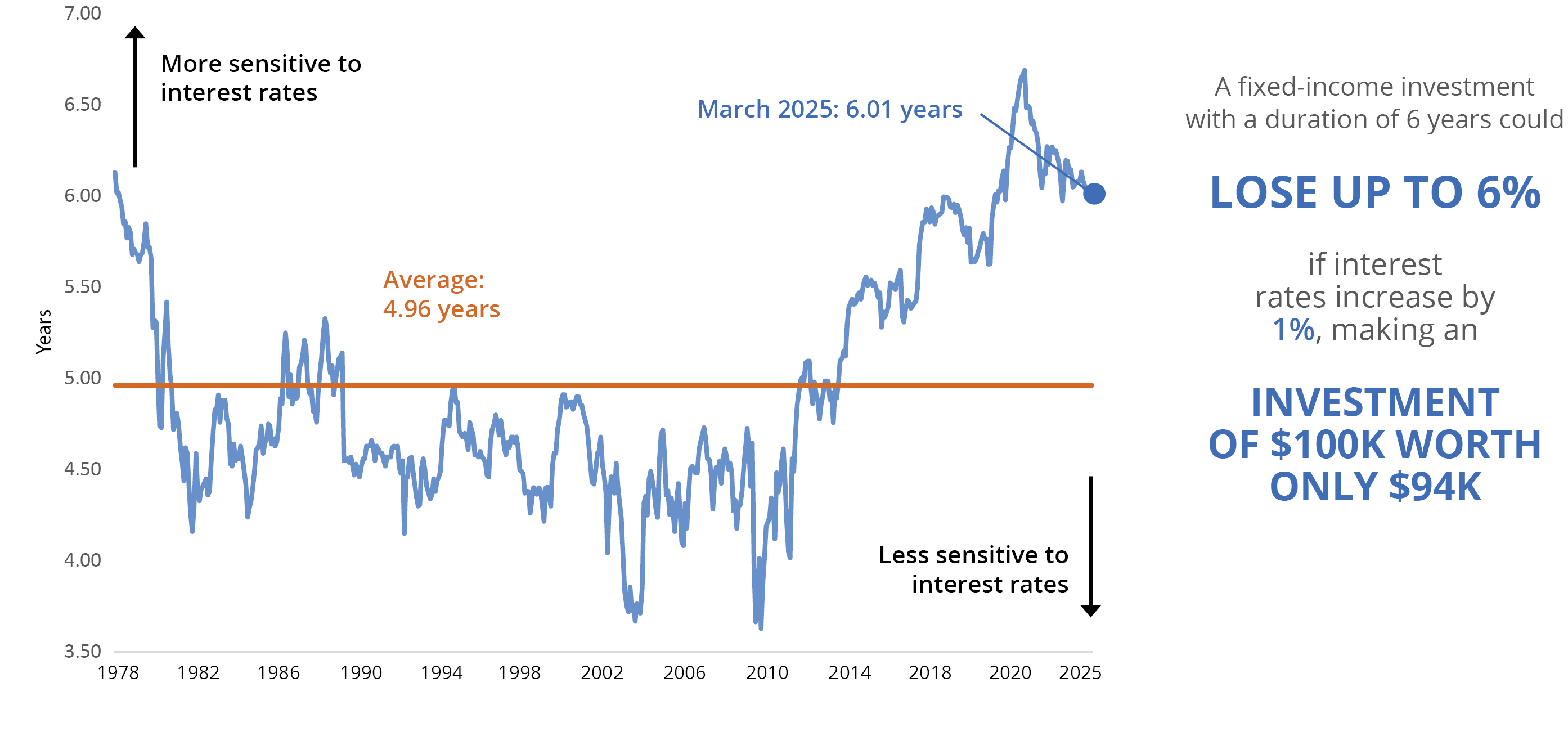

The Bloomberg US Aggregate Bond Index is a widely used proxy for the US bond market. The duration of the Index is currently 6 years vs. its long-term average of 4.98 years. Duration measures the sensitivity of bonds to changes in interest rates and can pose a growing risk to bond returns, especially when interest rates are rising. Investors should work with their financial professionals to seek bond funds that have offered attractive yields without significant duration risk.

Duration of the Bloomberg US Aggregate Bond Index (1978-2025)

Indices are unmanaged and not available for direct investment. For illustrative purposes only. Data Sources: Barclays Live, Bloomberg, and Hartford Funds, 1/26.

Select Hartford Funds With Short Duration*

Morningstar ratings for Mutual Fund I-Shares

©2026 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/ or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

©2026 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/ or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

* Funds listed have a duration of approximately three years or less; duration is subject to change. View the full list of Hartford Funds.

Talk to your financial professional about bond funds that seek to manage duration risk.

Bloomberg US Aggregate Bond Index is composed of securities that cover the US investment-grade fixed-rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

Important Risks: Investing involves risk, including the possible loss of principal. • Fixed income security risks include credit, liquidity, call, duration, and interest-rate risk. As interest rates rise, bond prices generally fall.