Andrea stood at the cash register, flushed with humiliation. Her credit card had been declined. “I don’t know what the problem is,” she said. But deep down, she knew. After missing two payments, her card had been deactivated. “I’m sorry,” she told the cashier. “I’ll have to call my credit card company.” She left the school clothes she’d picked out for the boys on the counter and walked away with her head down.

All I want to do is take care of my family, she thought. She didn’t spend money on herself because her sons came first. She’d been in financial jams before and was trying to turn over a new leaf—again. I’m trying so hard…why do I always make a mess of things? She wondered.

Andrea didn’t realize that her situation isn’t due to a character flaw. Ingrained beliefs about money have been influencing her financial decisions for years. Instead of beating herself up, she can use a money genogram to find out why she keeps making the same mistakes—and how to stop.

What a Money Genogram Is

A money genogram is like a lot like a family tree diagram. And like the genetics in your family tree, attitudes and behaviors about money also get passed down. The money genogram tracks this generational transmission of money messages and how they affect you today. In other words, what did family members and caregivers in previous generations teach you about money, how to manage it, and its purpose in life? These messages are part of your personal history with money, also referred to as a “money story.”

Money stories and the messages within them aren’t inherently good or bad—it’s how they influence you that matters.

Money Stories Are an Unknown Influence on Financial Behavior

Your financial behaviors and decisions are greatly affected by previous generations’ thoughts and beliefs about money. These thoughts and beliefs might have been taught, observed, or both. But even though your money story is a major influence on how you feel about money, chances are you’re not even aware of it. That’s because our money stories are ingrained in our subconscious mind.

Why the Money Genogram Is a Powerful Tool

Your money genogram can bring childhood messages and experiences into your conscious awareness, revealing any beliefs and behaviors that may be interfering with your financial decision-making today. Even better is that creating a money genogram isn’t a complicated process, nor does it require the help of a professional. You can easily do it on your own.

How to Create Your Money Genogram

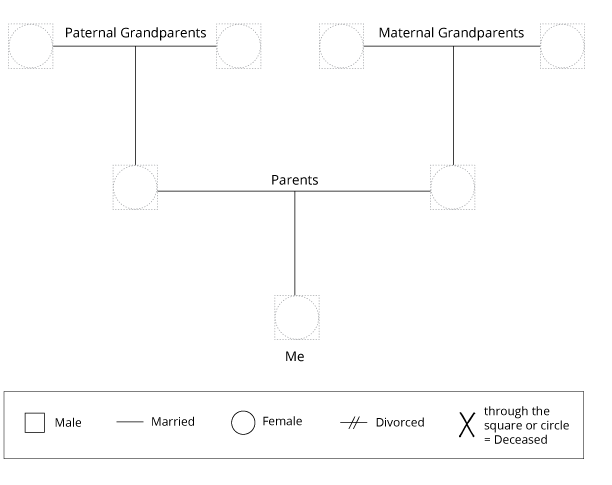

- On a blank sheet of paper, draw this simple diagram:

- Label each family member or important caregiver, including yourself, with his or her first name, age, and occupation.

- Use the key on the right to indicate gender, marital status, and whether the family member is living or deceased.

- Next to each person’s profile, write down a description or brief statement about their personal money beliefs or behaviors. If you’re unsure, you can ask other family members for their perspective or leave it blank.

- Now look at your genogram and ask yourself the following questions:

- How are your beliefs and behaviors about money—similar, or different—from others in your genogram?

- How did money messages shape your relationship with money and what you want out of life, especially as it relates to spending, saving, and investing?

- What do you do as a result? How do these messages inform your decisions?

- How have these messages affected your struggles or success?

“Discovering your unique money story and appreciating its power is an important step toward making peace with money and improving your financial health.”

