- Individual Investor? Learn More Individual Investor? LEARN MORE >

-

ACCOUNT ACCESS

- FOR FINANCIAL PROFESSIONALS

- Mutual Fund Accounts

- Smart529 Accounts

- FOR INDIVIDUAL INVESTORS

- Mutual Fund Accounts

- Smart529 Accounts

-

CONTACT US

Pre-Sales Support

Mutual Funds and ETFs - 800-456-7526

Monday-Thursday: 8:00 a.m. – 6:00 p.m. ET

Friday: 8:00 a.m. – 5:00 p.m. ETPost-Sales and Website Support

888-843-7824

Monday-Friday: 9:00 a.m. - 6:00 p.m. ET- PHONE US MAIL US

- ADVISOR LOG IN

-

Products

- INVESTMENT RESOURCES

- Systematic ETFs

- Model-Delivery SMAs

- The Hartford SMART529 College Savings Plan

- VIEW FUNDS BY ASSET CLASS

- Taxable Bond

- Domestic Equity

- International/Global Equity

- Tax Advantaged Bond

- Multi Strategy

-

Insights

- Market Perspectives

- Equity

- Fixed Income

- Global Macro Analysis

- Strategic Beta & ETFs

- Investor Insight

- The Future of Advice

- Navigating Longevity

- Investor Behavior

- See all Investor Insights

- Investment Strategy

- Global Investment Strategist

- Fixed-Income Strategist

- Informed Investor

- Practice Management

- Resources

- About Us

-

Note: Prior to implementing any of the strategies referenced in this workbook, please consult with your firm’s legal and compliance teams about social media policies and programs.

LinkedIn is known for being an effective prospecting tool. Yet many financial professionals fail to get results with it. Why? LinkedIn is vast and it can feel overwhelming. Many wonder if they’re using the right strategy or just wasting time. Mastering LinkedIn can help. Oechsli's research reveals how top financial professionals brought in new clients using LinkedIn. These methods can help put an end to frustration and get you the results you want instead.

Learn:

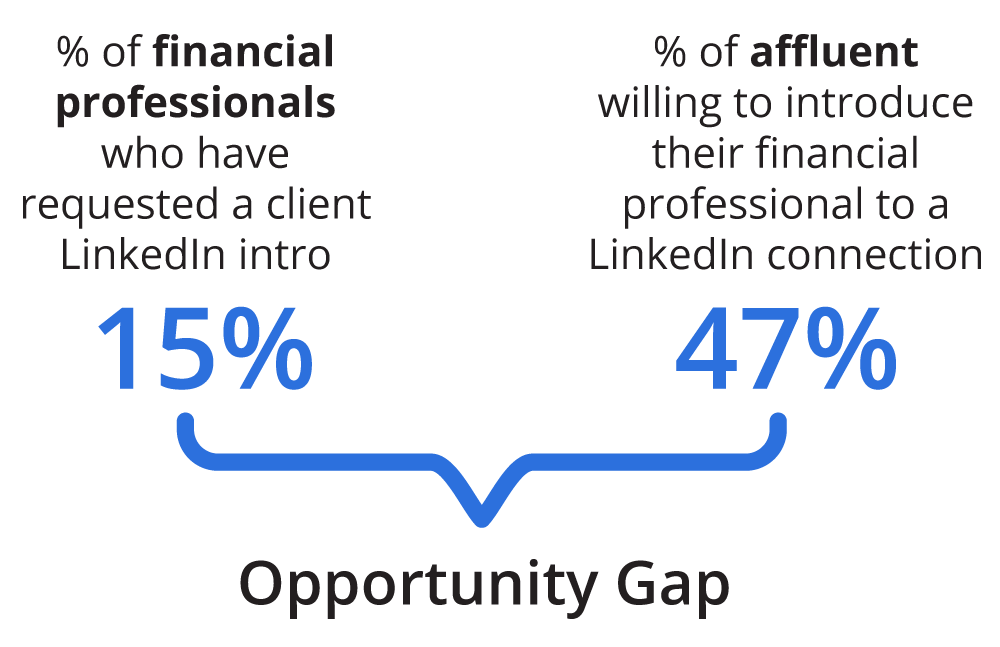

- Effective search terms to find prospects on LinkedIn

- How to find ideal prospects using an "advocate search"

- Three specific ways to ask clients for introductions to their LinkedIn connections

Source: Oechsli, 2019. Most recent data available.

| Resources For Financial Professionals |

Financial Professional Workbook

Next Steps

| 1 | Consult with your firm’s legal and compliance teams about social media policies and required participation in social media programs |

| 2 | Today, download or order the Mastering LinkedIn workbook |

| 3 | Follow instructions on pages 4-6 to identify 21 prospects using LinkedIn |

Oechsli is not an affiliate or subsidiary of Hartford Funds.