Back in the early 2000s, there was a lot of buzz about a mysterious new device called “Ginger.” Steve Jobs even said it would be “as big of a deal as the PC.” But when the Segway Human Transporter finally came out in 2001, it didn’t quite live up to the hype of revolutionizing personal transportation..

Similarly, retirement is often seen as a paradise, a time for fun and relaxation. But for many, it can initially be as disappointing as the Segway. Luckily, there are ways to avoid a retirement letdown and make the transition smoother.

Entry into Retirement May Be a Letdown

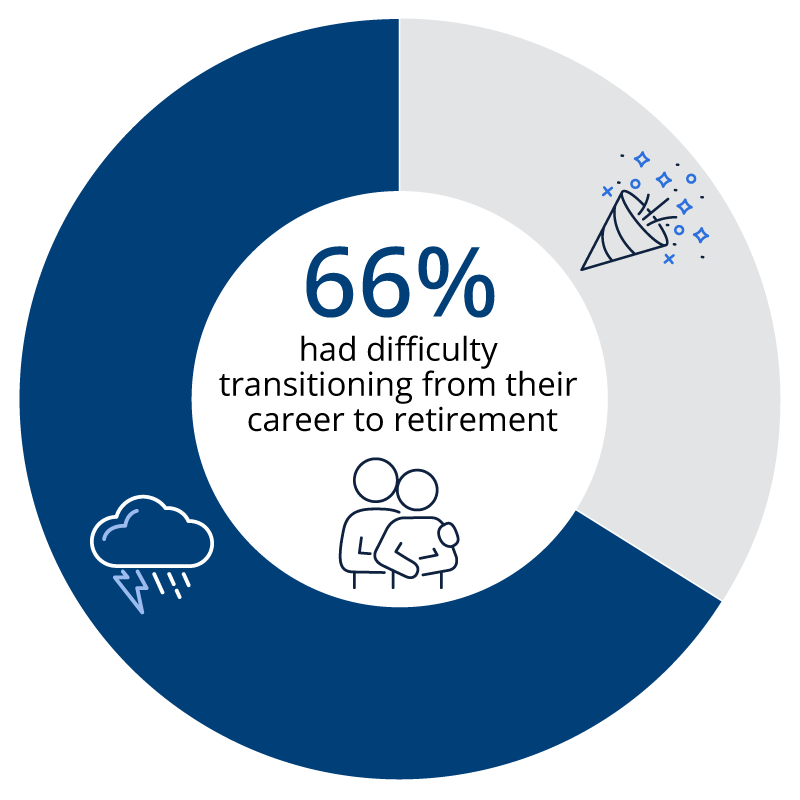

We work to save for retirement for most of our lives. We anticipate having the time and freedom to do what we want when we want. However, when retirement happens, many of us struggle with the transition. Two-thirds of recent retirees (66%) say they had challenges adapting to retirement.1

Retirement Is Supposed To Be Fun, Not Challenging

Source: How to Ease the Emotional Transition into Retirement, More Than Your Money, Inc, 1/22/20. Most recent data available.

What’s the Honeymoon Phase of Retirement?

According to Dr. Joseph Coughlin, director of the MIT AgeLab (agelab.mit.edu), retirement is made up of four phases. (hartfordfunds.com/days). The Honeymoon Phase is the first one. Advertising portrays this time being filled with beaches, bike riding, and golf. It’s true that if you’ve stopped working, you’ll have more time for leisure activities. You might even think, “This is the life. This is what I want my retirement to be like.” But after a while, these activities can become routine. They might not provide the happiness we expected.

The Four Phases of Retirement

Instead of planning for ‘retirement’ as a single state, it may be beneficial to reframe the conversation to reflect a four-phased concept of retirement. Each is characterized by the tasks and issues individuals are most likely to be managing.

The Highest Levels of Resources

In each of the four phases, we’ll have varying levels of resources in the following categories: financial, cognitive, physical, and social. These resources tend to diminish the longer we’re retired.

Financial resources tend to be highest in the Honeymoon Phase since retirees have just started spending their retirement savings. For most, aging hasn’t taken its toll on bodies and minds, therefore, our cognitive, physical, and social resources also tend to be at their highest level. As a result, our lifestyle and well-being are often comparable to our life during full-time work.

So, What’s The Problem?

Despite our resources potentially being at their highest level, the Honeymoon Phase comes with transition challenges related to our routines, roles, and relationships.

