Claiming Social Security is one of the most important income decisions you’ll make in retirement—and it’s one many people make too quickly. The moment you become eligible, it can be tempting to file simply because the benefit is available. For some people, that choice makes sense. But others later realize that waiting could have significantly increased their lifetime income. Before you decide when to start taking Social Security, it’s important to understand how timing affects your benefit. Here are three key factors to consider before you file.

First, When Will You Begin Taking Social Security Income?

Many people claim Social Security earlier than necessary, often based on incomplete or incorrect information. Concerns about Social Security’s future are common, but misunderstandings about how benefits work also play a role.In one survey, 73% of respondents knew that their filing age affects the maximum benefit they can receive, but only 21% knew the age at which they qualify for their full retirement benefit.¹

Although benefits can begin as early as age 62, filing at that age is considered early filing. There are valid reasons for early filing, but the trade off is a permanent reduction in benefits, which can sometimes be substantial.One common misconception is the belief that benefits will automatically increase to the full amount once a person reaches full retirement age (FRA). In reality, monthly benefits do not reset or adjust upward simply because a person has reached FRA.

Just as important, many people who file early may not need the income right away. Today, more people continue working beyond traditional retirement ages—often because they enjoy the work or want to stay active.² Others retire with additional income sources that can support their lifestyle, reducing the need to claim Social Security as soon as they’re eligible.

Second, How Delaying Social Security Income Can Benefit You

You might be thinking, “If I don’t start taking Social Security, I could be missing out.” Not necessarily. If you’re able to hold off on taking your Social Security income, it can literally pay off.

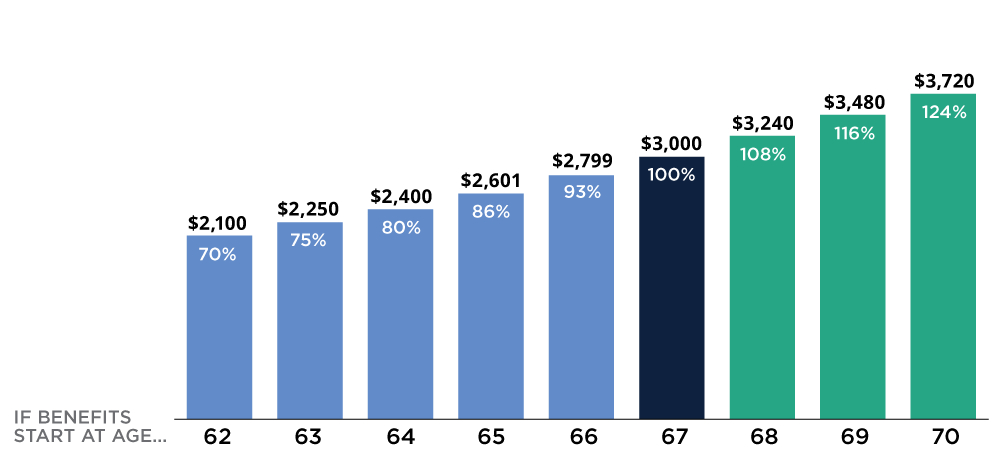

Today’s FRA is 67,3 and at that age, your Social Security benefit is paid at its full amount, without any reduction for early filing. As the bar chart below shows, claiming benefits earlier (such as at age 62) results in a permanently lower monthly payment, because those benefits are expected to be paid over a longer period of time. By contrast, waiting until FRA means fewer years of payments, but at a higher monthly amount.

If you delay claiming beyond FRA, your benefit can actually grow.

For each year you defer—up to age 70—the Social Security Administration increases your benefit by 8%. The longer it’s deferred, the greater the benefit. A larger monthly benefit is appealing on its own, but for many investors, the more compelling reason to delay is how a higher benefit can improve long term retirement security.

Thanks to advances in medicine and technology, and the adoption of healthier lifestyles, we’re living longer. For a couple who are 65 today, there’s a 50% chance that one person will be alive at 92.4 It’s encouraging to know that life expectancy is up, but living longer will cost more—maybe a lot more.

A 65-year-old retiring today could spend $172,500 on healthcare expenses in retirement.5 This can dramatically raise your risk of running out of money. But delaying your Social Security benefit to ultimately receive more monthly income can help prevent healthcare expenses from eroding your retirement savings.

