Institutional investors have long turned to private equity for its compelling risk-return profile and low correlation to traditional asset classes, making it a powerful tool for portfolio diversification and long-term growth.

Today, private markets are no longer just for institutions and the ultra-wealthy—Hartford Funds is helping individual investors gain access to these once exclusive opportunities.

Learn More About The Private-Equity Opportunity Set

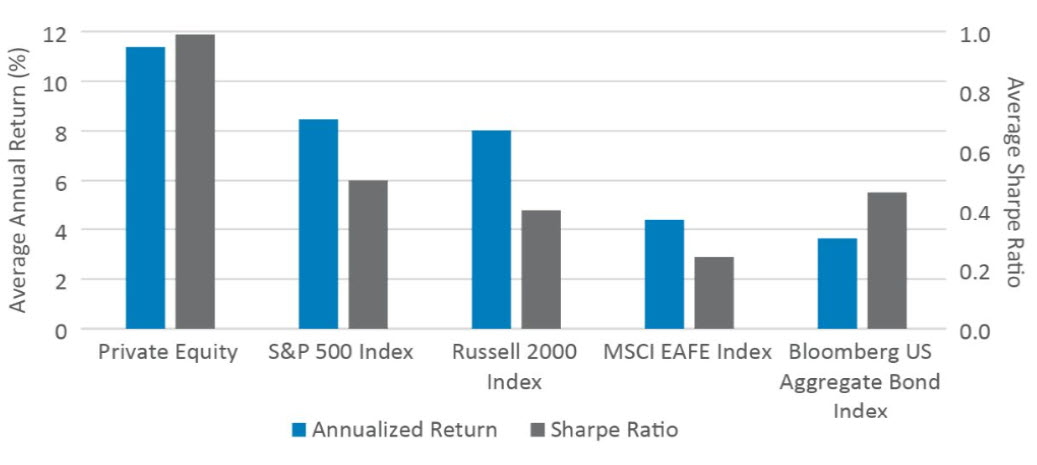

Private Equity's Return Potential

Return (%) and Sharpe Ratio (2001-2024)

Past performance does not guarantee future results. Indices are unmanaged and not available for direct investment. Sharpe Ratio is a measure of the excess fund returns per unit of risk, as measured by standard deviation. Private equity is represented by the Preqin Private Equity Index. For illustrative purposes only. Data Sources: Morningstar, Preqin, and Schroders, 6/25.

Overview

Gain access to institutional-quality private equity through a registered fund structure.

The Hartford Schroders Private Opportunities Fund seeks long-term capital appreciation by investing primarily in unlisted companies that are driving growth, transformation, or innovation. Structured to address traditional private-equity challenges, the Fund offers limited, periodic liquidity on a discretionary basis.

This is an unlisted tender-offer fund available to investors through monthly subscriptions.

Investment Expertise

Schroders Capital has been managing private equity for more than 25 years with 13 offices in the US, Europe, and Asia.

The portfolio managers are supported by the full resources of Schroders Capital.

Performance

| 1 MONTH | YTD | 1YR | 3YR | 5YR | 10YR | SI | |

|---|---|---|---|---|---|---|---|

| Hartford Schroders Private Opportunities SDR | 1.24 | 1.24 | 27.51 | --- | --- | --- | 17.41 |

| MSCI ACWI Index | 2.96 | 2.96 | 21.87 | --- | --- | --- | --- |

| 1 MONTH | YTD | 1YR | 3YR | 5YR | 10YR | SI | |

|---|---|---|---|---|---|---|---|

| Hartford Schroders Private Opportunities SDR | 2.59 | 26.96 | 26.96 | --- | --- | --- | 17.48 |

| MSCI ACWI Index | 1.04 | 22.34 | 22.34 | --- | --- | --- | --- |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when repurchased, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance for periods of less than one year is not annualized.

SI = Since Inception. Fund Inception: 07/31/2023

Characteristics

Insights

Private Markets Insights from Schroders Capital

Resources

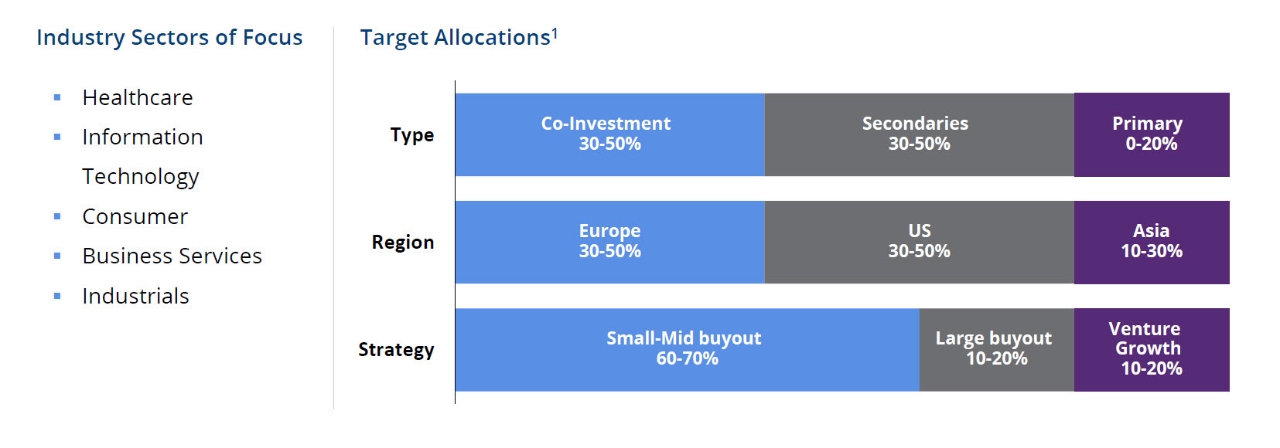

1 The target allocation above excludes the cash allocation of the strategy, which will normally range between 10-20%.

GLOSSARY:

