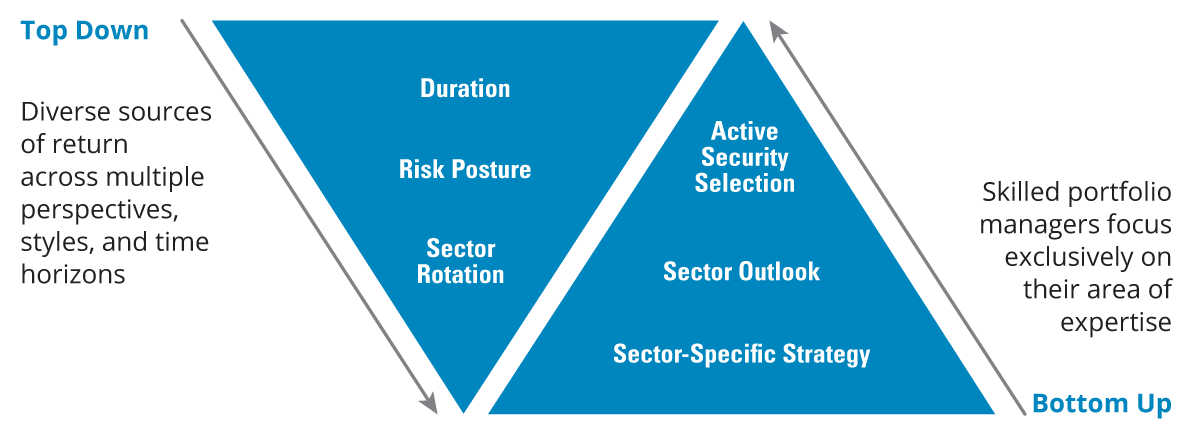

Diversified Sources of Return Across Multiple Perspectives

Hartford Total Return Bond ETF blends top-down strategic planning with bottom-up analysis from skilled portfolio managers―a combination designed to deliver total return and income to fixed-income investors.

HARTFORD TOTAL RETURN BOND ETF INVESTMENT PROCESS

Top-Down Macro Perspective

Portfolio managers gather multiple perspectives and determine strategic investment positioning

Bottom-Up Security Selection

Sector specialists lend their specific expertise to help support active security selection in core bonds with tactical allocations to income-focused sectors

Sub-advised by Wellington

Wellington prioritizes independent thought and collaboration across all major asset classes

Objective: Seeks a competitive total return with income as a secondary objective.

The portfolio managers are supported by the full resources of Wellington.

Performance

SI = Since Inception. Fund Inception: 09/27/2017

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted.

ETF shares are bought and sold at market price, not net asset value (NAV). Total returns are calculated using the daily 4:00 p.m. Eastern Time NAV. Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns an investor would receive if they traded shares at other times. Brokerage commissions apply and will reduce returns.

Characteristics

| Turnover | 61% |

|---|---|

| Dividend Frequency | Monthly |

| Yield to Worst (%) | 5.00% |

|---|---|

| # of Holdings | 1938 |

| Effective Duration | 6.50 yrs |

| Distribution Yield at NAV | 3.45 |

| Trailing 12 Month Yield | 4.61 |

| 30-Day SEC Yield | 4.08 |

|

Unsubsidized 30-Day SEC Yield

|

4.08 |

| Aaa/AAA | 9 |

| Aa/AA | 69 |

| A | 11 |

| Baa/BBB | 16 |

| Ba/BB | 3 |

| B | 1 |

| Caa/CCC or lower | 0 |

| Not Rated | 3 |

| Cash & Cash Offsets | -12 |

| Ticker | HTRB |

| CUSIP | 41653L305 |

| IOPV TICKER | HTRB.IV |

| Stock Exchange | NYSE Arca |

| Market Price Close | $34.52 |

| Market Price Change | $0.00 |

| Net Asset Value (NAV) | $34.51 |

| NAV Change | $0.01 |

| Premium/Discount | 0.04% |

| 30 Day Median Bid/Ask Spread |

0.03% |

| FNMA TBA 30 YR 6 SINGLE FAMILY MORTGAGE | 3.07 |

| US TREASURY N/B 01/29 4 | 2.40 |

| US TREASURY N/B 11/28 3.5 | 1.94 |

| FNMA TBA 15 YR 4.5 SINGLE FAMILY MORTGAGE | 1.92 |

| US TREASURY N/B 11/48 3.375 | 1.91 |

| GNMA II TBA 30 YR 2.5 JUMBOS | 1.63 |

| US TREASURY N/B 05/28 3.75 | 1.62 |

| US TREASURY N/B 12/27 3.375 | 1.48 |

| US TREASURY N/B 02/34 4 | 1.44 |

| FED HM LN PC POOL SD8462 FR 09/54 FIXED 5.5 | 1.31 |

| Total of Top Ten Holdings % | 18.72 |

| Mortgage Backed Securities | 41 |

| United States Government | 31 |

| Investment Grade Credit | 24 |

| Asset Backed Securities | 6 |

| Commercial Mortgage Backed Securities | 5 |

| High Yield Credit | 4 |

| Developed Government and Related (Non-US $) | 2 |

| Other | 0 |

| Emerging Market Debt | 0 |

| Bank Loans | 0 |

| Cash, Cash Equivalents and Cash Offsets | -12 |

| Ex-dividend date | record date | payable date | ordinary income | short term capital gains | long term capital gains | total distribution |

|---|---|---|---|---|---|---|

| 1/30/2026 | 1/30/2026 | 2/3/2026 | $0.0983 | $0.0000 | $0.0000 | $0.0983 |

| 12/30/2025 | 12/30/2025 | 1/2/2026 | $0.2469 | $0.0000 | $0.0000 | $0.2469 |

| 12/17/2025 | 12/17/2025 | 12/19/2025 | $0.0000 | $0.0000 | $0.0000 | $0.0000 |

| 11/26/2025 | 11/26/2025 | 12/1/2025 | $0.1100 | $0.0000 | $0.0000 | $0.1100 |

| 10/30/2025 | 10/30/2025 | 11/3/2025 | $0.1262 | $0.0000 | $0.0000 | $0.1262 |

| 9/29/2025 | 9/29/2025 | 10/1/2025 | $0.1294 | $0.0000 | $0.0000 | $0.1294 |

| 8/28/2025 | 8/28/2025 | 9/2/2025 | $0.1167 | $0.0000 | $0.0000 | $0.1167 |

| 7/30/2025 | 7/30/2025 | 8/1/2025 | $0.1328 | $0.0000 | $0.0000 | $0.1328 |

| 6/27/2025 | 6/27/2025 | 7/1/2025 | $0.1185 | $0.0000 | $0.0000 | $0.1185 |

| 5/29/2025 | 5/29/2025 | 6/2/2025 | $0.1173 | $0.0000 | $0.0000 | $0.1173 |

| 4/29/2025 | 4/29/2025 | 5/1/2025 | $0.1375 | $0.0000 | $0.0000 | $0.1375 |

| 3/28/2025 | 3/28/2025 | 4/1/2025 | $0.1240 | $0.0000 | $0.0000 | $0.1240 |

| 2/27/2025 | 2/27/2025 | 3/3/2025 | $0.1177 | $0.0000 | $0.0000 | $0.1177 |

Insights

Resources

BLOOMBERG® and any Bloomberg Index are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited ("BISL"), the administrator of the indices (collectively, "Bloomberg") and have been licensed for use for certain purposes by Hartford Funds. Bloomberg is not affiliated with Hartford Funds, and Bloomberg does not approve, endorse, review, or recommend any Hartford Funds product. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to Hartford Funds products.