Functions Of The Reactive And Reflective Parts Of Our Brains

Picture the scene. It’s Friday night, and you and your date have settled down at the end of a long work week to chill with a movie. The popcorn’s ready, you’re sitting comfortably on your couch, and you choose something entertainingly scary. The opening credits roll.

The suspense slowly builds. You hide behind your hands and, just when you think you’re safe, a ghost jumps out of your screen, scaring the life out of you! Your heart races and you both scream in terror. Soon after, you both laugh at each other for being so scared. You grab another handful of popcorn and hunker down, ready to enjoy being scared all over again.

Why would we want to feel scared—on purpose? The answer lies in an ancient, primal response: fear can be biologically invigorating. But unlike scary movie fans, most investors don’t look forward to getting scared. Instead of being invigorating, fear can cause us to make panicked investment decisions. By understanding our biological response to fear, you can prevent fear from negatively impacting your judgment.

First, the Science Behind Fear

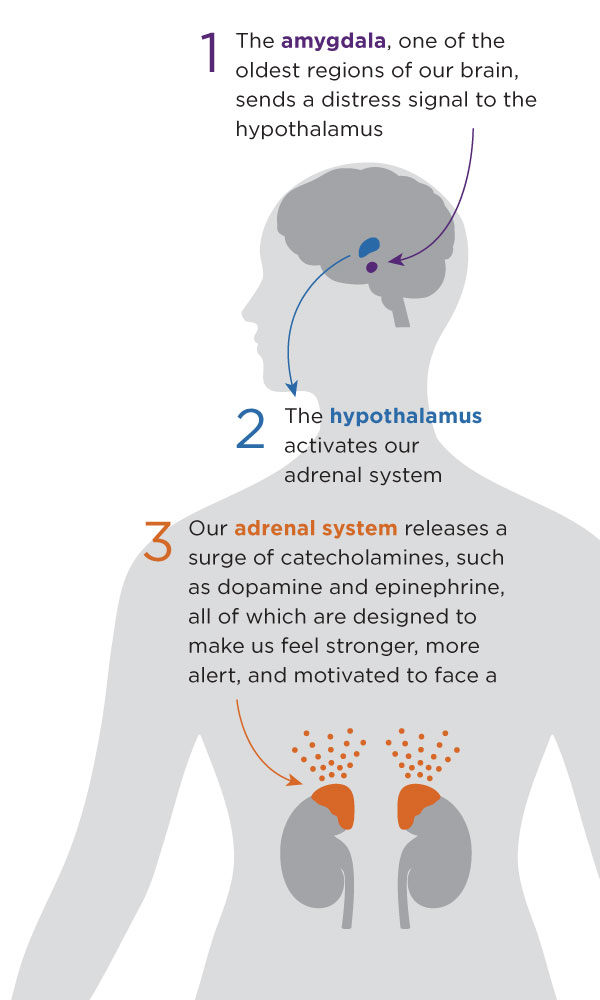

What happens when we feel threatened or scared? Our amygdala, one of the oldest regions of our brain, sends a distress signal to the hypothalamus (see diagram). This kicks our adrenal system into gear, releasing a surge of catecholamines, such as dopamine and epinephrine, all of which are designed to make us feel stronger, more alert, and motivated to face a threat.

At the same time, cortisol levels immediately ramp up, increasing blood glucose levels to the brain (vital for keeping us in a state of high alertness), while also managing the potentially damaging side-effects of raised catecholamine levels (e.g. tachycardia, hypertension, and a faster respiratory rate).

The Cortisol Effect Is Incredibly Powerful

It enables us to remain switched on—full of energy, focused, and primed to face down a threat for as long as we physically need to. It even acts as a messenger to the brain, telling our Parasympathetic Nervous System (PNS) when a threat has passed, so that it can relax us, dissipating stress hormones and returning us to a physiological state of homeostasis (balance).

Cortisol & Investing: A Scary Combination?

