Gary McPherson, an Australian music psychologist, discovered that he could predict how well a child would be able to play an instrument before their first lesson. He predicted their success by asking them this simple question, “How long do you think you’ll play your instrument?” Students who indicated a long-term commitment outperformed the others. Their success was triggered by a strong sense of purpose.

Likewise, having a purpose can be the key to a fulfilling retirement. Like McPherson’s discovery, your fulfillment in retirement can likely be predicted based on whether or not you have a purpose for your future. For some, a way of maintaining a sense of purpose can be continuing to work.

Questions to Consider

If you want to keep working in retirement, consider what you enjoy doing, what you’re good at, or if there’s something you’ve always wanted to try. If you’re already working, and you like your job, ask your employer about staying, either full- or part-time.

Older Workers Have Some Advantages Over Younger Workers

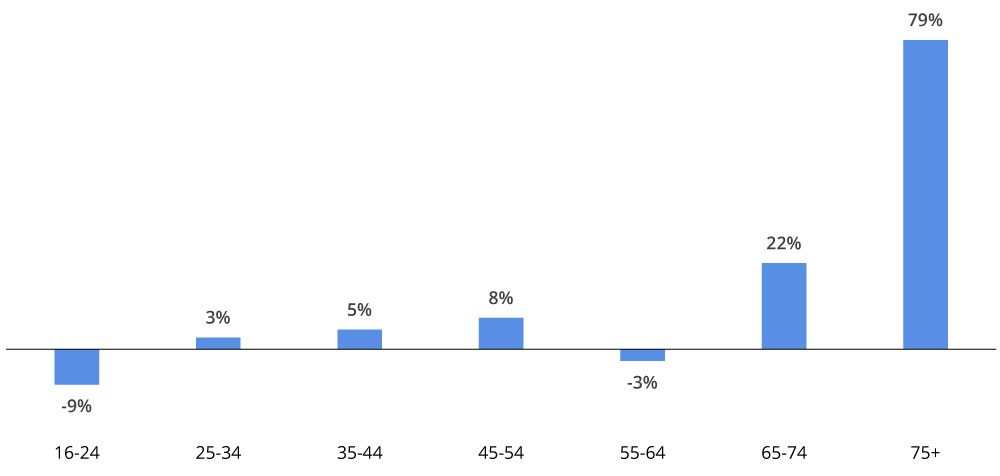

Employers are constantly challenged to find skilled workers. Older workers have much more experience than younger ones and may be better prospects for employers. Employers like to fill positions that require customer contact with retirees. The reason: Older workers tend to be more patient, attentive, and better customer service providers than younger employees. The graph below conveys that, as a group, older workers are projected to show a greater increase in the workforce over other age groups.

Older workers Outpace Growth Rate of Other Age Groups

Civilian labor force participation rates by age group 1999 – projected 2029

People aged 65 and older are the fastest-growing group in the workforce—by a long shot. Some aging adults will work because they need the income and others to maintain a sense of purpose

Source: Civilian labor force participation rate by age, sex, race, and ethnicity, US Bureau of Labor Statistics, 8/29/24

10 Resources to Help You Find a Job

- Job opportunities: Google "AARP 15 Growing Jobs for Older Workers"

- Online job postings: Sites featuring positions for aging workers retirementjobs.com, retiredbrains.com, workforce50.com, the AARP Job Board, and Work at Home Vintage Experts (WAHVE)

- Career coaching: One-Stop Career Centers typically provide free job counseling. Many local colleges and community libraries also offer free workshops with career coaches.

- Selling talents: You can list your services on websites such as Upwork.com. It’s free to join, but Upwork charges a service fee based on your earnings.

You can sell goods you make at Etsy.com. It’s free to become an Etsy seller, but users should understand the transaction and processing fees on what you sell.

At Fiverr.com, you can find freelance work in over 200 categories. Fiverr charges 20% of earnings for the use of their platform. - Apps that offer flexible employment:

- DogVacay or Rover—If you have personal or professional experience watching or walking dogs, you can earn money by becoming a pet sitter or dog walker. You’ll have the freedom to choose your schedule, services, and rates.

- HopSkipDrive—A ride service for kids was created by three moms who understood the struggle of getting kids around town safely. They also provide transportation to aging adults. Drivers can earn up to $32/hr., but need to have 5 years of caregiving experience, have a good driving record, and pass a background check.

- Lyft & Uber—You can drive part-time. And you can choose your hours, drive your car, and make money.

- Envoy America—Take care of shopping and errands for nearby elders who need assistance

- SilverRide—An assisted ride company that specializes in door-to-door service—also, often for doctor’s visits. They’re especially interested in hiring boomer drivers who have the interest and compassion to do this job and could use the extra income.

- Job test drive: Clients can volunteer or moonlight (work a second job outside normal business hours) in their new job before they make the leap from their current job.

- Network: Clients can get back in touch with their alumni and industry groups and see what kind of work is available. They can find people who are already doing the job they'd like to do and ask them how they prepared themselves.

- Career advice for older workers: Visit aarp.org/work

- Find a mentor: A mentor can help you with a specific goal—finding a job, planning a second career, asking for a raise, or suggesting ways to spiff up your image with the proper dress for success attire. For tips, Google Harvard Business Review’s article, “What’s the Right Way to Find a Mentor?”

- Create an elevator pitch: Making a great first impression is a must for job seekers. Google AARP’s video, “Creating an Elevator Pitch AARP YouTube”

Retirement is Changing

For decades, retirement had a clear definition: Life after work. Today, however, retirement takes a more ambiguous form. Now retirement may mean employment remaining constant, scaling back to part-time, or even changing careers. According to Employee Benefit Research Institute’s 2022 survey, 75% of workers surveyed said they plan to work after they retire, and many (89%) do so because they want to stay active and involved.*

Next Step

If you’re thinking of working in retirement, review the resources above and try a few of them to help you find the right job opportunity.

*Source: 2025 RCS FACT SHEET #2 Expectations About Retirement, Employee Benefits Research Institute, 2025

Hartford Mutual Funds may or may not be invested in the companies referenced herein; however, no particular endorsement of any product or service is being made.

Links from this article to a non-Hartford Funds site are provided for users’ convenience only. Hartford Funds does not control or review these sites nor does the provision of any link imply an endorsement or association of such non-Hartford Fund sites. Hartford Funds is not responsible for and makes no representation or warranty regarding the contents, completeness or accuracy or security of any materials on such sites. If you decide to access such non-Hartford Funds sites, you do so at your own risk.