Breaking a Routine That Began in Kindergarten

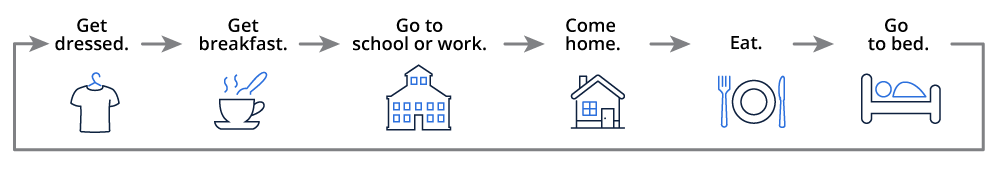

Get up. Get dressed. Get breakfast. Go to school or work. Come home. Eat. Go to bed. Retirement can break this routine. Nothing is forcing you to live like this anymore. You’ll have a lot more time on your hands. You may enjoy this freedom, but if you’re not sure what you’re going to do with it, boredom can set in. Thirty-two percent of recent retirees struggle with getting used to a new and different routine.1

Our 60-Year Routine

Retirement can break this routine. There’s nothing forcing you to live like this anymore.

Clients' Relationships Change

If you stopped working, you may miss the socializing, intellectual stimulation, and sense of accomplishment resulting from collaborating with co-workers on projects. Among recent retirees, 37% miss the day-to-day social interaction with co-workers.1

In the Honeymoon Phase, clients will spend less, if any, time with co-workers, and way more time with their spouse. This adjustment can put a strain on relationships if couples don’t share similar interests or social circles. New conflicts can pop up about the sharing of chores, how to spend leisure time, and how to manage the household.

Plus, 50% of parents are dipping into their retirement savings to fund their kids’ lifestyles.3 On top of that, 55% of Americans are either helping their parents financially or plan to do so.4 Balancing support for grown kids, parents, or both on a retirement budget can really strain relationships as people worry about overextending their resources.

Your Role Will Change

Work can give clients an identity, a sense of purpose, and respect. In the Honeymoon Phase, if they stop working, they may miss that identity and sense of accomplishment. The might feel under-appreciated and like they’re in a state of limbo after leaving the structured world of work. Their family members may expect more from them, more of their time and attention, maybe more than they’d like. Their previous identity, built over their career, was clear. Their new identity is foggy.

Timing Is Important

If clients are nearing retirement, they may be a bit anxious about entering the Honeymoon Phase. Sixty three percent of people feel stressed about retirement leading up to that decision.1 Retirees usually have a smoother transition if they enter it in a planned way, where they choose a retirement date. They tend to experience more anxiety if they’re forced into this phase by a layoff or health problems.

Help Clients Make a Smoother Transition

- Create a new routine

Even though we know retirement is coming, most of us don’t spend much time planning what we’ll do when we get there. Ask yourself: “How do you plan to spend your time? What are your hobbies? What activities will fill your days?” Set some long-term and short-term goals. Moving towards these goals can provide a sense of purpose and control in your new routine. - Find your new identity

Find ways to be productive. Consider volunteering, working part-time, taking a class, or learning a new skill. For more ideas, check out encore.org. Find a retirement mentor, someone who’s thriving in retirement. Ask if they’d be willing to meet with you regularly to discuss transition challenges and options for your new role. - Discover new relationships

Looking to replace work relationships? Try taking a class, volunteering, working part-time, or joining a group to meet new people.

Check out meetup.com and enter your zip code to find folks with similar interests in your area.

- Give yourself time

Don’t expect to hit your retirement groove right away. It may take six months or a year or two to find your new roles, routines, and relationships. - Work with a financial professional

During the Honeymoon Phase, you might not have a regular paycheck and may need to start withdrawing money from your savings. This can lead to concerns about running out of money in retirement. A financial professional can help you assess your situation and develop a solid financial plan.

Wait a Second, The Honeymoon Phase Sounds Like a Lot of Work

Yes, finding your new role, routine, and relationships will take planning, time, and effort. And it will push you out of your comfort zone. But it’s worth it. Consider the possible alternative—a boring and lonely retirement.

To Summarize, We’ve Covered:

- What’s the Honeymoon Phase of retirement

- The Honeymoon Phase sounds pretty good. What’s the problem?

- How can you smooth your transition into the Honeymoon Phase

Retirement Doesn’t Have to Bomb Like the Segway

Sure, the Segway never lived up to the hype, but if you’ve bought into the propaganda that rest and relaxation are the keys to a great retirement, you may also be disappointed. Now you know more about the transition to the Honeymoon Phase of retirement. Start planning now for your new roles, relationships, and routines when you get there.

Next Steps

| 1 | Research groups in your area. Go to meetup.com, enter your ZIP code, and search for groups that match up with your interests. |

| 2 | Find a retirement mentor. Find someone thriving in retirement and invite them to lunch. Ask if they’d be willing to meet with you to learn their secrets to retirement success. Your financial professional may be able to identify potential retirement mentors. |

| 3 | Search for volunteer opportunities in your area. This article has some great ideas to get started: 9 Tips to Find an Ideal Volunteering Gig |