| Take Full Advantage of Tax Benefits Earnings within your 529 plan grow free from federal taxes. Furthermore, as long as the money withdrawn from your plan is used for qualified expenses at an eligible institution, no federal taxes will need to be paid on these earnings. This is a compelling reason to continue saving through your 529 plan. Non-qualified withdrawals are taxable as ordinary income to the extent of earnings and may also be subject to a 10% federal income tax penalty. Such withdrawals may have state income tax implications. |

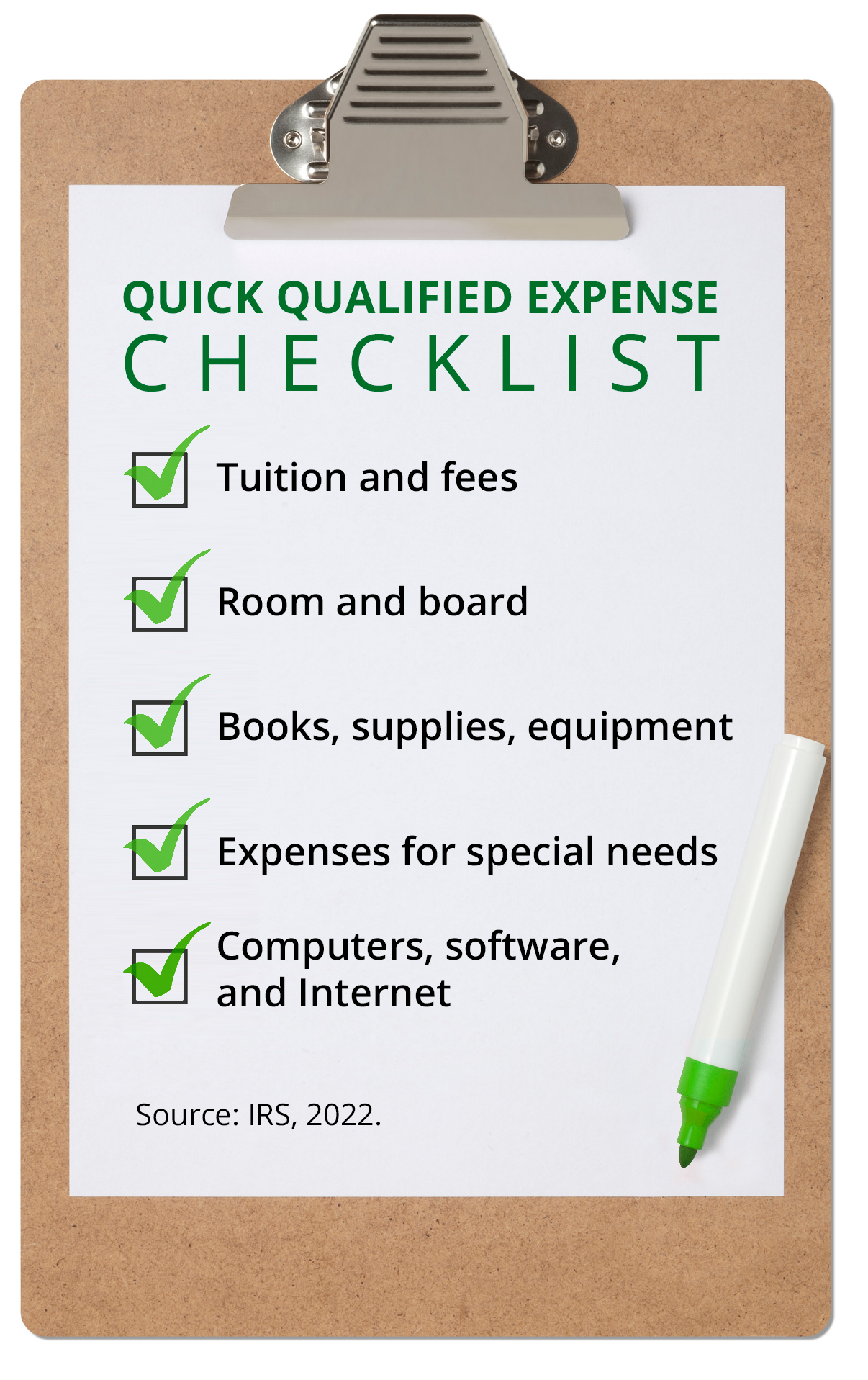

| Save Enough to Cover Eligible Expenses While you probably know that your 529 plan savings can be used to pay for college tuition, you may not realize that it can also help pay for other qualified school-related expenses such as fees, books, supplies, computer equipment, and room and board. Some room and board charges are quite high, so you may want to up your savings rate to cover eligible expenses beyond tuition costs. |

| Traditional College Expenses Plus More Your 529 plan dollars can be used for traditional four- and two-year college expenses, accredited vocational and trade schools, as well as graduate and doctoral programs. If your child is thinking about obtaining a graduate or doctoral degree, you may wish to contribute more to your child’s 529 plan. |

| Expecting? You Can Start Saving Now If you have another child on the way, consider setting up a 529 plan for this child. Starting early with your 529 college savings plan means that your investments will have more time for potential growth. Investment returns are not guaranteed, and you could lose money by investing in a 529 plan.

Taxes on earnings are deferred while they remain in the plan and they can be withdrawn on a tax-free basis as long as they are used for qualified educational expenses.

|

| Protection in Bankruptcy Has the volatile market caused severe financial distress for you and your family? If so, keep in mind that federal law provides creditor protection for 529 plans under the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA). Deposits made up to two years prior to a bankruptcy filing are protected up to $5,000 per beneficiary. It’s important to note that the creditor protection for 529 plans provided by BAPCPA is not related to the creditor protection offered by state statutes. Furthermore, account owners who apply for protection may receive it from one of those two sources, but not both. Please consult your tax or legal professional for specific information. |

| Family and Friends Can Help Save When family members and friends ask about ideas for birthday presents and holiday gifts for your child, don’t forget to mention your child’s 529 savings plan. Contributing to your child’s college savings plan is a practical, meaningful gift that your child will appreciate into adulthood. |

| More Than One Plan Can Be Established A family member or friend may also establish a separate 529 plan for your child. For example, grandparents often opt to do this. As account owners, they can make decisions about the plan’s investments and beneficiaries. Possible estate tax benefits are associated with this option, which may be an attractive consideration. A tax expert should be consulted regarding details on this subject. |

| Convenient Ways to Save 529 offers convenient saving options. You may make a single lump sum investment, send contributions in check form at any time, or save regularly through the 529 Automatic Investment Program. |

| K-12 Effective January 1, 2018, as part of the Tax Cuts and Jobs Act, up to $10,000 per student can be withdrawn annually to pay for private K-12 education.*

* Qualified-expense status varies by state for withdrawals used for K-12 education. Non- qualified withdrawals are taxable as ordinary income to the extent of earnings and may also be subject to a 10% federal income tax penalty.

|

| Apprenticeships and Student Loans Effective January 1, 2019, as part of the Setting Every Community Up for Retirement Enhancement (SECURE) Act, the benefits of 529 plans were expanded to include some student loan repayments ($10,000 lifetime max per beneficiary) and certain costs associated with apprenticeship programs.*

* Qualified-expense status may vary by state for withdrawals used to repay student loans or to pay for apprenticeship costs. To be considered a qualified 529 plan expense, an apprenticeship program must be registered and certified with the Secretary of Labor under section 1 of the National Apprenticeship Act. Non-qualified withdrawals are taxable as ordinary income to the extent of earnings and may also be subject to a 10% income tax penalty.”

|