In many ways, the experience we have while eating those complimentary pretzels is similar to the one we have as investors. We invest our financial assets, work with a trusted financial professional to help grow our portfolios, and hopefully reach our financial goals.

Unfortunately, you don’t have to strap yourself into an aircraft seat to experience turbulence.

Highs and Lows

Investing in equities has always required riding out the ups and downs. The 24-hour cable-news cycle repeatedly declares heightened volatility to be the “new reality.”

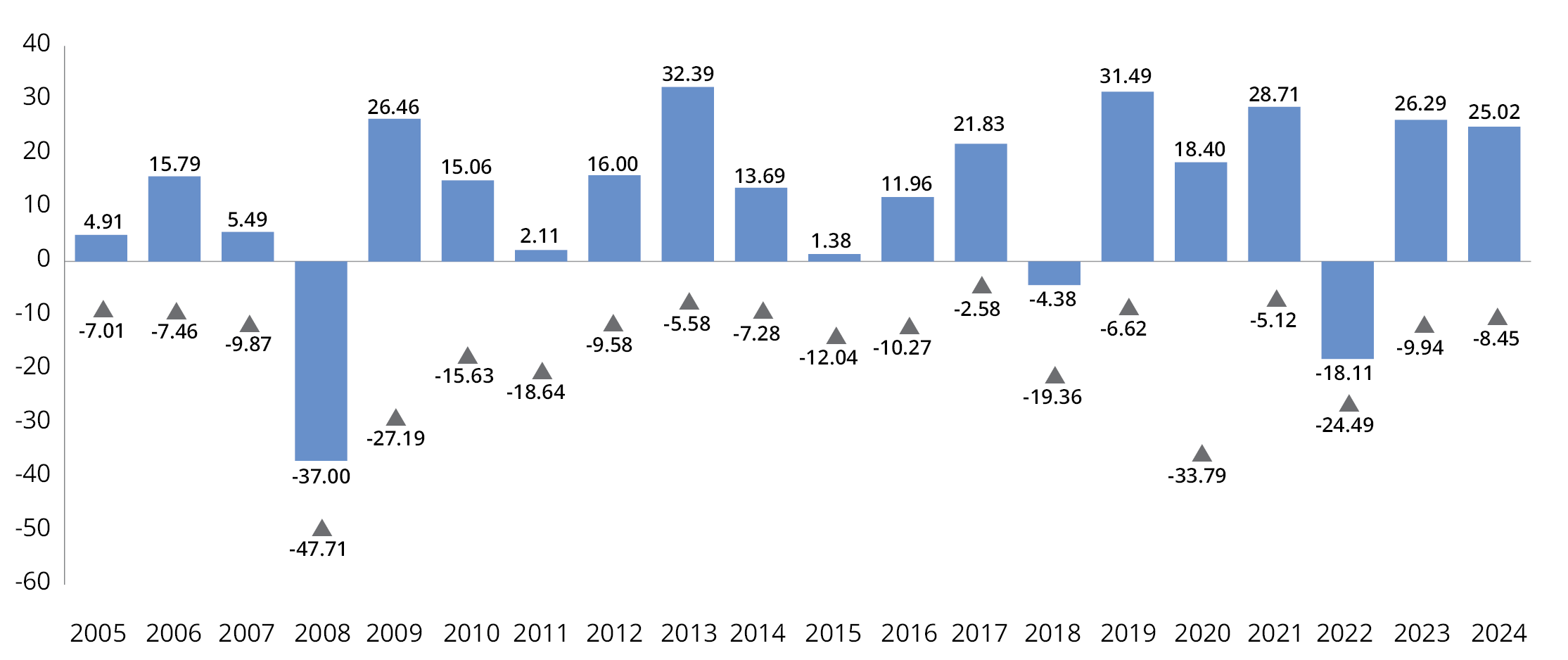

But in reality, volatility happens more frequently than many realize. In the last two decades, for example, the S&P 500 Index1 has experienced intra-year declines in every calendar year—even when it ultimately produced positive year-end returns (FIGURE 1). Not every year managed to recover and notch a positive ending, but no year was immune to a period of negative performance.

This seemingly unpredictable market cycle of gains and losses has investors asking, “How can we prepare for what comes next week, next month, or next year?” Plain and simple: develop a solid financial plan, stick with it, and resist the urge to panic.