Early Vs. Delayed Filing: How It Affects Your Social Security Benefit

Portion that would be received assuming a benefit of $3,000 at a Full Retirement Age (FRA) of 67*

*When to Start Receiving Retirement Benefits, Publication No. 05-10147, ssa.gov, 5/24

Third, How Delaying Social Security Income Can Benefit Your Spouse

Delaying Social Security may boost your benefit and may increase your spouse’s benefit, too.

When you file for your Social Security benefits, your spouse may be eligible for a spousal benefit if you’re the higher earner and vice versa. It can’t be claimed until the higher-earning spouse files, which they must do before the lower-earning spouse.6 The maximum spousal benefit is 50% of the higher earner’s benefit and is capped at their FRA. Let’s see how it would work for a couple who’ve been married for 10 years, Evelyn and Alex.

Early vs. Delayed Filing: The Difference Can Be Significant

The Advantage of Waiting

If Evelyn files for Social Security benefits when she becomes eligible at age 62, her monthly benefit amount will be reduced. But waiting until her full retirement age of 67 to file, or even until age 70, can make a significant difference.

| Benefit at 62 | Benefit at 67 | Benefit at 70 | ||

| Evelyn |  |

|

|

|

Potential Bonus: A Higher Spousal Benefit6

Suppose Evelyn is married and also the higher earner. Whenever she files for Social Security retirement benefits, her husband Alex may opt to collect the spousal benefit. He’s eligible at age 62, but filing early will reduce his spousal benefit. In this example, if Alex waits until his FRA to collect the spousal benefit, he can increase his benefit by $500 per month, or $6,000 per year.

| Benefit at 67: | Alex is entitled to the greater of: | ||

| Evelyn |  |

$3,500 | Up to 50% of Evelyn’s FRA benefit

$1,750 |

| Alex |  |

$1,250 | His own benefit

$1,250 |

Note: The spousal benefit will not increase if Evelyn delays filing. This is a very basic example, but some situations can be complicated. We strongly urge you to consult the Social Security Administration with any questions you may have.

Again, spousal benefits will be reduced if the lower-earning spouse files before their own FRA.6

Anyone considering this option may want to look at earnings differences between spouses. If incomes have been mostly similar, or a lower monthly income is manageable, the lower-earning spouse may want to claim Social Security first, while the higher earner waits until age 70, allowing their benefit to grow.

“But What if Social Security Goes Away?"

While it’s true that Social Security faces financial challenges, economists emphasize that there’s no imminent bankruptcy or collapse in the cards: The program will continue paying benefits even as its trust fund experiences a shortfall. The real uncertainty lies in how much future benefits may be adjusted, depending on the actions Congress takes, not in whether the program will survive. With that in mind, filing early just to “grab it while it’s there” may not serve you as well as considering whether waiting could put you in a better position later.

As You Consider When To Begin Taking Social Security, Remember These Three Things

First, filing for Social Security income prior to your FRA can dramatically reduce your monthly income amount. Second, if you have no immediate need for Social Security income, consider holding off on filing. This will allow your benefit to grow 8% each year you defer past your FRA, until the age of 70. Third, by waiting until their own FRA to file, your spouse can potentially collect the maximum spousal benefit.

Next Steps

- Think about whether you’ll work in retirement or have other expected income sources

- Calculate how much monthly income you’ll need in retirement, and determine whether your expenses can be covered without Social Security

- Talk to your financial professional about your retirement income strategy

1 “Nationwide Retirement Institute + The Harris Poll Social Security Survey,” Nationwide, 8/25

2 “Survey Finds 75% of Americans Plan to Work in Retirement. Here’s Why,” USA Today, 9/25

3 This is true for those born in 1960 or later. If you were born in 1959 or earlier, your FRA will be different. For more details, please see “Retirement Benefits/Starting Your Retirement Benefits Early” at ssa.gov

4 “You’ll Probably Live Longer Than You Think,” NerdWallet, 6/23

5 “Fidelity Investments Releases 2025 Retiree Health Care Cost Estimate, a Timely Reminder for All Generations to Begin Planning,” Fidelity, 7/25

6 “Benefits for Spouses,” ssa.gov, 2025

All information provided is for informational and educational purposes only and is not intended to provide investment, tax, accounting or legal advice. As with all matters of an investment, tax, or legal nature, you should consult with a qualified tax or legal professional regarding your specific legal or tax situation, as applicable.