1 Duration is a measure of the sensitivity of an investment’s price to nominal interest-rate movement.

2 SEC yield reflects the hypothetical net current income earned, after the deduction of a fund’s expenses, during a 30-day period, expressed as an annual percentage rate based on the fund’s share price at the end of the period.

3 Expenses are the total annual operating expenses from the Fund’s most recent prospectus at the time of publication.

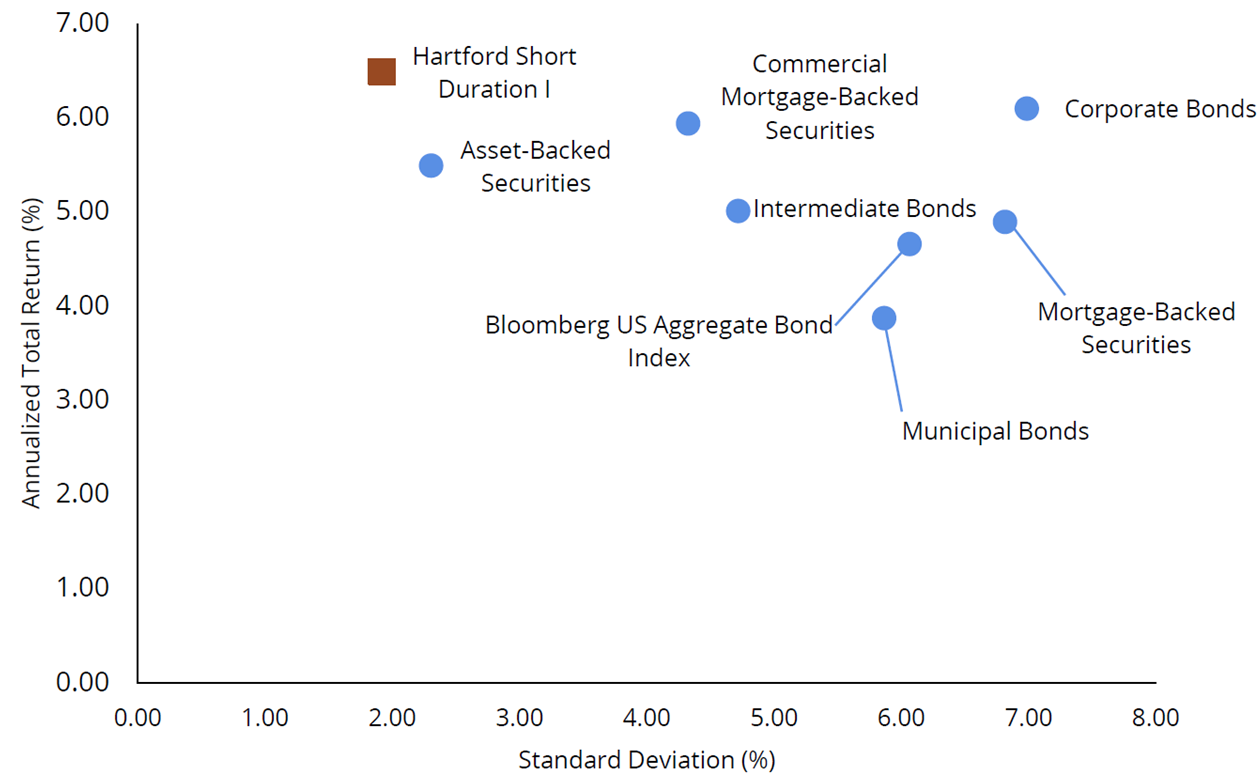

Asset-Backed Securities are represented by the Bloomberg US ABS Index, a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market.

Bloomberg US Aggregate Bond Index is composed of securities from the Bloomberg Government/Credit Bond Index, Mortgage-Backed Securities Index, Asset-Backed Securities Index, and Commercial Mortgage-Backed Securities Index.

Commercial Mortgage-Backed Securities are represented by the Bloomberg Global Aggregate US CMBS Index, a component of the Bloomberg U.S. Aggregate Bond Index that includes commercial mortgage-backed securities.

Corporate Bonds are represented by the Bloomberg US Corporate Bond Index, which covers all publicly issued, fixed rate, nonconvertible, investment grade debt.

Intermediate Bonds are represented by the Bloomberg US Aggregate Intermediate Index, an unmanaged index reflecting performance of the intermediate-term government bond market.

Mortgage-Backed Securities are represented by the Bloomberg US Agency Fixed Rate MBS Index, which measures the performance of investment grade fixed-rate mortgage-backed pass-through securities of GNMA, FNMA, and FHLMC.

Municipal Bonds are represented by the Bloomberg Municipal Index, which is designed to cover the USD-denominated long-term tax exempt bond market.

Important Risks: Investing involves risk, including the possible loss of principal. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies. • Fixed income security risks include credit, liquidity, call, duration, event and interest-rate risk. As interest rates rise, bond prices generally fall. • Loans can be difficult to value and less liquid than other types of debt instruments; they are also subject to nonpayment, collateral, bankruptcy, default, extension, prepayment and insolvency risks. • The risks associated with mortgage-related and asset-backed securities as well as collateralized loan obligations (CLOs) include credit, interest-rate, prepayment, liquidity, default and extension risk. • Investments in high-yield (“junk”) bonds involve greater risk of price volatility, illiquidity, and default than higher-rated debt securities. • Derivatives are generally more volatile and sensitive to changes in market or economic conditions than other securities; their risks include currency, leverage, liquidity, index, pricing, valuation, and counterparty risk. • Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political, economic and regulatory developments. • Restricted securities may be more difficult to sell and price than other securities. • Obligations of U.S. Government agencies are supported by varying degrees of credit but are generally not backed by the full faith and credit of the U.S. Government. • The portfolio managers may allocate a portion of the Fund’s assets to specialist portfolio managers, which may not work as intended.

Diversification does not ensure a profit or protect against a loss in a declining market.