In today’s market environment, investors are increasingly seeking strategies that manage volatility while still offering growth potential. One such approach is dividend-paying stocks, which can help reduce turbulence during uncertain periods. Beyond this, dividends offer added appeal: They provide a tangible return on investment and may signal a company’s financial health and strategic discipline.

By potentially cushioning against market declines and offering exposure to historically resilient sectors, dividends can be a valuable investing strategy in challenging economic times.

1. Potential Sign of Corporate Strength

Though an obvious draw of dividend-paying stocks is income that contributes to total return, they may also hint at a company’s character and strategy. In times of market uncertainty, investors tend to seek out companies that display resilience and a history of long-term performance. Dividend-paying companies frequently fit this profile, as their ability to return capital to shareholders on an ongoing basis generally reflects a well-established business with a strong market footprint. These companies typically operate in well-understood industries with proven business models, making them less susceptible to the dramatic swings that can affect younger, growth-oriented companies.

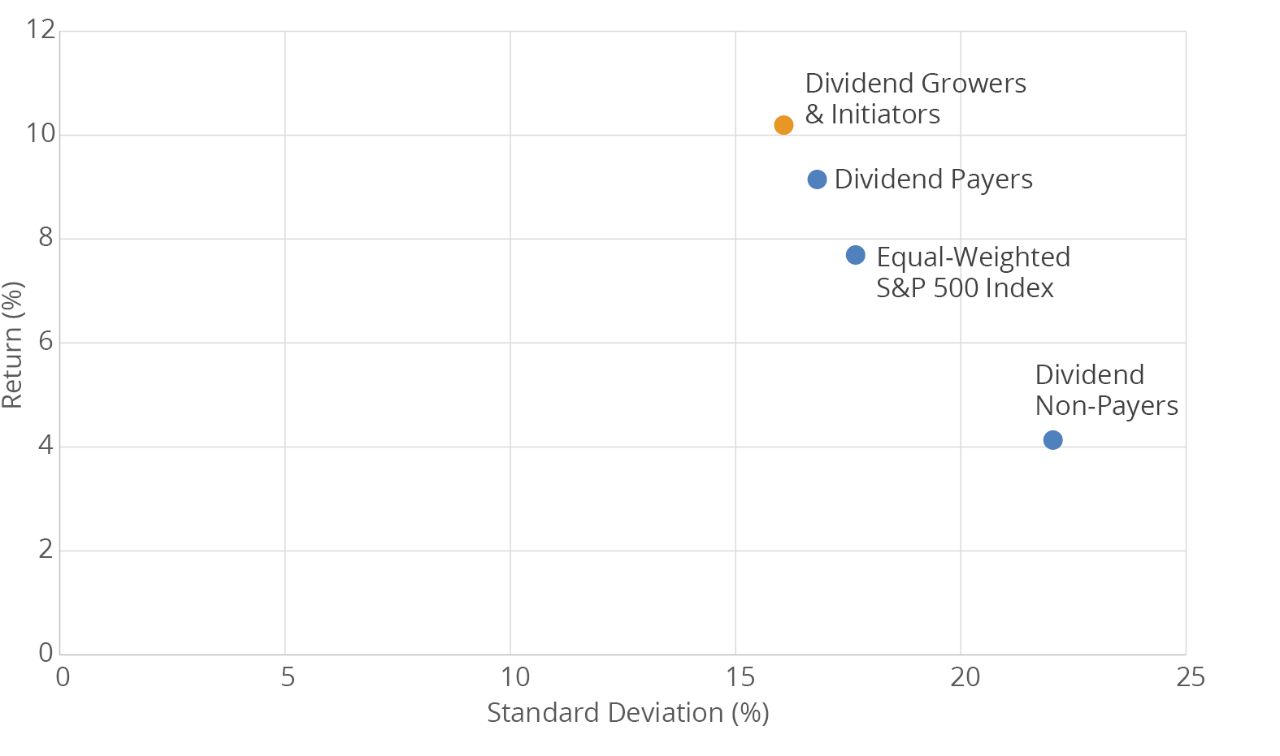

This link between dividend payments and stronger, less volatile performance shows up in the data, too: A study by Ned Davis Research makes it clear that non-dividend-paying companies and those that cut their dividends have historically underperformed their peers. Companies that opted not to pay dividends were not only more volatile (as measured by standard deviation1) but also underperformed compared to those that grew, initiated, or maintained a dividend (FIGURE 1).