Our View

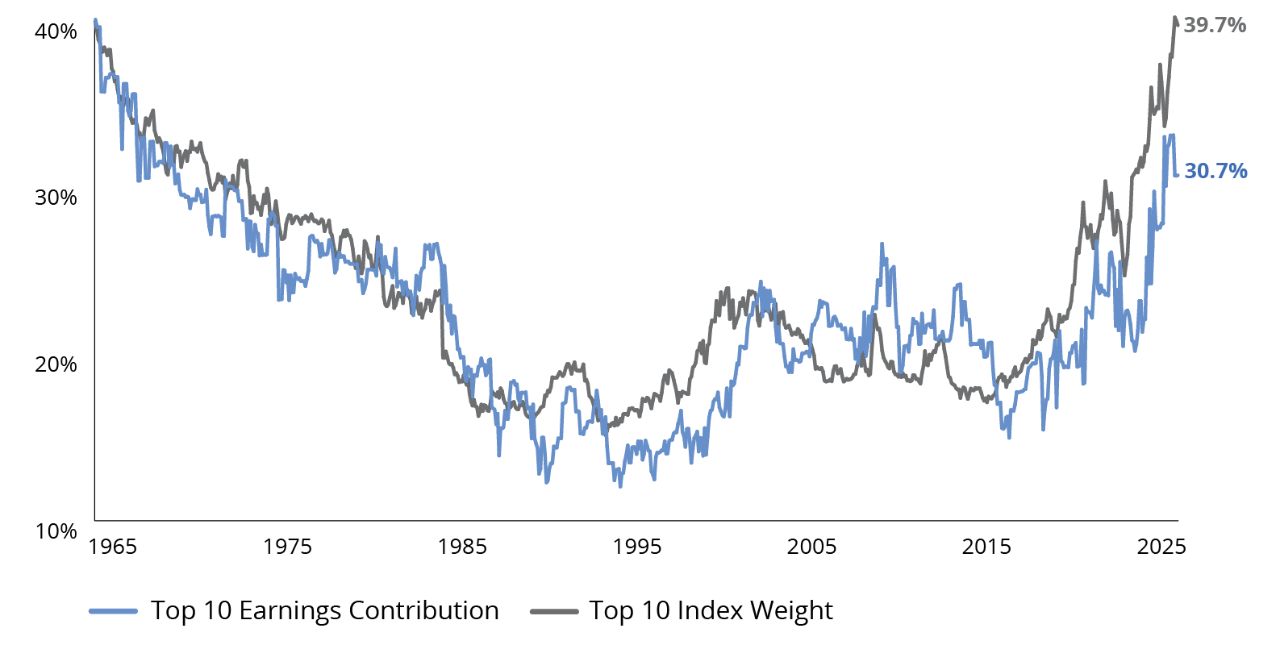

The US stock market has reached its highest concentration level in 60 years, with the top 10 stocks comprising a weighting of 39.7%.1 While there’s always an urge to proclaim “this time is different,” market history tells us that while the plot may change, the story often ends the same.

Observations

1. The weights of the top 10 stocks have been rising much faster than their earnings, creating a widening gap between the two (FIGURE 1).

- The last time a gap of this magnitude appeared was at the height of the dot-com bubble and, before that, the Nifty Fifty bubble of the late 1960s.

- A stock’s placement in the top 10 tends to be short-lived and can be volatile (FIGURE 2).

