You know that prospecting is critical to growing your business, but many financial professionals struggle to continuously find good prospects. They might feel as though they’ve exhausted all their opportunities or just don’t know where to look anymore. Cold-calling is outdated, direct mail campaigns are expensive, and hosting a sizeable client event isn’t an option right now.

It’s Possible to Find an Endless Stream of Prospects

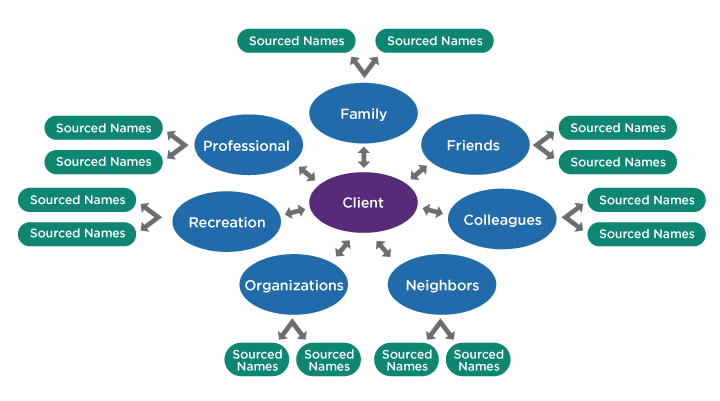

Oechsli, renowned experts in affluent client acquisition, has created a prospecting model called the seven spheres influence. By discovering top clients’ connections in seven categories, you can actually multiply the number of prospects in your pipeline.

What Are the Seven Spheres of Influence?

The seven spheres of influence are seven distinct groups of people that are connected to your clients. These groups are:

- Family

- Organizations

- Friends

- Recreation

- Colleagues

- Professional

- Neighbors

When you use this approach you’re not starting from scratch or blindly choosing prospects. The model provides a map of where potential prospects exist. Chances are, at least one or two people within each group will fit your ideal client profile.

How To Apply This Approach

First you need to source names. This means uncovering names of people within clients’ seven spheres. If there are clients you know pretty well, you and your team can put your heads together and think about prospects associated with those clients. But in many cases, you’ll need to source those names by talking to your clients.

Don’t worry, though—this can easily be done during a casual conversation with natural, non-intrusive questions. You’re not asking your client, “Who do you know?” That’s the approach that nobody likes.

Sample Questions Related to the Spheres

- Family sphere: “Who will you be spending time with over the holidays, Matt?”

- Organizations sphere: “Who else is on the board with you at the art museum?”

- Recreation sphere: “Matt, who’d you play golf with last weekend?”

In this scenario, if your client says, “My colleague Stephen and I played a round of golf on Saturday,” jot down Stephen’s name because Stephen is now a new prospect. But don’t do anything else—yet.

Once You’ve Sourced a Prospect’s Name, Refrain From Immediately Asking Your Client to Introduce You

Instead, wait a couple weeks to arrange the introduction. Then reach out to your client to say, “Matt, we’re looking to get a foursome together for golf next Saturday. Would you like to join us? (Pause.) Do you think your colleague Stephen would be interested?” This doesn’t feel forced. And the result? You get to meet Stephen.

You can also try one of these approaches when asking your client for introductions:

- Direct: “Matt, I’d like to meet your colleague Stephen. What would be the best way for us to get together socially?”

- Two-Step Indirect: “Matt, you mentioned you spend a lot of time with Stephen outside of work. Does he know that we work together? I’d love the opportunity to meet him.”

- Social: “Matt, why don’t you invite Stephen and his wife to our club’s wine tasting this Friday night?”

They’re just three of the 10 strategies for requesting introductions that you’ll find in The Affluent Mindset, a financial professional workbook created in collaboration with Oechsli.

There’s a Secret to Arranging Personal Introductions

Planning for these introductions to take place in a relaxed atmosphere, or while engaged in an enjoyable activity, is the secret to avoiding awkwardness. If you’re unable to meet in person initially, consider hosting a virtual trivia night or wine tasting.

When you meet new prospects, it’s not a time to sell your services. Your only goal is to connect with them on a personal level, develop a rapport, and build trust. It’s far easier to do that when everyone’s at ease.

New Prospects Are Closer Than You Think

Sourcing names using the seven spheres of influence, and then thoughtfully requesting introductions, dramatically increases prospecting potential. There’s less pressure on everyone and it avoids the salesy approach that can turn off affluent clients. As you turn new prospects into clients, you can replicate this approach with them.

Next Steps

- Download “The Affluent Mindset” workbook for more affluent prospecting ideas

- Choose an affluent client and identify prospects in three of their spheres

- Arrange three introductions to identified prospects

Oechsli is not an affiliate or subsidiary of Hartford Funds.