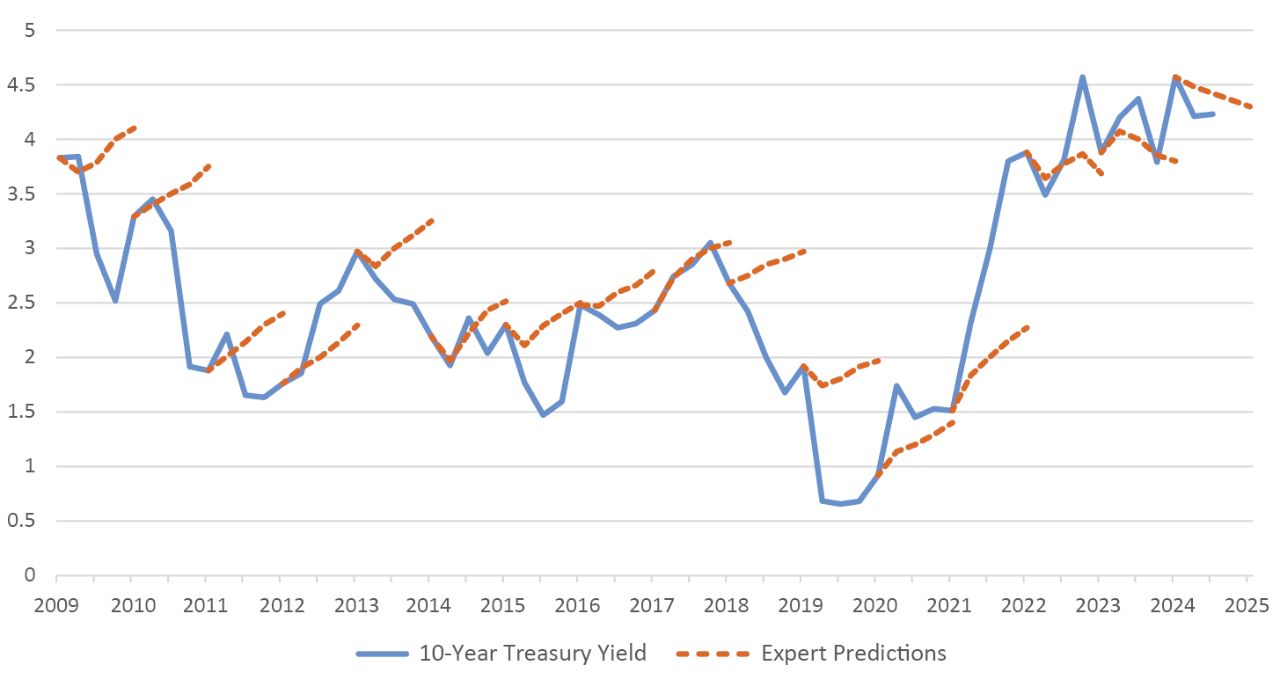

The chart below reveals a consistent pattern: Expert predictions about interest rates are frequently wrong.

FIGURE 1

Interest Rates Are Hard to Predict

10-Year Treasury Yield (%) vs. Expert Predictions

Data as of 6/30/25. Past performance does not guarantee future results. The dotted lines indicate the median estimate of interest-rate movement by economists at the beginning of each year. Data Sources: Philadelphia Federal Reserve, FactSet, and Hartford Funds, 7/25.

The divergence between expert predictions on rates from actual yields highlights how difficult it is—even for professionals—to anticipate rate movements accurately. This isn’t a one-off issue; it’s a recurring challenge that underscores the complexity of forecasting interest rates in a dynamic environment.

Why Rate Predictions Often Fail

There are several reasons why these predictions often miss the mark:

- Interest rates are influenced by a wide range of unpredictable factors, including inflation, employment data, geopolitical events, and central-bank decisions

- Mean reversion1 and lagging economic data further complicate the picture

- Due to the continuing flow of changing data, even the Federal Reserve’s own projections (i.e., the dot plot) can quickly become outdated

Therefore, investment strategies based on interest-rate forecasts may introduce significant risk.

What to Consider Instead

Rather than trying to time the market or adjust duration2 based on uncertain (and often faulty) predictions, investors may want to consider actively managed strategies that can adapt to changing conditions (as opposed to passive fixed-income investments that are locked into static allocations).

Diversified, flexible strategies that can address changing interest-rate environments may help clients stay focused on long-term outcomes rather than reacting to short-term market noise driven by flawed forecasts.

To learn more about managing fixed-income risk, please talk to your financial professional.

1 Mean reversion, or reversion to the mean, is a theory used in finance that suggests that asset price volatility and historical returns eventually will revert to the long-run mean or average level of the entire dataset.

2 Duration is a measure of the sensitivity of an investment’s price to nominal interest-rate movement.

Important Risks: Investing involves risk, including the possible loss of principal. • Fixed income security risks include credit, liquidity, call, duration, and interest rate risk. As interest rates rise, bond prices generally fall. • Diversification does not ensure a profit or protect against a loss in declining market.

This information should not be considered investment advice or a recommendation to buy/sell any security. In addition, it does not take into account the specific investment objectives, tax and financial condition of any specific person. This information has been prepared from sources believed reliable, but the accuracy and completeness of the information cannot be guaranteed. This material and/or its contents are current at the time of writing and are subject to change without notice.