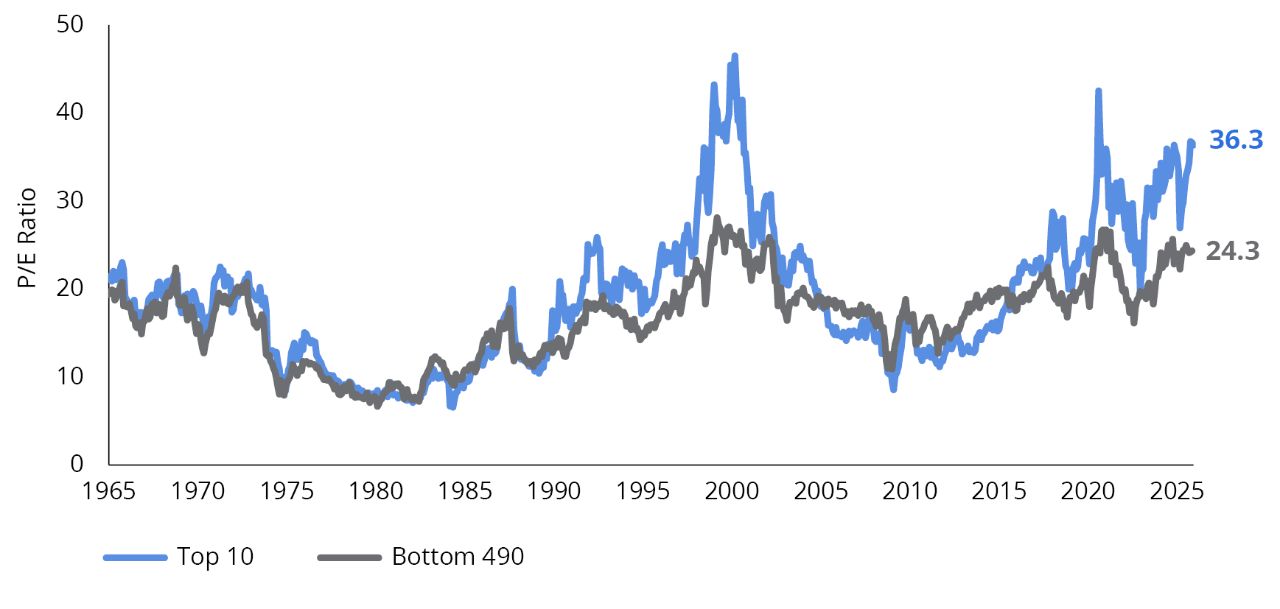

2. The price-to-earnings ratio (P/E ratio)2 of the top 10 stocks compared to the bottom 490 stocks is at an extreme not seen since the peak of the dot-com bubble (excluding the COVID-19 period, which affected earnings figures) (FIGURE 3).

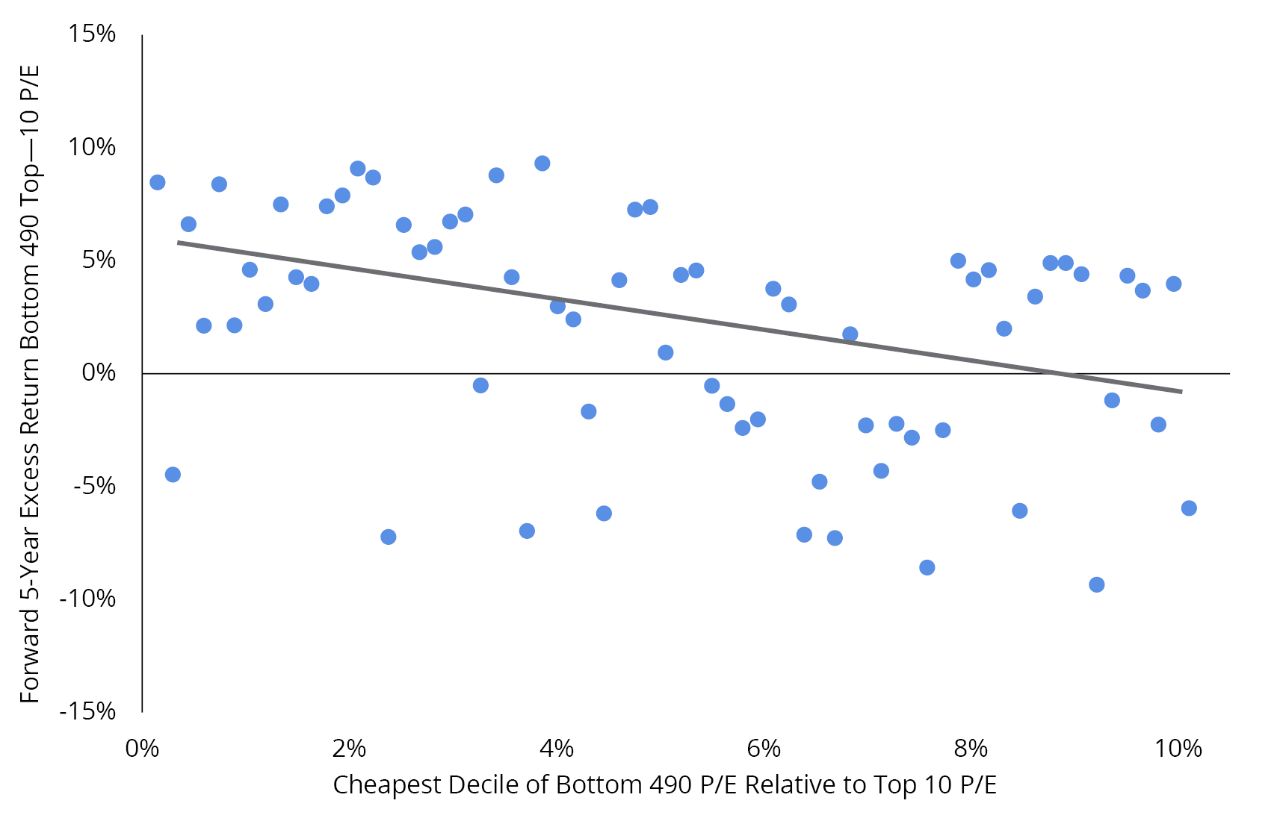

- Historically, when the P/E ratio of the bottom 490 has been this inexpensive relative to the P/E ratio of the top 10, the bottom 490 have outperformed by 2% on average over the next five years (FIGURE 4).

