Time: The Secret Weapon Of Investing

What a one-time investment of $1,000 can look like over time

Source: Investor.gov Compound Interest Calculator. The chart above is for illustrative purposes only. Assumes a hypothetical 10% return average annual return on investment compounded monthly and does not take into account taxes, transaction costs, or market declines, For illustrative purposes only. The illustration doesn’t represent any particular investment, nor does it account for inflation.

Ever get that sinking feeling when your boss says, “Can we talk privately?” or the even scarier, “We need to talk”? It could mean anything from bad news to a simple lunch invite, leaving you wondering why they chose such a dramatic opener.

Similarly, if you’re trying to chat with your 20-something kid about investing, the way you start the conversation is crucial. Many parents stumble right out of the gate, shutting down the discussion before it even begins. Here are some conversation starters to help your son or daughter take steps toward a better financial future.

First, Things to Say

Telling your kid, “You need to start investing,” might just get you an eye roll and a bored look. Instead, try something like:

“Do you know why you have a huge advantage over me when it comes to investing?”

This kind of question sparks curiosity. Your child might wonder how they could possibly have an edge over you, given your experience and resources. But the truth is, young people have the ultimate advantage: time. It’s the secret weapon in investing.

Your son or daughter may not realize the benefit of starting to invest at a young age, even if they only have a small amount to invest. Here’s how to help them see that each year they’re not investing is a missed opportunity for financial growth.

Share this hypothetical scenario:

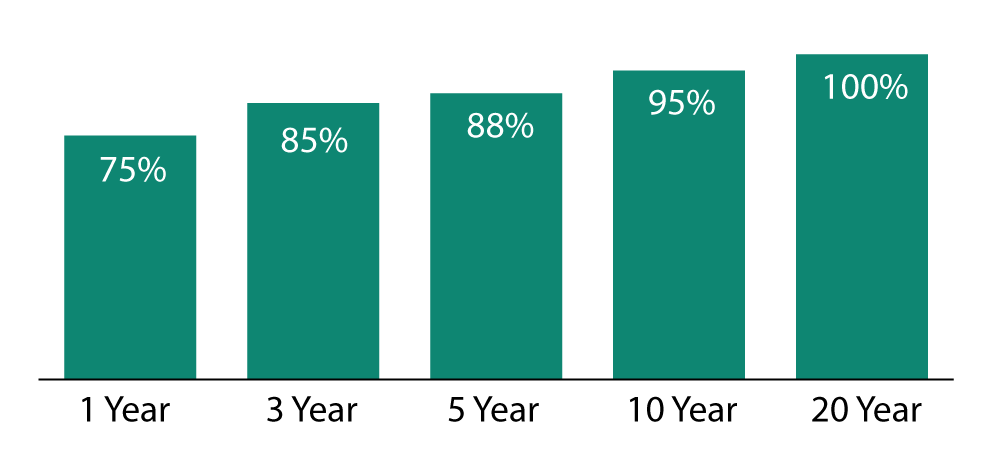

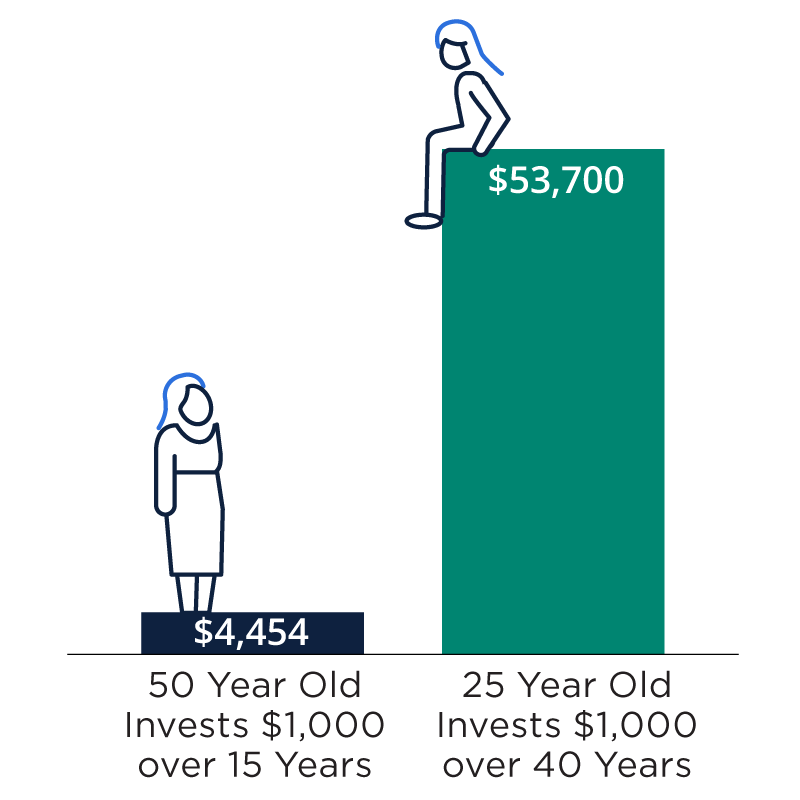

A 25-year-old and a 50-year-old each invest a one-time investment of $1,000, earn a 10% average annual return and keep it invested until they’re 65 years old. Since 1926, the average annual return of the S&P 500 Index was 10.3%. For the last 40 years, 1984–2023, it was 11.3%.1

Over the course of 40 years, the 25-year-old would end up with $53,700. With only 15 years in the market, the 50-year-old would have $4,454.2

The difference is clear. Investing early, and allowing compound interest to grow, can pay off.

“Do you think you could ever be a millionaire?”

This question sparks both curiosity and doubt. Many 20-somethings are focused on short-term financial goals like paying off student loans, affording rent, and enjoying their independence. Becoming a millionaire might seem out of reach, especially when they’re just trying to stay afloat. But in reality, starting to invest early and consistently can make it a very achievable goal.

For example, if a 25-year-old starts investing $160 each month and earns a 10% annual return in a tax-deferred account, they could have $1,011,853 by the time they turn 65.2 Plus, as they progress in their career and their salary increases, investing $160 each month will become easier, and they might even be able to invest more, boosting their overall returns. This scenario can help them see that becoming a millionaire is more attainable than they might think.

Becoming a Millionaire May Be More Doable Than You Think

If a company offers a 401(k) match, it can significantly reduce the amount needed to contribute from one’s own pocket to reach $1 million. For example, if a 25-year-old invests just 3% of their salary into their company-sponsored retirement plan, which might be around $80 a month, and the company matches it with another $80, they could reach $1 million by age 65 with an average annual return of 10%. This doesn’t even account for salary raises and higher contributions over time, meaning they could hit $1 million even sooner.3

Your son or daughter might get excited about the possibilities that come with consistent investing over time. Often, just seeing what’s achievable can be the motivation they need to start working towards their goal. Now that we’ve covered how to kick off the conversation, let’s talk about some common challenges parents face when discussing investing.