For decades, retirement had a clear definition: It was life after work. Today, however, retirement takes a more ambiguous form. Now, it may mean employment remaining constant, dropping to part-time, or even leading to a career change. The future holds an array of options in what to do, where to live, and with whom clients should spend their time.

The traditional view of retirement is outdated

Unlike past generations, that period is no longer a relatively brief one at the end of our lives. Most of us are excited about what lies ahead, imagining endless days devoted to golf, grandchildren, and travel. But chances are retirement will be a bit different than that. The idea of this time as a brief period of relaxation and reward is a misconception.

Retirement is now an entire life stage waiting to be written

But for some people, that story is a difficult one to craft alone. Getting a better sense of what lies ahead and how to map it all out can be a remarkably helpful means of putting a framework together for your own tale.

A Life in 8,000 Day Parts

Here’s some basic math about modern lives. Let’s assume that a person, with some or more college education and good income, is now likely to live well into their 80s. Your life can be divided into four periods averaging approximately 8,000 days each. Birth to college graduation at age 22 is about 8,000 days. College graduation to midlife at about age 44 is another 8,000 days. Midlife to retirement at age 66 is 8,000 more days. And, add about another 8,000 days from your retirement party forward.

- Learning (1st 8,000 Days)

- Born

- Go to school

- Enjoy teen years

- Attend a college

- Growing (2nd 8,000 Days)

- Start professional career

- Relationship/marriage

- Home owner

- Have children

- Maturing (3rd 8,000 Days)

- Enter prime career years

- Enjoying income/buying car/bigger houses/nice vacations

- Welcome grandchildren

- Retire from job

- Exploring (4th 8,000 Days)

- Golf, grandchildren, travel

- ?

- ?

- ?

The previous three life stages have compelling examples and clear stories that guide and engage us through the decades. Retirement planning has not yet caught up to the realities of an 8,000 day retirement. Without a clear picture of what lies ahead, you’ll have the challenges associated with planning an entire life stage without examples or story lines to follow. This inability to envision your future self not just years, but decades in the future, is caused by the ambiguity of exactly what happens next.

The Reality of Retirement

In an ongoing study at the MIT AgeLab, hundreds of people have been asked to describe how they envision life after retirement. The majority of participants mentioned extended work, even if part time, leisure activities, and spending time with family or volunteering as the top activities they envision themselves doing.

Although these pursuits suggest a healthy perspective on aging, the responses may indicate an overly generalized vision of what could be decades of changes in work, health, finances, housing, marital status, and countless other activities. The 8,000 day story enables a clear vision to plan and to anticipate what is likely to come.

The Four Phases of Retirement

It’s often asked, “What will you do on Day One of your retirement?” Most people have a clear image of Day One. Maybe even Day 1,001. But few can imagine 8,000 days of golf, and even fewer have a vision of what they will be doing on any given day—such as Day 4,567. But getting started on the right foot can be crucial.

Instead of planning for ‘retirement’ as a single state, it may be beneficial to reframe the conversation to reflect a four-phased concept of retirement. Each is characterized by the tasks and issues individuals are most likely to be managing. The four retirement phases enable a clear vision to plan and to anticipate what is likely to come.

