3 Components of Gentelligence

I was waiting to board a flight when a news headline caught my eye: “Why Millennials Can’t Grow Up.” It was an article in The Atlantic sharing that Millennials were delaying home ownership, marriage, and starting a family far longer than previous generations. From these trends, the article concluded that Millennials couldn’t seem to grow up.

While you might not share that perception, it’s easy to make similar assumptions about people in different generations, knowingly or not. Oftentimes this can get in the way of building meaningful intergenerational relationships.

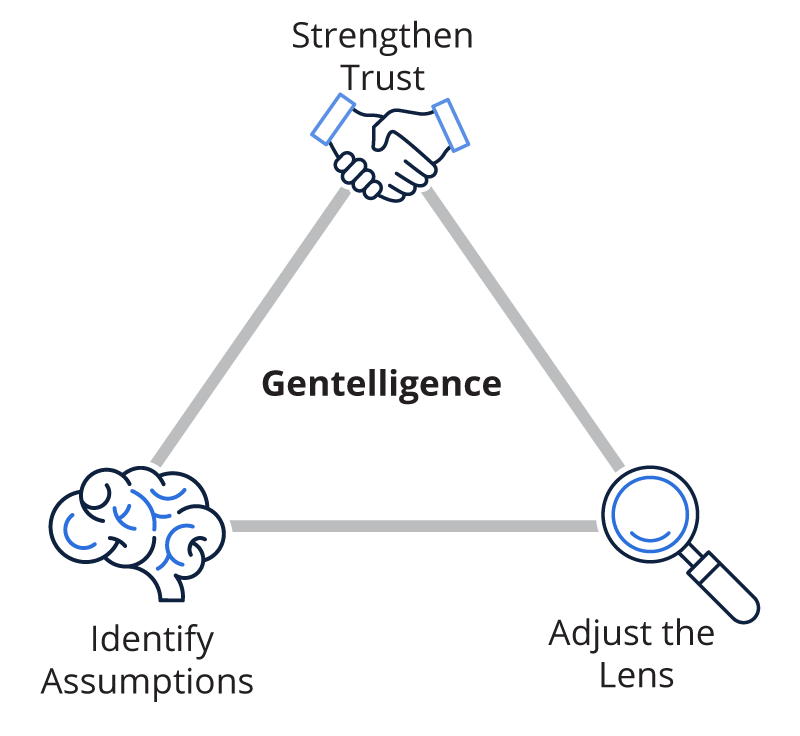

Many financial professionals want to build relationships with younger generations. No wonder, since 80% or more of clients’ children will leave their parents’ financial professional once they receive their inheritance.1 So how do we build those relationships? Fortunately, there’s a way to turn generational differences into opportunities rather than obstacles. I call this approach Gentelligence. I’ll explain how to use Gentelligence to avoid some common pitfalls and recommend additional strategies to build strong connections.