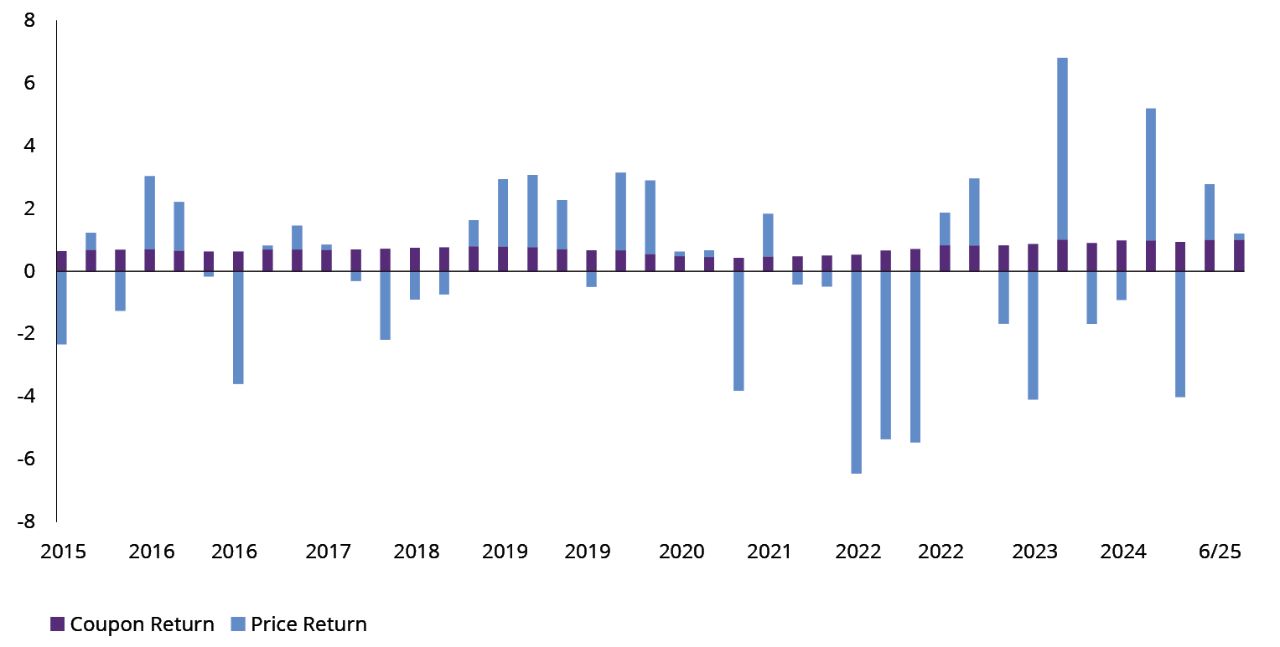

Breaking Down Bond Returns: Coupons vs. Price Moves

Coupon returns are generally predictable because they’re calculated as a fixed percentage of the bond’s face value at the time of issuance. Price returns, on the other hand, reflect the market’s reaction to shifting interest rates, yield-curve dynamics,3 and changing risk premiums. Since the pandemic, inflation shocks and rapid Federal Reserve (Fed) policy shifts have amplified these effects, creating wide swings in quarterly price returns. For investors, that means the path of rates, not just the level, has become a critical driver of outcomes.

This shift isn’t happening by chance. Inflation shocks, rapid Fed pivots, and shifting risk premiums have pushed interest-rate sensitivity to the forefront of fixed income. In this environment, with an uncertain path forward for interest-rate policy, price swings may overshadow the steady drip of income, making the old “buy and hold for yield” playbook less reliable.

Adapting to a More Volatile Bond Market

The takeaway isn’t that bonds have lost their value—it’s that fixed-income strategies need to adapt. Active management of duration4 and curve positioning, stress-testing for rate volatility, and diversifying across sectors have become essential tools. Yield and price appreciation still matter in fixed income, but the road to those returns is far less predictable than it once was. For financial professionals and investors alike, understanding where returns come from, and the risks that come with them, has never been more important.