- The Honeymoon Phase

- The Big Decision Phase

- The Navigating Longevity Phase

- The Solo Journey Phase

1. The Honeymoon Phase

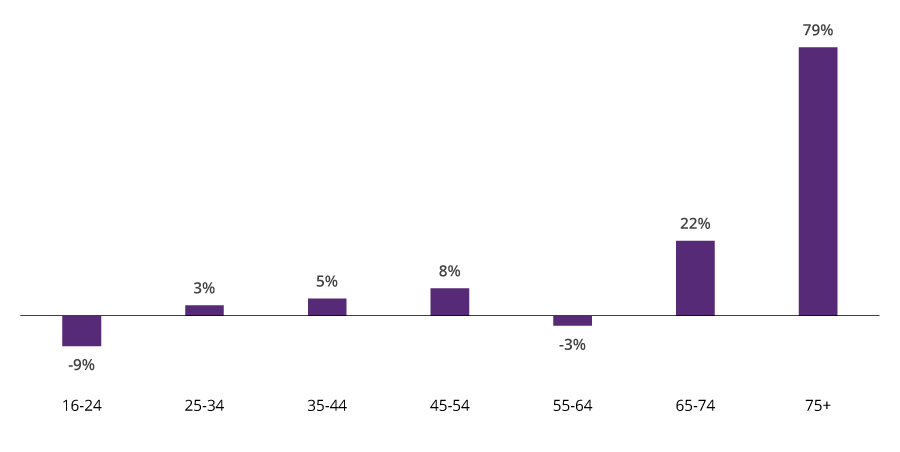

For those with greater education and income, there is likely to be an even greater span of well-being in retirement giving far more time to do more than walk an endless beach. A 65-year-old person in their early 60s today is likely to enjoy nearly 20 healthy years ahead of them.1 Many see this first retirement phase as a honeymoon stage. It’s a time filled with travel and participation in other leisure activities, perhaps with a balance of work, part-time employment, or volunteering to remain engaged and to ensure adequate income to support loved ones. For people aged 65 to 74, the number of those working is expected to jump by 22% from 2023 to 2033. And for those over 75, it’s predicted to soar by 79%.2

Everything Has Changed. Nothing Has Changed.

The Honeymoon Phase is characterized by resources and well-being comparable to life during full-time work. Shifting responsibilities, desire to pursue existing and new interests, and additional healthy life years often allow for more freedom. It is also the opportune time to anticipate and safe-guard against potential decreases in resources in the future through planning.

Full House

Baby boomers, even in their retirement years, are increasingly described as the sandwich generation because of their responsibilities in continuing to support adult children in addition to caring for frail, aging parents. In fact, 48% of parents surveyed are financially supporting their adult children over 18 in some way and 25% of them are providing financial support to their parents.3

Many adult children may also still be living with their parents. More than half (56%) of adults ages 18 to 24 lived in their parental home in 2022.4

Older Workers Outpace Growth Rate of Other Age Groups2

% change in civilian labor force by age group 2023–2033

People aged 65 and older are the fastest-growing group in the workforce—by a long shot. Some aging adults will work because they need the income and others to maintain a sense of purpose.

2. The Big Decision Phase

While the second retirement phase is best characterized by more ‘free’ time, it is often unstated that it is a key time for making big decisions. It takes shape as work truly fades from view.

While health status may be less vibrant than before, the second retirement phase does provide greater opportunity to make or renew social connections. Friends now have more time to socialize and even travel together. Work may be replaced by increased volunteering, grandparenting, travel plans, or hobbies.

Where to Go?

Individuals and couples are confronted in the second retirement phase by tactical questions: “Now that we are fully ‘retired,’ should we buy a new car for both transportation and personal reward? Should we stay in our hometown or move somewhere warmer? Will life be easier if we downsize? Can we afford our current lifestyle for the long term?”

As empty nesters face issues regarding changing housing needs, the option to downsize may be appealing. In fact, 29% of homebuyers 55+ downsized in 2023.5

For many, concerns about the cost of home maintenance, proximity to family, access to services, and livability of their existing home (such as having a master bedroom and other necessities on the first floor when stairs are no longer manageable) are reason enough to leave the house, the town, or even the state.

Changing Income Sources

Retirees in the second retirement phase are drawing a greater share of their income from different sources. Here’s where retirees over 65 are getting their income: 92% receive income from Social Security, 60% from 401(k)s or IRAs, and 55% from pensions.6

Financial decisions, such as whether assets from savings should be converted to annuities, whether insurance is worthwhile, and so forth, become time sensitive, as does the need to create an estate plan.

Stay in my home

Move in with family member

Upsize or downsize

50+ community

Assisted living

Continuing care retirement community (CCRC)