Part of our stress response includes the switching off all “non-essential” brain functions, and the switching on of our desire to take action—even if holding firm would be the best choice in that particular moment. Why? The brain is focused purely on protecting us from harm, re-routing resources to where they’re most vitally needed. This automatic response is extremely useful if we’re facing down an angry bear, as it triggers immediate, knee-jerk responses that will increase our chances of survival, such as fighting back or running fast.

But it’s far less helpful for an investor during a market sell-off, because the execution of all sophisticated cognitive thought processes aren’t immediately useful when threatened. Why? Thinking about self-control, memories, and analysis (all vital skills when it comes to investing) slows us down when we need to react fast. So they swiftly shut down.

Second, Why the Cortisol Effect Can Be Hard to Turn Off

When we watch a scary movie, it’s entertaining because our rational brain knows that the threat is manufactured, but our primal brain does not. As a result, we can hit the pause button or switch on the lights at any time, quickly dissipating cortisol and calming us down. Yet we still got the thrill of a “fight-or-flight” fix.

When it comes to investing, the cortisol effect can be harder to control. Once it’s triggered by a market plunge, it’s difficult to turn it off. Think back to Wednesday, August 14, 2019, when the Dow tanked 800 points and closed at 25,479. The S&P 500 fell by 3%. Spooked investors rapidly abandoned investments that would’ve been profitable in the long-term.

Just a month later, the Dow closed above 27,000. Back on August 14, most investors didn’t realize that around 85% of the trades executed in the initial sell-off originated from automatic trading algorithms and machines designed to favor short-term profits—not long-term financial security.1 Imagine how repeatedly reacting to the market’s drops like the August plunge could wreck your long-term results.

This can stimulate cortisol responses over and over, placing you in an almost constant state of fight-or-flight. The long-term effects of being in a chronically-stressed state can result in compromised decision-making, physical ill-health, anxiety, and even death of brain tissue. Even worse, once the cortisol effect is triggered, financial news can perpetuate it. Our phones give us access to the sensationalistic 24/7 financial-news click-bait culture: recession warnings, simmering trade wars, and frequent sell-offs—all of which can trigger our stress response. Tech and social media use are also linked to increased cortisol levels, so habitually using our smartphones to check the markets amplifies the stress response even further, ultimately endangering our long-term health and wealth.

Third, Managing the Cortisol Effect

When we face a sudden, unexpected threat, our physiological stress response is powerful, automatic and instinctual. Given that this response lies outside our conscious control, is it realistic to expect that we can influence it?

Happily, yes.

Simply being aware of the power of your “fight-or-flight” response allows you to avoid being overpowered by its effects. The next time you wake up to some worrying financial headlines, find a healthy distraction to make use of powered-up cortisol levels (e.g., a run in the park). Use that time to reflect on your long-term investment goals. Biologically, this will leave you feeling calmer. But if you still feel stressed, call your financial professional and ask for their perspective on what’s going on.

For the next seven days, limit your daily internet use to a minimum (say, one hour a day). Ban your smartphone from your bedroom, allowing you to wind down naturally without cortisol levels becoming artificially raised via excessive screen time. See how you feel in a week, and make the shift permanent if you notice the benefits. Always rely on trusted sources of investing advice and data, or you’ll risk re-triggering your stress response.

Today we’re exposed to an almost constant state of physiological arousal Integrating stretching, breathing, meditation and/or exercise in your daily routine can help keep cortisol levels in check.

Finally, tell your financial professional that you want to proactively prepare for market uncertainty. Ask them to explain the benefits of staying invested for the long-term—even if it means riding out a storm—to help you resist making knee-jerk investing decisions when you’re feeling panicked.

Things to Remember About the Cortisol Effect

First, fear causes a cortisol release that can put us in fight-or-flight mode. Second, once the cortisol effect is triggered, it can be hard to stop. Constant exposure to financial news keeps it going. Third, if you realize you’re experiencing a cortisol effect, there are things you can do to shut it down.