In the Navigating Complexity phase of retirement, the logistics of health management may become a full-time job with increased medical appointments, medication management, and increasing mobility challenges.

— Dr. Joseph Coughlin, Founder and Director, The MIT AgeLab

MIT AgeLab calls this stage of retirement the “navigating complexity” phase—and for good reason. Life gets busier: more medical appointments, more medications, tighter finances, and mobility challenges. These changes can feel overwhelming, but having a plan helps you stay in control and make the most of this stage of life.

First, Physical Health: Why Complexity Grows Over Time

Many retirees enjoy years of good health, thanks to advances in medicine and healthier lifestyles. But as longevity increases, aging eventually brings new challenges. Chronic conditions such as diabetes, arthritis, and heart disease become more common—about 93% of adults age 65 and older have at least one chronic condition, and nearly 79% live with two or more.1 These changes often mean more medical tests, more specialists, and more decisions to manage.

Hospital stays can lead to transitions between rehab facilities, home care, or long-term care communities. For some, this cycle repeats as recovery slows or health declines, adding layers of complexity to daily life.

More Medical Care; More Paperwork

As health needs grow, aging adults often face a surge in medical paperwork. Bills arrive from doctors, hospitals, rehab facilities, and other providers, while insurance statements outline what’s covered—and what isn’t. These statements often say, “This is not a bill,” yet they look like one because they list amounts owed.

Older adults are especially vulnerable to billing errors. With more chronic conditions and more frequent, complex care, they face a greater chance of incorrect charges. Pat Palmer, a patient advocate and author of The Medical Bill Survivor Guide, estimates errors appear on 9 out of 10 hospital bills and 7 out of 10 physician bills she reviews.2

And according to a 2024 survey published in JAMA Health Forum, 1 in 5 people reported receiving a medical bill they either disputed or couldn’t afford.2 These mistakes can lead to unpaid balances, collections, and even credit issues—adding yet another layer of complexity to this stage of retirement.

Caregiving Often Begins With Small Tasks—But Can Expand as Health Needs Increase

Early in retirement, caregiving needs are usually minimal—maybe a quick check-in or a reminder to refill prescriptions. Over time, as health challenges increase, support often expands. Aging adults may need help with transportation to appointments or simple home tasks like changing a light bulb.

Caregivers frequently become advocates, speaking with doctors and pharmacists, and sometimes managing household finances. As physical limitations grow, assistance with daily activities such as bathing, dressing, and meal preparation can add significant emotional and physical demands for caregivers.

How to Manage Complexity of Declines in Physical Health

To reduce complexity in this phase, try to avoid the need for medical treatment. Stay in the best shape possible with a healthy diet and exercise plan. Staying healthy can also lessen your need for caregiving. Schedule annual health screening tests to identify health problems as early as possible. Many of these screening tests are completely covered by insurance or Medicare.

To help manage your medical needs, consider finding a geriatrician. They can design care plans to address your needs by managing your medications, coordinating treatments, and answering healthcare-related questions.

Second, Cognitive Decline Adds Complexity

About one in four adults aged 80–84 experience mild cognitive impairment, a condition that often precedes dementia.3 When reasoning ability declines, everyday decisions—about finances, health, or property—can become overwhelming. Even without cognitive impairment, illness or stress can make complex choices harder to manage.

This vulnerability also increases the risk of exploitation, as older adults are frequent targets for scams and financial abuse.

Planning Ahead for Cognitive Complexity

One of the best ways to reduce stress later is to plan before decisions become overwhelming. Many families set up a durable power of attorney early—an arrangement that allows a trusted person to handle financial matters if mental capacity declines. The “durable” feature means this authority continues even if decision-making ability changes over time.

Similar planning can apply to health care. A medical power of attorney ensures someone is ready to make treatment choices if needed, avoiding confusion during a crisis. These steps are easier and more effective when completed while decision-making is still clear.

Keeping Our Brains Healthy

Research shows that lifestyle choices—not just genetics—play a major role in how well the brain ages.4 Simple habits can lower the risk of memory loss and keep cognitive function sharp as we age.

Quick Tips for Brain Health:4

|

Sleep: Aim for 7–9 hours of quality sleep; deep sleep clears brain toxins. |

|

Diet: Favor a Mediterranean-style diet rich in fruits, vegetables, fish, and healthy fats. |

|

Stress: Practice mindfulness or breathing exercises to calm the stress response. |

|

Exercise: Even short bursts of brisk walking or regular movement can lower dementia risk. |

|

Learning: Challenge the brain with new skills—languages, music, or unfamiliar subjects. |

|

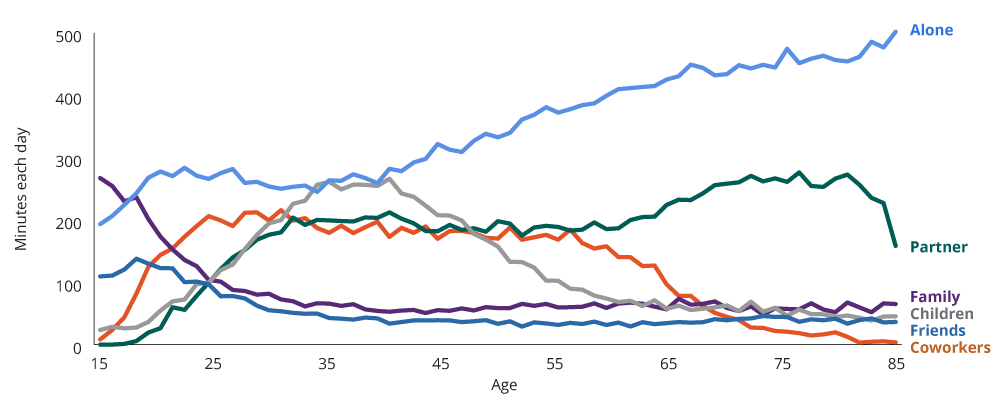

Friendship: Stay socially connected; strong relationships protect memory and mood. |