3. The Navigating Longevity Phase

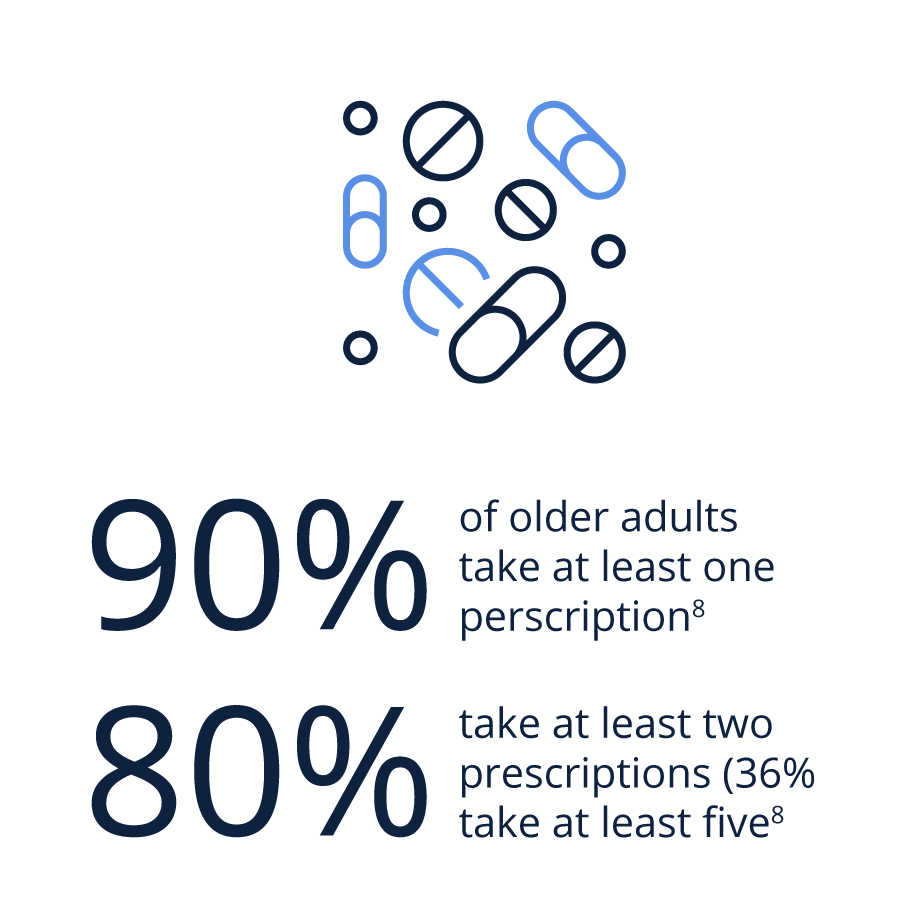

In the third retirement phase, the logistics of health management may become a full-time job with increased medical appointments, medication management, and increasing mobility challenges. Spending per capita on healthcare increases steeply after age 65.

A Bitter Pill to Swallow

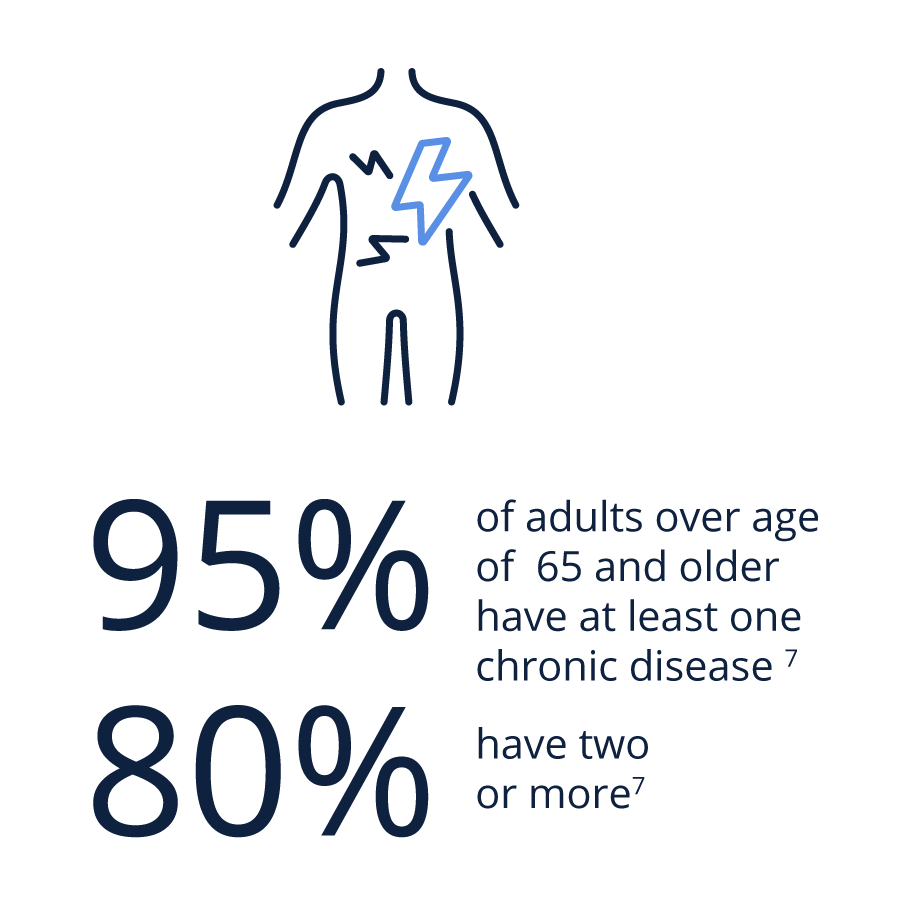

It’s estimated that 85% of older adults are managing at least one chronic condition and 60% are managing the complexities of two or more chronic conditions.7 Chronic conditions can make handling other health issues more difficult or make health, in general, more complex to manage.

