International equities started 2025 on a strong note, in stark contrast to the US equity dominance that had been in place for the past decade. But is this a short-term shift in performance leadership, and merely a temporary response to current conditions? In my view, these five potential drivers could lead to persistently strong performance for international equities.

1. AI Reset: Markets were surprised in early 2025 when several Chinese firms claimed to have made breakthroughs in their AI capabilities. Up to that point, the consensus was that delivering competitive generative-AI solutions required access to cutting-edge chips and substantial electrical power.

China’s Deepseek, and later Alibaba and Tencent, claimed they were able to produce competitive generative-AI systems despite having limited access to state-of-the-art semiconductors due to sanctions. Their solutions also required a small fraction of the power needed by their Western counterparts.

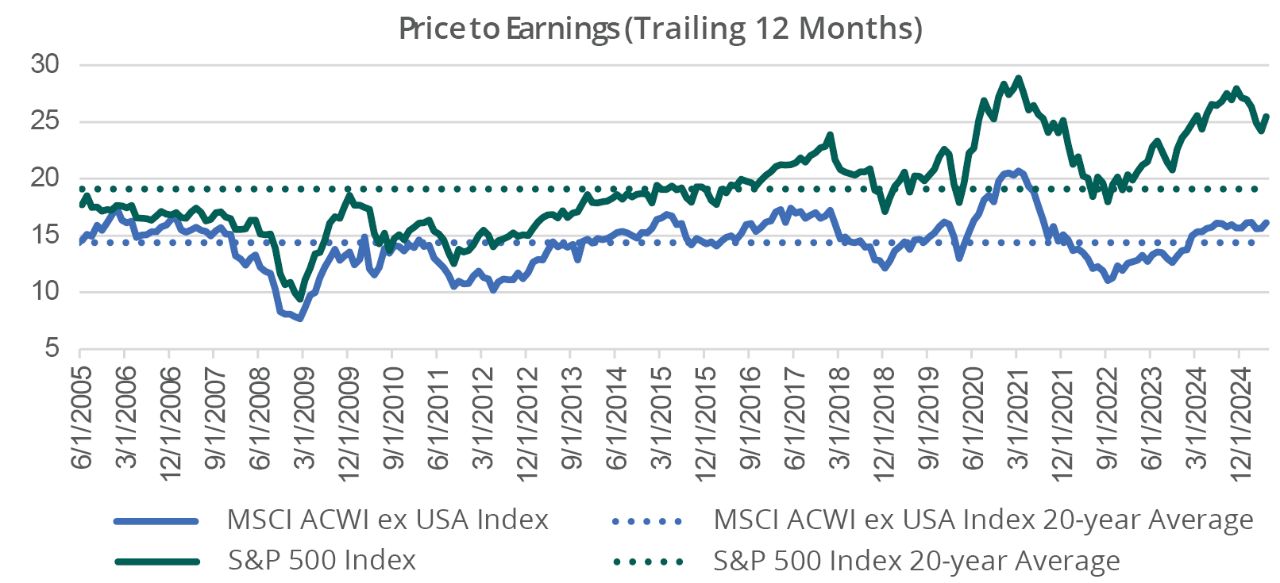

If these claims prove true, it could ultimately lead to investors rethinking their outlook for big US tech players in the AI space, as well as firms down the AI value chain (such as data-center builders, wiring providers, and electric utilities, among others). The winners could expand beyond the handful of domestic companies to include many international players (FIGURE 1). Lower-cost AI solutions could be a key catalyst for democratizing the technology and rapidly expanding adoption, bringing its benefits to a broader audience and at a faster pace.