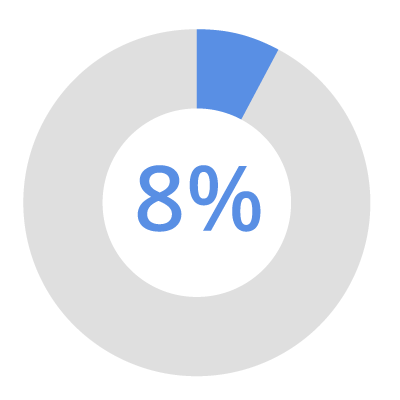

Only 8% of older adults know the factors that can reduce their benefit1

There’s a lot of noise surrounding Social Security these days. Given the uncertainty about the program’s future, the volume has been turned up even higher than before. But the conversations would be more productive if they were focused on a bigger issue at hand: Many pre-retirees will depend on a system they know very little about for their livelihood.

Why Are Clients in the Dark About Social Security?

One potential reason for this low level of understanding: less than half of older Americans have a financial professional providing advice on Social Security.1 Many are left to figure out the complexities of Social Security on their own, making them vulnerable to making mistakes. A whopping 79% say they would switch to a financial professional who knows how to help them maximize their benefits.1 Are you educating your own clients? If so, great—but there could be an opportunity to help more.

Here are three key factors to discuss with your clients as they begin making decisions about their Social Security benefits: timing, work, and taxes.

Timing: Age Isn't Just a Number

In 2024, 63% of retirees claimed Social Security benefits before reaching their full retirement age (FRA), and a third claimed benefits at 62, which is the earliest most Americans are eligible.2 However, this is considered early filing. By doing so, they may lock in a lower-than-expected benefit for the remainder of their lives.

Suppose the Social Security benefit for an individual at their full retirement age of 67 is expected to be $2,291 per month. But instead of waiting, they file for Social Security early at age 62. This would reduce their monthly benefit to $1,487.3 That's a $804 per month difference, or $9,648 annually. Coupled with the fact that life expectancy has been steadily increasing, many retirees who file early find themselves having much less financial flexibility than they’d hoped for.