What This Means for Investors

The scale of AI investment is unprecedented, and the transformative potential of this technology across virtually every industry (and everyday life) is massive. That said, not all AI players will be winners.

In our view, there are a few things to consider when it comes to seeking out the potential beneficiaries of AI investment:

- Infrastructure: Despite the massive scale of AI investment, infrastructure is already under strain. There aren’t enough data centers with the computing power needed to sustain AI’s rapid growth. To fully realize the potential of AI, significant infrastructure buildout will be essential. And that expansion won’t stop at tech—it could ripple into sectors such as utilities and energy. In short, the infrastructure demands of AI could create positive investment opportunities well beyond technology.

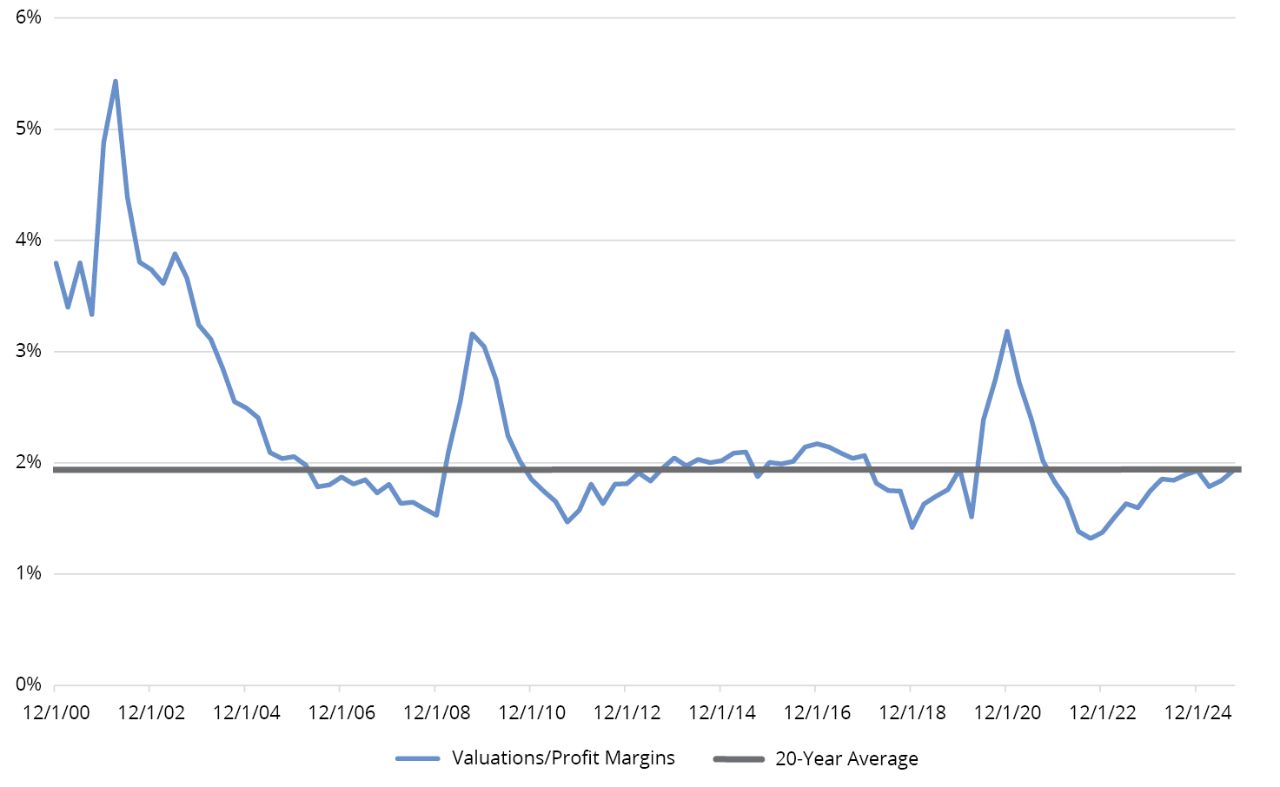

- Fundamentals: US growth is increasingly tied to AI. Infrastructure spending and tech earnings have helped support GDP and equity markets, offsetting the tariff-related drag that might have occurred otherwise. The US economy has become more dependent on its dominant tech sector, raising the stakes for the narrative of US exceptionalism. The higher a sector climbs, the harder it can fall, which makes it critical to stay prudent with AI and tech allocations, focusing on quality and fundamentals.

- Ripple effects: Selection beyond tech is essential. Many companies outside the tech sector are already weaving AI into their workflows, though broad benefits have yet to materialize. Still, we see early signs of progress that could grow into meaningful returns as adoption accelerates, and businesses apply AI more creatively across diverse industries.

- Big-picture thinking: While public equities often dominate the conversation around AI investing, the opportunity spans multiple asset classes. In private markets, early-stage AI companies can offer long-term growth potential. In fixed income, AI-driven demand for utilities and infrastructure is creating opportunities in related credit. This underscores the need for cross-asset expertise—not just an understanding of the technology itself. An active approach, backed by deep research and broad capabilities, can help investors take a more holistic view of this innovation.