For the first time since 2007, investors are finally getting an attractive interest rate on their cash holdings. With a little searching, you can find money-market funds and one-year CDs that pay 5% or more. Loading up on cash may seem like a good strategy, but like your favorite dessert, is there a downside to having too much of a good thing?

Here are three reasons why investors should be careful about holding too much cash:

- Cash has usually delivered negative returns after inflation and taxes

- Cash hasn’t historically helped investors grow their wealth

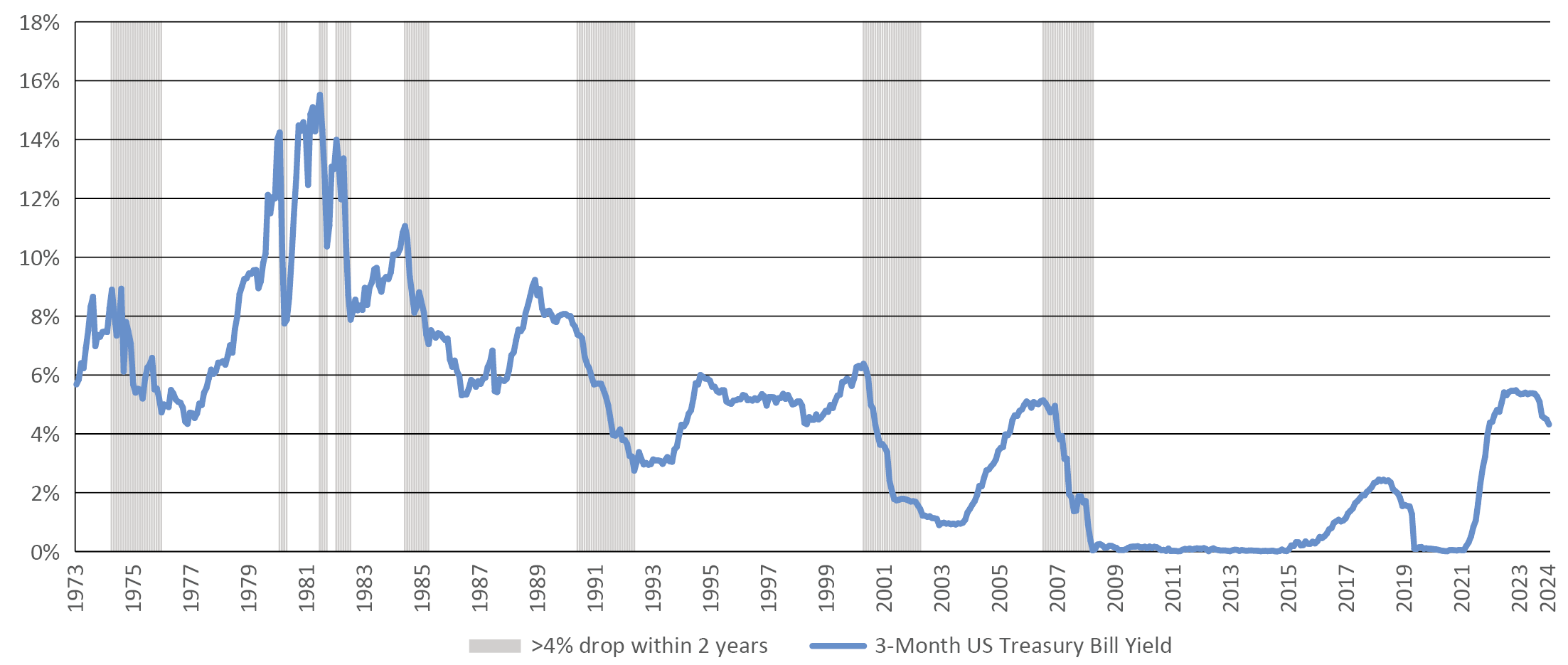

- Today’s attractive interest rates may not be available tomorrow

