- Individual Investor? Learn More Individual Investor? LEARN MORE >

-

ACCOUNT ACCESS

- FOR FINANCIAL PROFESSIONALS

- Mutual Fund Accounts

- Smart529 Accounts

- FOR INDIVIDUAL INVESTORS

- Mutual Fund Accounts

- Smart529 Accounts

-

CONTACT US

Pre-Sales Support

Mutual Funds and ETFs - 800-456-7526

Monday-Thursday: 8:00 a.m. – 6:00 p.m. ET

Friday: 8:00 a.m. – 5:00 p.m. ETPost-Sales and Website Support

888-843-7824

Monday-Friday: 9:00 a.m. - 6:00 p.m. ET- PHONE US MAIL US

- ADVISOR LOG IN

-

Products

- INVESTMENT RESOURCES

- Systematic ETFs

- Model-Delivery SMAs

- The Hartford SMART529 College Savings Plan

- VIEW FUNDS BY ASSET CLASS

- Taxable Bond

- Domestic Equity

- International/Global Equity

- Tax Advantaged Bond

- Multi Strategy

-

Insights

- Market Perspectives

- Equity

- Fixed Income

- Global Macro Analysis

- Strategic Beta & ETFs

- Investor Insight

- The Future of Advice

- Navigating Longevity

- Investor Behavior

- See all Investor Insights

- Investment Strategy

- Global Investment Strategist

- Fixed-Income Strategist

- Informed Investor

- Practice Management

- Resources

- About Us

-

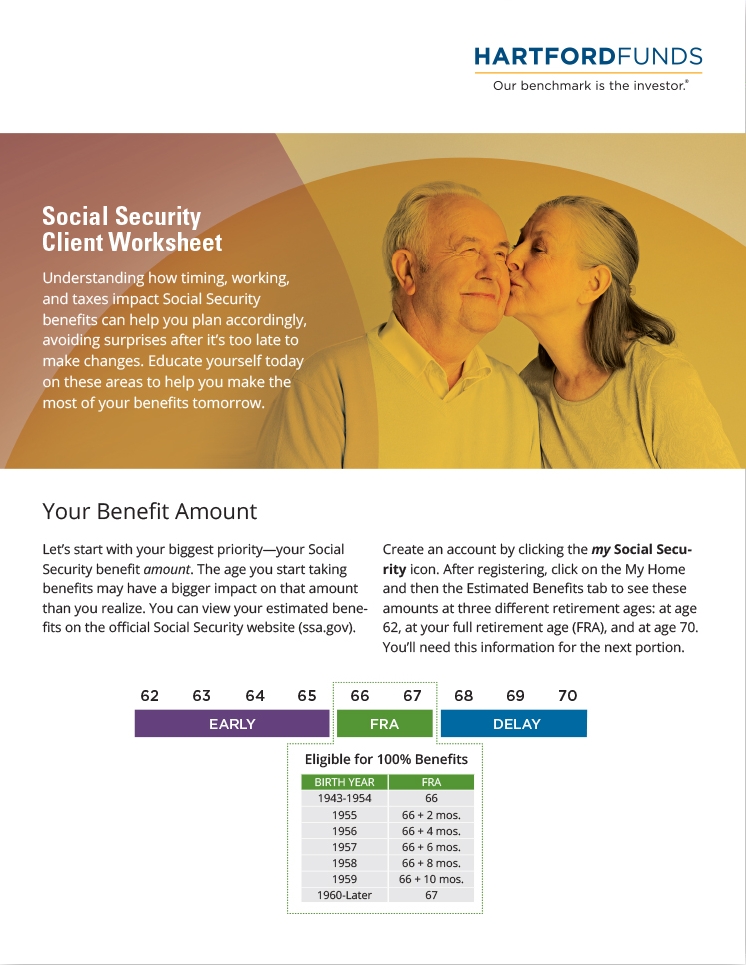

Help Clients Make the Most of Their Social Security Benefits

Social Security was originally designed to supplement employer-sponsored plans and other savings, not to be retirees’ sole source of income. Yet 40% of retirees say that Social Security is their only source of income.1 But benefits are more modest than people realize: Social Security benefits only replace about 37% of past earnings, and that figure will continue to decline.2 Knowing the factors that can negatively impact Social Security benefits can help clients avoid being caught by surprise, when it’s too late to make changes.

Learn:

- How confusion about Social Security can lead clients to claim benefits early, which can result in significantly lower benefits

- Why certain income options, tax treatment of benefits, or continuing to work may also lower benefits

- How to help clients maximize their Social Security benefits and integrate them into their overall portfolio

Next Steps

| 1 | Download or order the worksheet |

| 2 | Identify clients in your book of business who are age 50-60 |

| 3 | Contact your Hartford Funds Advisor Consultant about hosting a client education event |

*Contact your Hartford Funds representative or call 800-456-7526 about CE information. Hartford Funds Distributors, LLC, Member FINRA is the provider of CE credits.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses to certification marks, CFP®, Certified Financial Planner®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

Accepted by the CFP Board for CE credit.

1 Older Americans increasingly struggling to save for retirement, cbsnews.com, 2/27/23

2 Policy Basics: Top Ten Facts about Social Security, cbpp.org, 3/4/22