Adapting to Shifting Conditions

How might this approach work in practice? Two examples come to mind:

The first relates to the consumer-finance sector in 2023. Going into 2023, the market was concerned about the impact of interest-rate hikes by the US Federal Reserve, believing that consumer-finance companies would be particularly at risk if recession fears materialized (outcome A).

While we couldn’t dismiss the possibility of a recession, we hypothesized about the probability of outcome B, that the US consumer was in a far healthier state than the market realized, interest-rate hikes were having less of an impact on consumers than had been feared, and small businesses weren’t as dependent on regional banks as the market seemed to think they were.

By working closely with sector-specific experts and diligently analyzing alternative data, we were able to position portfolios to capitalize on this mispricing and uncertainty.

The shifting dynamics of the Trump administration’s policy mix provides a more recent example. In this scenario, outcome A is that the Trump administration’s policies boost US growth and extend the economic and credit cycles, and outcome B is that they trigger a negative growth shock and tighter financial conditions. While both scenarios are plausible, I believe the latter may be more likely than the market expects.

President Donald Trump’s re-election seems to be accelerating underlying trends around weaker labor supply and a deteriorating fiscal backdrop. While tariffs may ultimately serve as a negotiating tool, they currently appear to be one of the few identifiable sources of funding within the administration’s economic strategy. This could suggest a reliance on tariffs to help support tax-cut extensions or additional stimulus measures. That said, the approach carries the risk of disrupting global trade, which could have unintended consequences.

Tighter immigration policies could also be negative for growth. Immigration hasn’t only been a positive catalyst for labor-supply growth but also a stimulant for demand. With fewer people seeking housing, food, goods, and services, will prices adjust downward? The effects could be especially acute in the housing sector, as the US has been aiming to close a structural housing-supply deficit.

Making Sense of a Complex Environment

So, how can bond investors leverage uncertainty to their advantage? We think the following considerations may help:

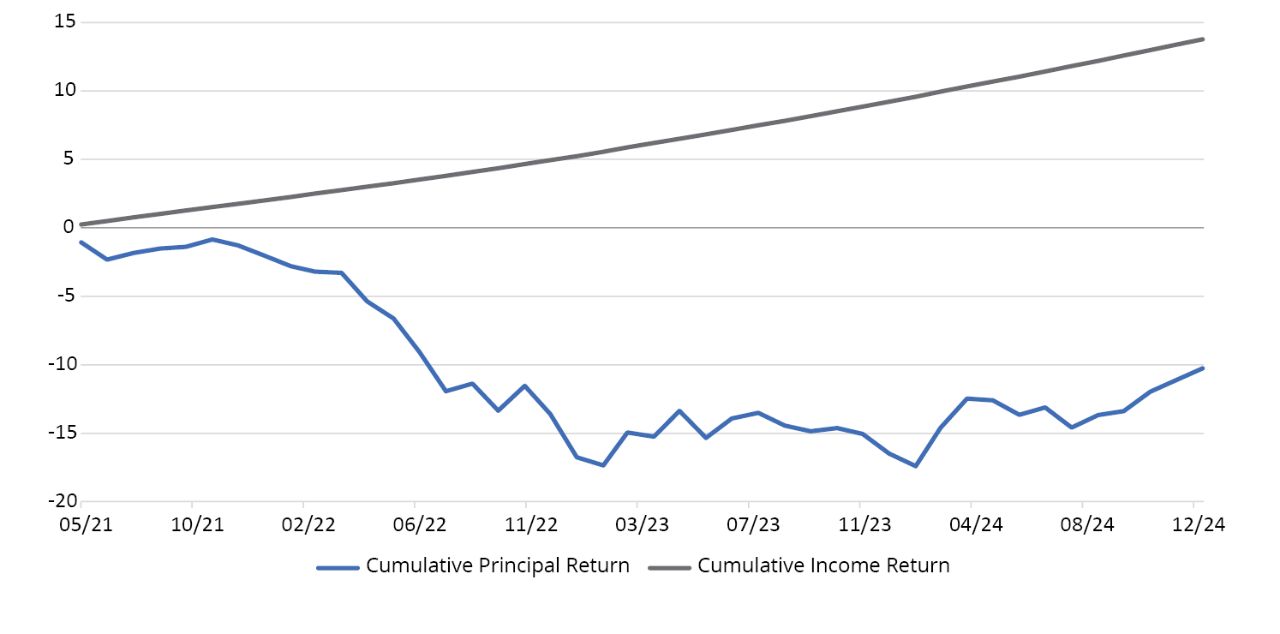

1. Embrace flexibility to seize dislocations – Bond allocations should be flexible enough to take advantage of dislocations as they occur. An unconstrained approach has a greater ability to capitalize on opportunities than a benchmark-oriented approach does.

2. Balance flexibility with discipline – An unconstrained approach can capitalize on opportunities, but it can also leave investors exposed to unnecessary risk. Employing a resilient and consistent framework to continually assess the upside and downside risks of every decision and possible price outcome can help investors seeking to achieve an “all-weather” total return experience.