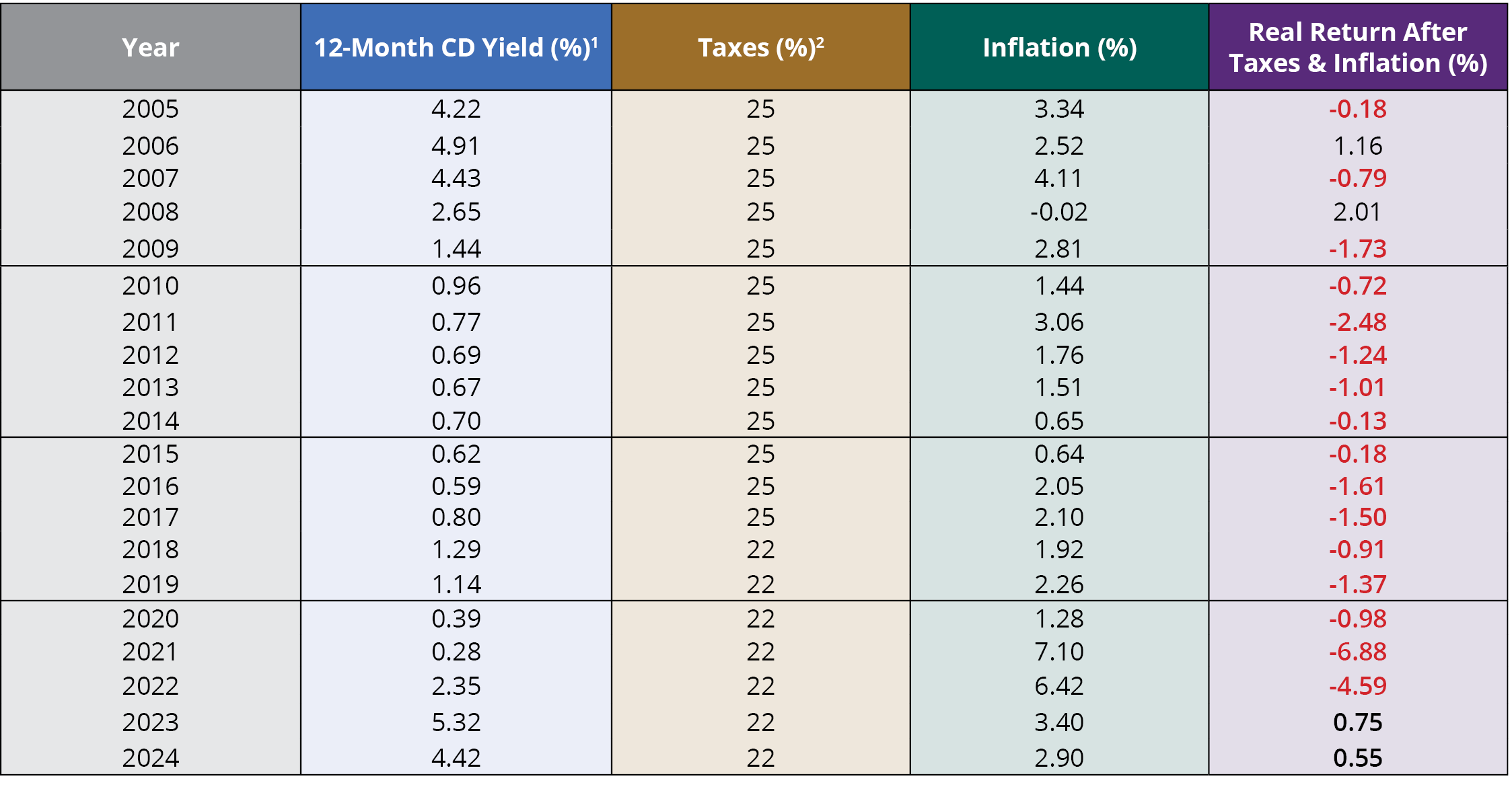

1. Cash Has Usually Delivered Negative Returns After Inflation and Taxes

Cash has a key role in every portfolio. Everyone needs cash on hand for recurring expenses such as mortgage payments, college tuition, and credit-card bills. It’s also prudent to have an emergency fund because life is unpredictable. But it’s important for investors to realize that cash investments such as CDs typically don’t generate a positive return after factoring in taxes and inflation (FIGURE 1). Even with a historically generous 12-month CD rate of 5.32%, the after-tax real return (i.e., the return after factoring in inflation and taxes) is still less than 1%.