Gold is a provocative topic these days. First, there’s the incredible 52% run-up in the price of gold through the first 10 months of the year.1 Second, there’s the unusual coincidence of stocks and gold performing well at the same time. After all, while the recent strong returns of US stocks would seem to reflect a positive outlook for risk, doesn’t the rise in gold, usually considered a hedge against risk, suggest the opposite?

I think the gains in US stocks and gold are indeed saying different things, but I also think that holding them both may make sense in the current environment. Even if stocks continue to do well, I see three reasons that gold can still play a potentially helpful role in portfolios over the next few years:

1. Gold and stocks have different drivers in today’s market environment:

In the past, gold’s performance has generally been tied to one of several drivers, including demand for a safe-haven asset amid economic or geopolitical volatility, its role as a store of value given worries about currency debasement, or its appeal during periods of inflation. But today, I would argue that gains in gold have been tied to a range of drivers, including concerns about stagflation,2 soaring US government debt as a percentage of GDP, US dollar (USD) debasement, and central-bank independence—and I expect these drivers to be with us for some time to come.

Meanwhile, the rise in US stocks has been driven largely by exceptional gains in the mega-cap tech companies dominating the US market (as of the end of October, the Magnificent Seven3 stocks accounted for almost 37% of the market capitalization of the S&P 500 Index).4 Along with these strong earnings, US stocks are benefiting from easy monetary and fiscal conditions and a decent growth backdrop. In short, the rally in stocks and gold isn’t the same trade.

2. Structural demand for gold is expanding:

Central-bank demand for gold has been well-documented. After the US government placed sanctions on Russian USD assets, central banks, especially in emerging markets, sought to diversify their currency reserves away from the USD. China’s retail demand has also been a factor following the country’s real-estate bubble. More recently, we’ve seen a surge in US and European retail demand for gold reflected in the surge in ETF holdings this year.

3. A gold allocation could move the efficient frontier5 in a positive direction:

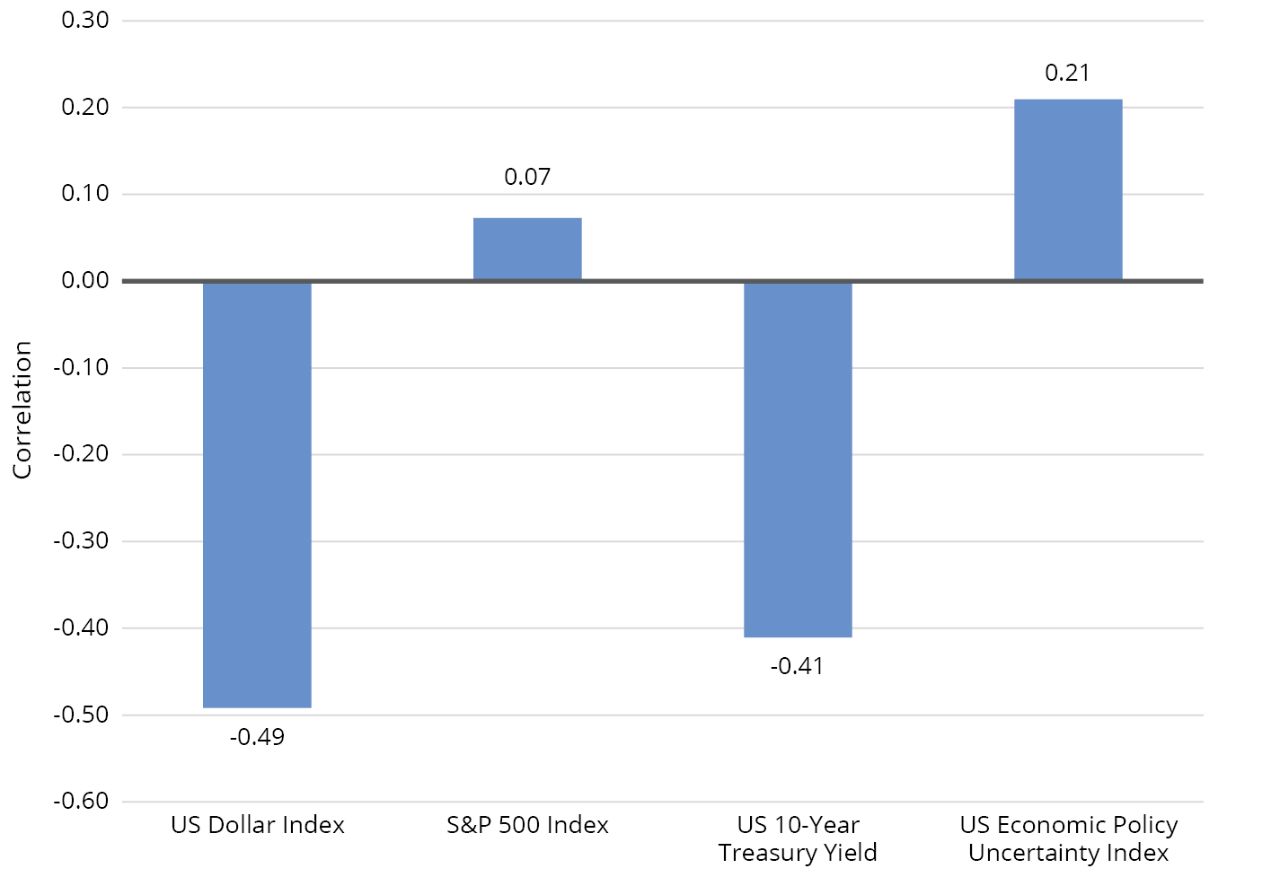

In other words, including gold in the mix may help improve a portfolio’s overall risk/reward profile. That’s because gold has tended to have a low correlation6 to risk assets7 and lower volatility. FIGURE 1 shows that gold has had a near-zero correlation to US stocks, a negative correlation to the USD and bond yields, and a positive correlation to policy uncertainty over the past 10 years.