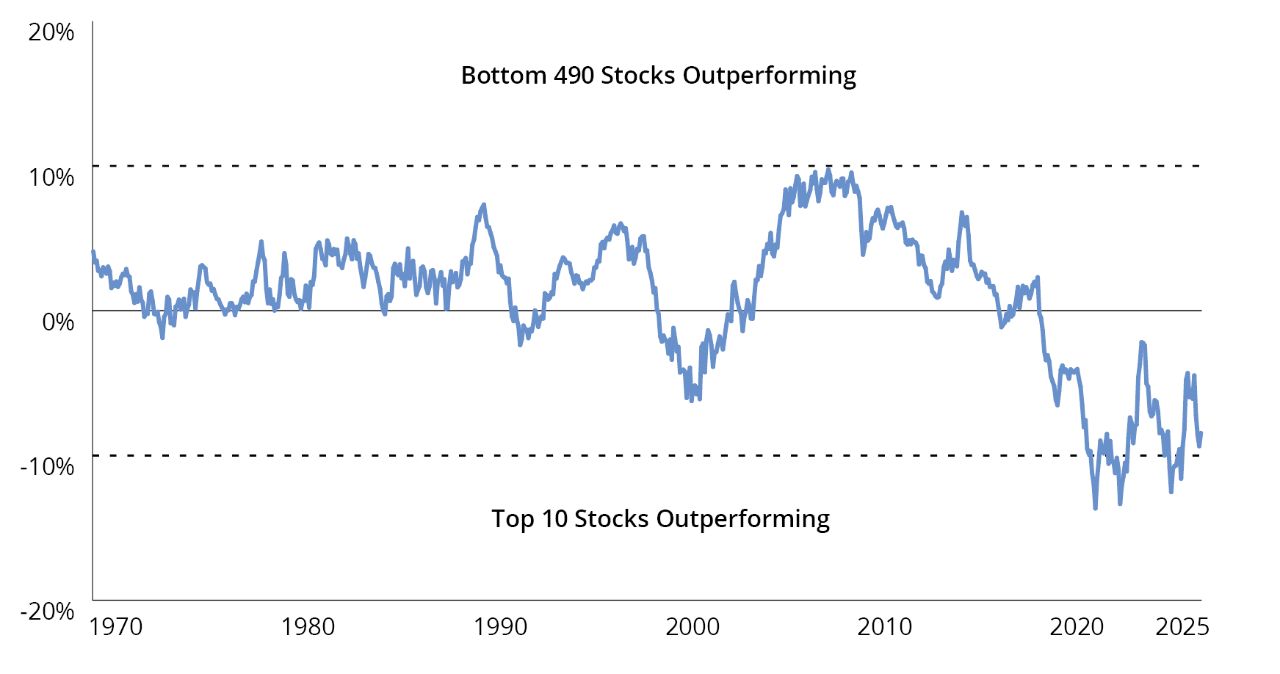

3. Even after taking into account the outperformance of the top 10 in recent years, the bottom 490 have outperformed the top 10 in 70% of 5-year rolling time periods since 1970 (FIGURE 5).

