Who doesn’t love money market and CD rates above 4%? After more than a decade of receiving extremely low yields, savers are finally being rewarded for holding cash. But will those attractive yields still be there when it’s time to reinvest your cash?

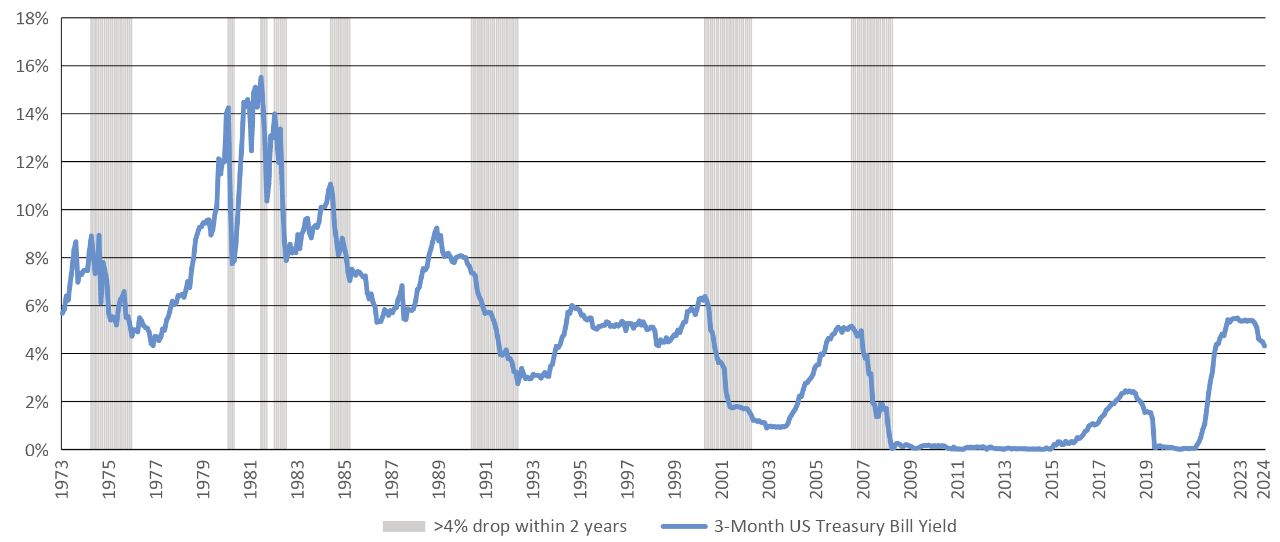

History shows that high yields on cash and CDs could evaporate rather quickly. Since 1973, there were eight instances when cash yields dropped by at least 4% over periods ranging from three months to two years; the average decrease was 5.06%.

Cash Can Be Volatile: Yield Drops of 4% or More Within Two Years or Less

3-Month US Treasury Bill Yield % (1/31/73–12/31/24)

| Date Range | Beginning Yield (%) |

Ending Yield (%) |

Total Yield Drop (%) |

|---|---|---|---|

| 4/74-1/76 | 8.90 | 4.73 | 4.17 |

| 3/80-6/80 | 14.24 | 7.88 | 6.36 |

| 8/81-11/81 | 15.52 | 10.37 | 5.15 |

| 3/82-9/82 | 13.99 | 7.88 | 6.11 |

| 8/84-6/85 | 11.06 | 7.05 | 4.01 |

| 9/90-9/92 | 7.37 | 2.75 | 4.62 |

| 10/00-10/02 | 6.38 | 1.44 | 4.94 |

| 2/07-11/08 | 5.14 | 0.04 | 5.10 |

| Average Yield Drop | 5.06 | ||

Data Source: Factset, 2/25.

Investors who want a potential hedge against the possibility of reinvesting their cash or CDs at significantly lower rates should consider investing in intermediate-term bonds or similar investments. In addition to offering attractive yields, intermediate-term bonds could enjoy some price appreciation if interest rates decline since bond prices typically increase when interest rates decrease.

The Risk of Owning Bonds vs. Cash

As with any investment, there are relative risks to be considered. Cash, CDs, and money-market funds generally involve the least amount of risk but also offer the least potential return.

Bonds tend to carry greater risk than cash equivalents, including the risk that a bond’s lender may be unable to make interest or principal payments on time. Bonds with longer maturities (e.g., 10 years or more) can offer higher returns but can lose value when interest rates rise. Bonds are also subject to the risk that the lender may choose to pay off the bond early, which could deprive investors of potential interest income. When rates are falling, lenders sometimes choose to pay off bonds ahead of maturity in order to reissue bonds at lower prevailing rates.

Talk to your financial professional to help you decide the amount of cash holdings that are right for you.

Important Risks: Investing involves risk, including the possible loss of principal. • Fixed-income security risks include credit, liquidity, call, duration, and interest-rate risk. As interest rates rise, bond prices generally fall.

All information provided is for informational and educational purposes only and is not intended to provide investment, tax, accounting or legal advice. As with all matters of an investment, tax, or legal nature, you and your clients should consult with a qualified tax or legal professional regarding your or your client’s specific legal or tax situation, as applicable. The preceding is not intended to be a recommendation or advice.