For example, what may seem like a straightforward routine, medication adherence, becomes a key and challenging aspect of managing health. A look at the numbers (see graphic) shows how increased age leads to juggling more medications.8

I’ll Be There For You

Due to changes in health, individually or as a couple, social well-being may change. Fewer opportunities to join friends and family may be available. Additionally, friends in the same age cohort managing their own health-related issues make maintaining connections a greater challenge.

Complexity also arises in the need for suitable housing and occasional or daily assistance from a friend or family member to help run routine errands and maintain the home. While many legal affairs haven’t yet come into play, such as a health care proxy or power of attorney, this phase of retirement often highlights the growing importance to have these legal contingencies established so that they are available when necessary.

In such scenarios, trusted people are selected to make decisions on one’s behalf, and it is in one’s best interest to put these plans in place while cognitive and physical functions are adequate and desires can be communicated clearly.

Managing Your Health Can Become a Full-Time Job

4. The Solo Journey Phase

In the fourth retirement phase, health or physical issues can quickly and abruptly come to the forefront. A single catastrophic event, such as a fall or stroke, can immediately change needs and lifestyle. Serious illness or disability of a spouse will greatly impact the well-being and safety of the household.

Health events or illness dictate the need for caregiver help on an occasional or daily basis to run errands, provide transportation, or help with other activities of daily living (ADLs) and instrumental activities of daily living (IADLs).

Going the Distance

Women typically outlive men. So they may need to take additional steps to ensure adequate resources and manage risk. Consider this: of women ages 65–74, 27% live alone while 39% of women 75–84 live alone.9 One-person households are likely to make issues that were once simple a burden. Consequently, rethinking living arrangements may be necessary, e.g., considering moving in with a family member or into an assisted-living or long-term care facility.

A Helping Hand

The fourth retirement phase may result in conflict between family members. For example, disagreements may surface between older adults and their adult children because a well-meaning son or daughter is concerned about the safety of their parent’s driving or even their capacity to live alone.

For this reason, clear intentions and plans previously put in place, such as a power of attorney, health care proxies, and, more broadly, one’s preferences for care, can help make this period run smoothly and comfortably. This can also decrease the burden placed on adult children who would otherwise feel compelled to make decisions for, and sometimes, against the will of their parents.

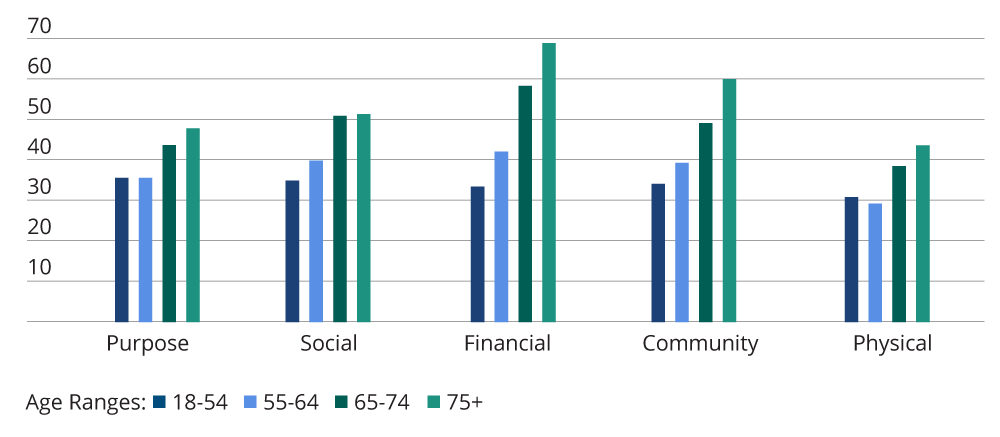

Though it may seem counterintuitive, even though we see a depletion of physical, financial, social, and perhaps cognitive resources, emotional well-being in older adulthood is high in comparison to other stages of life (see graph above). This suggests that with proper planning despite lower resources, aging individuals can feel optimistic about increased longevity. You can also use this period of time to reinvent yourself.