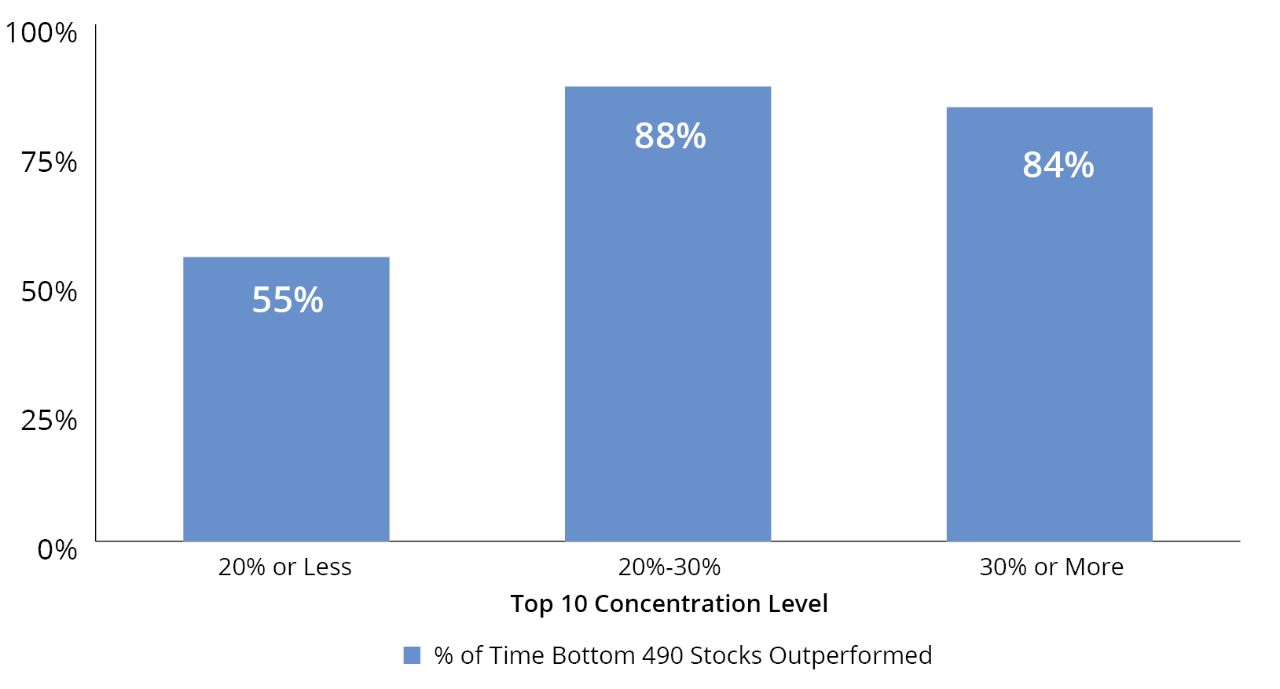

4. When concentration in the top 10 is 30% or more, the bottom 490 have historically outperformed 84% of the time over the next five years (FIGURE 6).

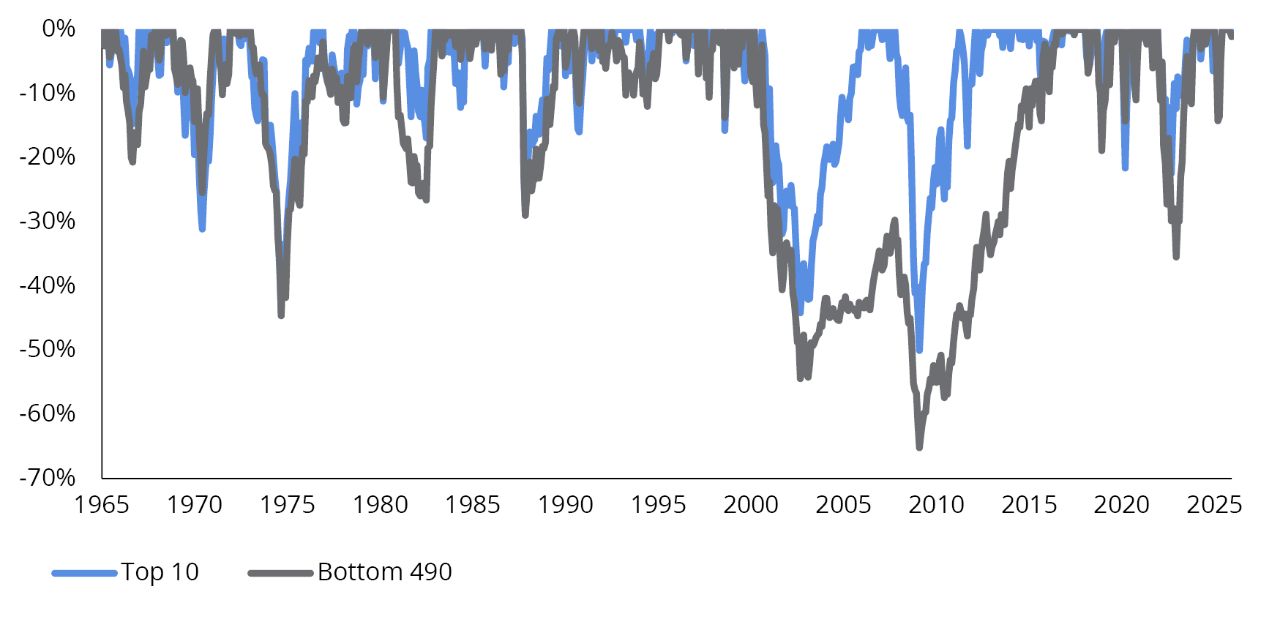

5. A rise in concentration and valuation levels often precedes a period of heightened volatility and larger drawdowns for the largest stocks (FIGURE 7).