— Kathleen Burns Kingsbury

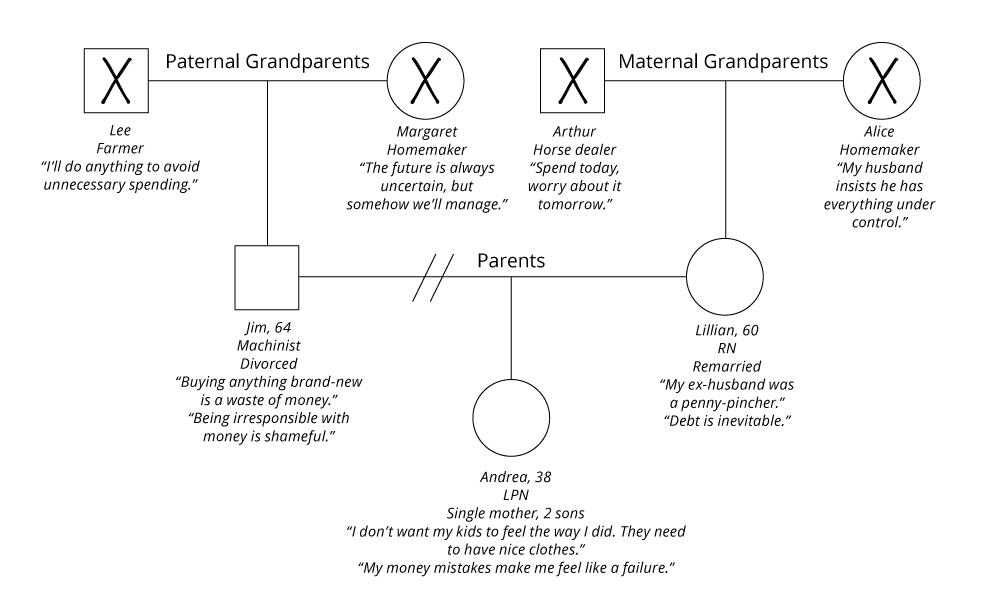

Let’s Look at Andrea’s Genogram as an Example

Andrea was raised by her single father, Jim. Although Jim worked tirelessly to support Andrea and her siblings, money was tight. Jim was a Mr. Fix-It, partly out of necessity, but also because he was born during the Great Depression (a big part of his own money story).

What Andrea’s Genogram Revealed

Jim’s main money messages were:

- “Buying anything brand new is a waste of money.”

- “Being irresponsible with money is shameful.”

How those messages affected Andrea growing up:

- Andrea felt embarrassed when she wore tattered hand-me-downs to school but would never complain to her hard-working dad.

How those messages influence her feelings and decisions today:

- “I don’t want my kids to feel the way I did. They need to have nice clothes.”

- “My money mistakes make me feel like a failure.”

Because her father was so meticulous about money, Andrea felt even worse when she found herself in a financial bind.

Your Money Genogram Is Like a Decoder

By making the connection between these messages and her decisions, and realizing how they affected her both financially and emotionally, Andrea was equipped to change her money story for the better. She substituted her old money messages with new, healthier ones:

- “My kids can have nice clothes—but they don’t always have to be brand-new or top-of-the-line.”

- “I’m taking responsibility for my finances by working with a financial professional. She’ll help me get on track and stay on track.”

For the first time in years, Andrea was gaining control over behaviors that had caused her so much angst. Now she was feeling hopeful. That’s the power of the money genogram.

Not Every Genogram Is Clear and Dramatic

The tool also isn’t intended to pinpoint only negative messages. Some messages have likely had a positive influence on your financial decision-making. Maybe you’re a good saver because you had a grandparent whose money message was, “Always pay yourself first.”

At this stage, your money genogram is simply a place for you to start to jot down memories, ideas, and associations to gain insight into your financial decision-making. By sharing this information with your financial professional, he or she can help you overcome obstacles you identified by working through your genogram.

“This Is Overcomplicating Things. You’re Either Good at Managing Money or You’re Not.”

It’s a common assumption that you either “have it” or you don’t when it comes to smart money management. And if you don’t have it, there’s no hope that you’ll ever be good at handling finances.

But it isn’t necessarily a lack of ability that causes people to make poor financial decisions. Not understanding the forces behind their decision-making can play a big role. The money genogram helps your clients identify learned money messages, and address those that are problematic to become more financially competent.

Your Relationship With Money Doesn’t Just Happen. It’s Shaped by Your History.

Oftentimes, people who struggle with finances think they’re just not good at handling money and there’s not much hope of changing that. Andrea’s declined credit card experience was discouraging because she didn’t know why she kept finding herself in bad predicaments. A genogram exercise can reveal how learned messages and behaviors from the past may be shaping your own decisions today. And it may give you some clues about how to make changes to improve your decision making.

Next Steps

| 1 | Download the whitepaper |

| 2 | Reflect on your own familial money messages and experiences |

| 3 | Share this information with your financial professional and consider its influence your financial decisions |