88%

88% of mobile users who search for a local business visit a store within 24 hours

Source: 45 Digital Marketing Statistics That Will Impact Your 2025 Strategy, seo.com, 10/15/25

(Prior to implementing any of the strategies referenced in this article, please consult with your firm about digital policies.)

In the 1970s, Kodak realized that digital photography could be an innovative technology and even went as far as inventing the very first digital camera in 1975, before shelving the idea. In the early 1980s, Kodak conducted a study on the future of its technologies and concluded that digital photography could replace their film-based business within ten years.

Nevertheless, Kodak decided to remain committed to their traditional film-based strategy; a decision that would leave them following in the footsteps of their competitors for decades to come. Kodak filed for bankruptcy in 2012 primarily because they failed to respond to changing technology and disruptive forces.

Similarly, disruptive forces are now changing how affluent clients are finding financial professionals. Traditionally, financial professionals have primarily relied on client referrals to get new clients, but advancing technology and changing mindsets are changing how consumers find a financial professional. Failing to respond and embrace this shift could cause you to fall behind the competition and miss prospecting opportunities.

First, How Affluent Consumers Find Financial Professionals

As a financial professional, you know that referrals and personal introductions are one of the best ways to acquire affluent clients. When looking for a financial professional, affluent consumers continue to rely on friends, family, and professional recommendations. However, more are using online searches and social networks to find financial professionals. Last year 13% began their search online; this year it's 24%.1

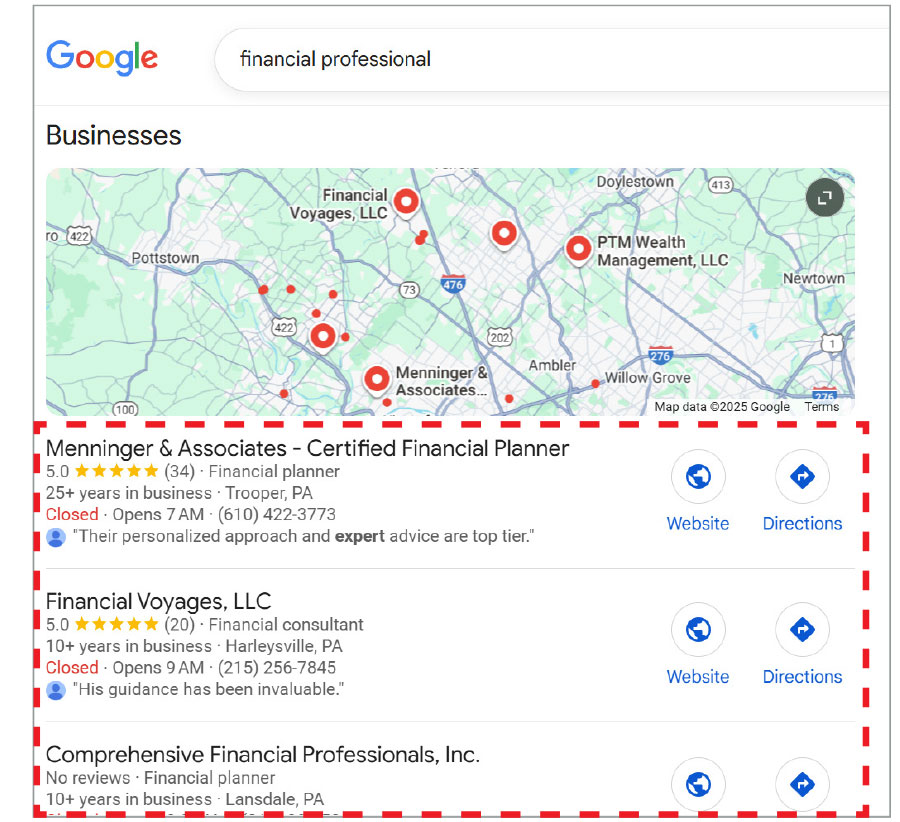

So what would typical financial professional search results on Google look like? You can try it yourself. Google “financial professional” in [your town].” You should get results that resemble the screenshot below left. If your practice shows up in the results, congratulations. If not, read on.

