1 Spreads are the difference in yields between two fixed-income securities with the same maturity but originating from different investment sectors.

2 The yield curve is a line that plots interest rates of bonds having equal credit quality but differing maturity dates; its slope is used to forecast the state of the economy and interest-rate changes.

3 The term premium is the amount by which the yield on a long-term bond is greater than the yield on shorter-term bonds. This premium reflects the amount investors expect to be compensated for lending for longer periods.

4 Stagflation is an economic cycle characterized by slow growth, inflation, and signs of labor market weakness.

5 As of 11/30/25. Equities are represented by the MSCI ACWI Total Return Index, which is a free float-adjusted market capitalization index that measures equity market performance across global developed and emerging markets (net of dividend withholding tax), returned 21.07%. Bonds are represented by the Bloomberg Global Aggregate Total Return Index, which provides a broad-based measure of global investment-grade fixed-rate debt markets, returned 16.15%. Commodities are represented by the Bloomberg Total Return Commodity Index, which measures the performance of a broad group of commodity futures such as energy, metals, and agriculture, returned 7.89%. Data Source: Refinitiv.

6 Duration is a measure of the sensitivity of an investment’s price to nominal interest-rate movement.

7 Multiples expansion occurs when equity valuations rise because investors assign higher price-to-earnings or similar valuation ratios to companies, rather than due to underlying earnings growth.

8 Risk assets refer to assets that have a significant degree of price volatility, such as equities, commodities, high-yield bonds, real estate, and currencies.

9 Earnings per share measures how much profit a company makes per share of common stock.

10 China’s anti-involution campaign seeks to reduce wasteful, zero-sum competition among companies by discouraging excessive price cutting and overexpansion, and instead promoting efficiency, innovation, and sustainable growth.

11 Carry is the return an investor earns from holding an asset, typically from interest or yield, after accounting for financing or holding costs.

12 A basis point is a unit that is equal to 1/100th of 1% and is used to denote the change in a financial instrument. The basis point is commonly used for calculating changes in interest rates, equity indexes and the yield of a fixed-income security.

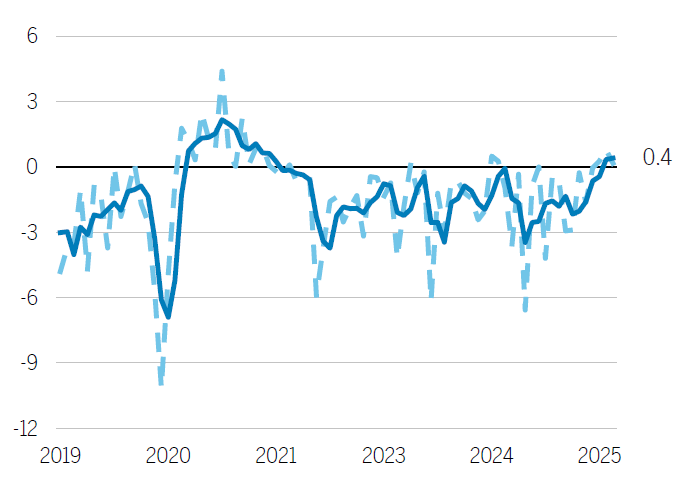

13 Data Source: Yield changes are Bloomberg as of 12/17/25. Measurement reflects the change in 10-year government bond yields for the US, Germany, France, Italy, Japan, the UK, and Australia since 12/31/24.

14 Capital expenditures are the money a company spends to buy or upgrade long-term assets such as buildings or equipment.

MSCI Emerging Markets Index is a free float-adjusted market capitalization-weighted index that is designed to measure equity market performance in the global emerging markets. MSCI index performance is shown net of dividend withholding tax.

MSCI Europe Index is a free-float adjusted market-capitalization-weighted index designed to measure the equity market performance of the developed markets in Europe.

MSCI Japan Index is a free-float adjusted market-capitalization index designed to measure large- and mid-cap Japanese equity market performance.

MSCI USA Index is a free float-adjusted market capitalization index that is designed to measure the performance of the large and mid cap segments of the US market.

Important Risks: Investing involves risk, including the possible loss of principal. • Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political, economic and regulatory developments. These risks may be greater, and include additional risks, for investments in emerging markets or if focused in a particular geographic region or country. • Small- and mid-cap securities can have greater risks and volatility than large-cap securities. • Fixed income security risks include credit, liquidity, call, duration, and interest-rate risk. As interest rates rise, bond prices generally fall. • Investments in high-yield (“junk”) bonds involve greater risk of price volatility, illiquidity, and default than higher-rated debt securities. • Investments in the commodities market may increase liquidity risk, volatility and risk of loss if adverse developments occur. • Diversification does not ensure a profit or protect against a loss in a declining market.

The views expressed here are those of the authors and are based on available information and are subject to change without notice. This information should not be considered as investment advice or a recommendation to buy/sell any security. In addition, it does not take into account the specific investment objectives, tax and financial condition of any specific person. Portfolio positioning is at the discretion of the individual portfolio management teams; individual portfolio management teams and different fund sub-advisers may hold different views and may make different investment decisions for different clients or portfolios. This material and/or its contents are current as of the time of writing and may not be reproduced or distributed in whole or in part, for any purpose, without the express written consent of Wellington Management or Hartford Funds.