Buyout is the acquisition of a controlling interest in a company. Co-investment is when an investor is a minority investment company alongside a private equity fund manager or venture capital firm. Growth capital is an equity investment in a company seeking to raise capital primarily to fund the company’s growth initiatives. Primary funds refers to interests in newly established Investment Funds. Secondary funds purchase a commitment to a private equity fund from the primary private equity fund investor. Venture capital is an equity investment in a company seeking to raise capital primarily to fund the company’s research and development, market development and revenue growth initiatives.

INDEX DEFINITIONS:

Bloomberg US Aggregate Bond Index is composed of securities that cover the US investment-grade fixed-rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. MSCI EAFE Index is a free float-adjusted capitalization index that is designed to measure developed-market equity performance and excludes the US and Canada. Preqin Private Equity Index is a benchmark that tracks the net performance of global private equity funds using real cash flow data, offering a clear view of how the asset class performs over time. It reflects the actual returns received by investors after fees. Russell 2000 Index measures the performance of the small-cap segment of the US equity universe. S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks.

An investment in the Fund involves substantial investment risk with the potential for attractive returns. An investment in the Fund may be appropriate for investors with a long-term investment horizon who have the risk tolerance commensurate with an investment in the Fund and sufficiently understand the Fund’s strategy, characteristics and risks, and have sufficient liquid assets to absorb potential losses and accept the lack of liquidity.

Alternative investments are complex, speculative investments and are not appropriate for all investors. Please note tax-exempt investors (such as retirement accounts) may be subject to unrelated business taxable income if invested in the Fund. Tax-exempt investors are urged to consult with their own tax professional prior to making an investment in the Fund.

An investment in the Fund is considered illiquid.

Unlisted Closed-End Fund Risks. The Fund is an unlisted, non-diversified closed-end investment company. Closed-end funds differ from open-end funds (such as mutual funds) in that investors in a closed-end fund do not have the right to redeem their shares on a daily basis. In addition, unlike many closed-end funds, Shares of the Fund are not listed on any securities exchange. To provide shareholders with limited liquidity, the Fund generally intends to conduct quarterly repurchases (also known as tender offers) of its Shares in an amount up to 5% of the Fund’s net asset value as of the prior calendar quarter end. The Fund’s Board of Trustees has complete discretion to determine whether the Fund will engage in any share repurchase. The Fund’s distributions may be funded from unlimited amounts of offering proceeds or borrowings, which may constitute a return of capital and reduce the amount of capital available to the Fund for investment. A return of capital to shareholders is a return of a portion of their original investment in the Fund, thereby reducing the tax basis of their investment. As a result of such reduction in tax basis, shareholders may be subject to tax in connection with the sale of Fund Shares, even if such Shares are sold at a loss relative to the shareholder’s original investment.

Investment Strategy Risks: Security prices fluctuate in value depending on general market and economic conditions and the prospect of individual companies. ● The Fund’s investment portfolio will consist of investments that hold securities issued primarily by privately held companies (“private equity”). Private equity investments involve a high degree of business and financial risk that can result in substantial losses. The valuation of private equity investments is complex and is typically based on fair value as determined in good faith by the Fund according to the Fund’s valuation procedures. The Fund’s net asset value could be adversely affected if the Fund’s determination regarding the fair value of the Fund’s investments were materially higher than the values that the Fund ultimately realizes upon disposal of such investment. ● Illiquid and restricted securities may be difficult to dispose of at a fair price at the times when the Fund believes it is desirable to do so. A particular investment may become illiquid, making it difficult for the Fund to sell that investment at an advantageous time or price. ● Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political, economic, and regulatory developments. These risks may be greater, and include additional risks, for investments in emerging markets. ● Small-cap and Mid-cap securities can have greater risks and volatility than large-cap companies. ● Leverage can increase market exposure, magnify investment risks, and cause losses to be realized more quickly. ● Obligations of U.S. Government agencies are supported by varying degrees of credit but are generally not backed by the full faith and credit of the U.S. Government. ● Because the Fund is non-diversified, it may invest in a smaller number of issuers, and may be more exposed to risks and volatility than a more broadly diversified fund. ● To the extent the Fund focuses on one or more sectors, the Fund may be subject to increased volatility and risk of loss if adverse developments occur. ● Financially material environmental, social and/or governance (ESG) characteristics are one of several factors that may be considered. The Fund may perform differently from funds that do not integrate ESG into their analysis.