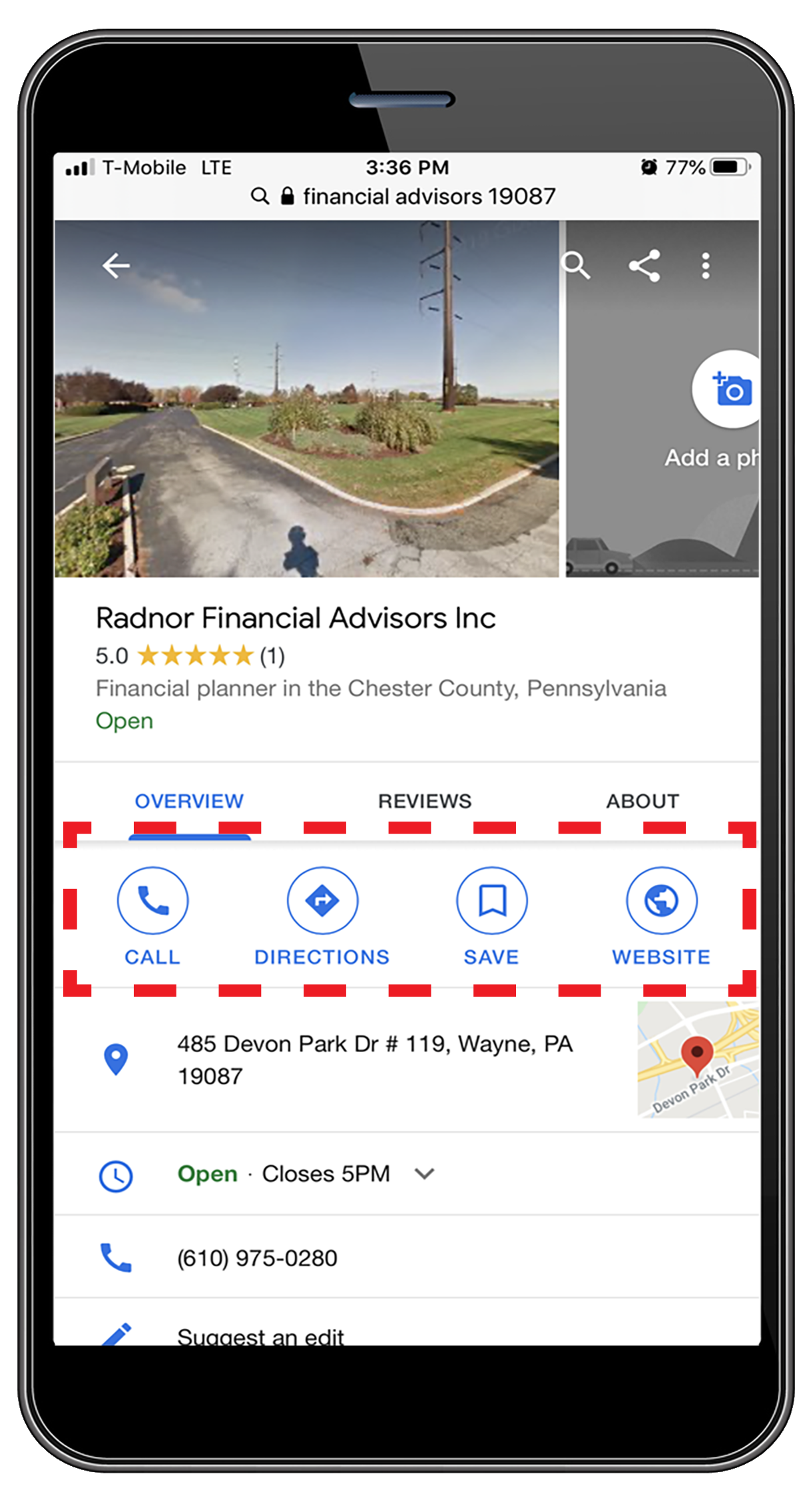

The “local listings” search results are shown in the map section, often referred to as the local search 3-pack. It’s advantageous to appear in this group because when people search for a product or service near them, they’re usually very close to making a purchase: 88% of mobile users who conduct a local search will visit a business that same day.2

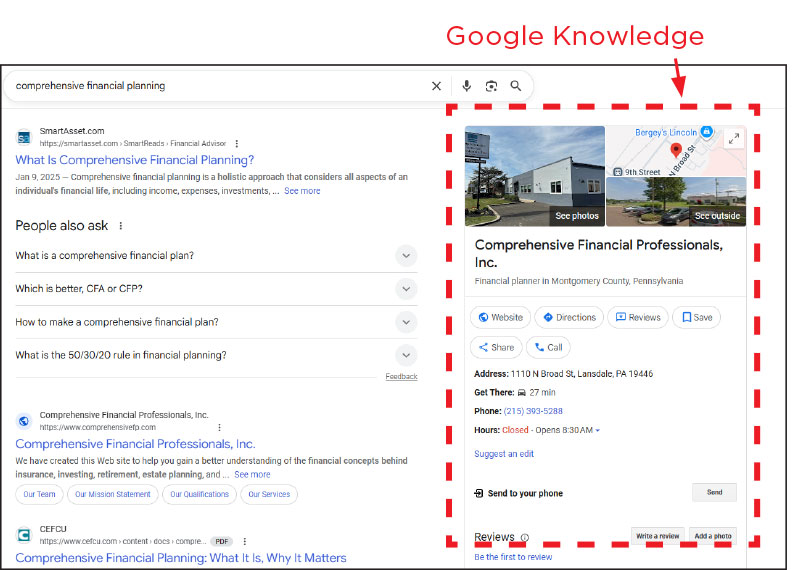

In addition to finding financial professionals by using a local search, some affluent customers may still be referred to you by others. It’s likely that before they call you, they’ll Google you by typing the name of your practice into the search bar. When they do, if you have a Google My Business listing, they’ll see your business at the top of the search results and also prominently displayed in the right sidebar. This sidebar is the Google Knowledge panel. It includes details from your profile, such as address, phone, hours, reviews, etc. Next, let’s focus on how Google My Business could improve your search rankings.