense, Offense, and choose your MVPs, or Most Valuable Prospects. Only Defense was covered in this article, but you can find out more about the other two strategies by downloading our financial professional worksheet and by listening to our webinar replay. (You can do both at the end of this article.)

Be Intentional

Many financial professionals build their practice by default—it just happens. But by leveraging your practice’s specific strengths, you can design, or redesign, your practice to create growth and retention. The first step is recognizing the 80/20 rule and creating a proactive, tiered service approach to your business.

Next Steps

| 1 | Download the "Create A Practice By Design Rather Than By Default" worksheet |

| 2 | Complete the grid on the worksheet |

| 3 | Contact your Hartford Funds advisor consultant about hosting a client event |