Americans 75+ have highest well-being Rankings10

Retirement Phase Caveats

The four retirement phases described are not intended to be four neatly defined stages that all individuals can expect to transition through in well-timed, evenly-phased procession. Everyone ages differently. Birthdays do not provide an effective predictive tool.

Rather, the transition from full-time work to The Honeymoon Phase can quickly change to The Big Decision Phase and The Navigating Longevity Phase if the individual or a loved one faces a major change, such as a change in living arrangements (e.g., divorce) or health status.

In as little as 10 years, individuals often find risk of poor health increasing rapidly. One incident, such as a fall, could cause the retirement phase he or she imagined to be sidelined because of a loss of self-sufficiency and consequent lifestyle-changing decisions. One fourth of Americans age 65 and older fall each year.11

While an individual might be in one phase of retirement, the health of his or her spouse may be in a different phase and propel the couple into a new manifestation of retired life together. Or, one may remain in the third retirement phase but find new complexities in the passing of a spouse and related transfer of responsibilities. This suggests that you should consider the overall available resources of a couple, rather than simply as individuals.

It’s Important That You Write Your Retirement Story

The outlook of the 8,000 days we may spend in retirement is already changing: While working longer has become increasingly appealing to baby boomers, there is a risk that remaining in the workforce could create a false sense of security for one’s future.

For example, one may think that retirement plans are not an immediate concern because he or she is still growing his or her retirement fund. This may delay the consideration of preferences for the future, let alone the decisions necessary to ensure those preferences are fulfilled.

One way to think of this is to consider the growing number of individuals in the workforce who plan to “work until they can’t work anymore.” While this can be seen as beneficial for financial and emotional well-being in the short term, it does not negate the importance of planning years ahead under the assumption of decreasing capacity to maintain current lifestyles.

Understanding retirement not as one chapter, but rather as four phases, ensures that realistic plans are in place so that a couple’s or an individual’s well-being does not suddenly, nor greatly, change due to controllable factors.

Considering retirement as something that changes shape throughout older adulthood prevents an outlook such as, “I will either be healthy or suffering,” or “I will either be able to do what I want or I won’t.” Planning for each of the four retirement phases individually allows for people to contextualize, understand, and ultimately prepare for their thriving in retirement.

A Coauthor for Your Journey

What these different phases are meant to show is that retirement is big and complex and overwhelming—but it’s not the end. It’s not what stereotypes would have us think. In everyone’s retirement, they will face these phases, but there is no formula for when or how the timeline will unfold.

Effective preparation can reduce the stress of uncertainty and boost prolonged independence and control in the lives we’ll lead tomorrow. Your financial professional, while still maintaining their core competency and value as your financial expert, can help you create a story of retirement where you will be the main character. He or she can also serve as a guide to the options and costs of various lifestyles in this yet largely uncharted phase of life.

Next Steps

- Within one week, review the four phases of retirement in this white paper and decide which phase you’re in. If you’re helping a friend or family member as they age, decide what phase they’re in.

- Within two weeks, download or order an 8,000 Days workbook at hartfordfunds.com/days and complete the section of workbook that’s most relevant to your situation.

- Within three weeks, schedule an appointment with your financial professional to discuss your workbook answers.

The MIT AgeLab is not an affiliate or subsidiary of Hartford Funds.

1 Social Security Administration, www.ssa.gov, 2024

2 Civilian labor force participation rate by age, sex, race, and ethnicity, US Bureau of Labor Statistics, 8/29/24

3 The ‘Sandwich Generation’ Is Financially Taking Care Of Their Parents, Kids And Themselves, Forbes, 4/24/23

4 Census Bureau Releases New Estimates on America’s Families and Living Arrangements, US Census Bureau, 5/30/24

5 Is Downsizing Right for Your Retirement? Kiplinger, 10/27/24

6 Retirement Income Sources: Where Do Most Retirees Get Their Income From? The Motley Fool, 11/26/24

7 Get the Facts on Healthy Aging, National Council on Aging, 8/16/24

8 The Hidden Drug Epidemic Among Older People, The New York Times, 12/16/19. Most recent data available.

9 Fact Sheet: Aging in the United States, Population Reference Bureau, 1/9/24

10 Gallup-Healthways, “State of American Well-Being,” 2015. Most recent data available used.

11 Older Adults Fall Data, CDC, 10/28/24