Many people have a false sense of confidence when it comes to Social Security. Eighty-nine percent of adults say they are somewhat confident in their knowledge about the system; however, 51% said they didn’t know how much income it would replace in their retirement.1

Those around age 60 are likely familiar with Social Security Statements. You may have received them in the mail, gotten an email about signing up online for them, or heard about them in passing. These statements aren’t just meant to clog up in your inbox, but rather provide you with important updates about your benefits.

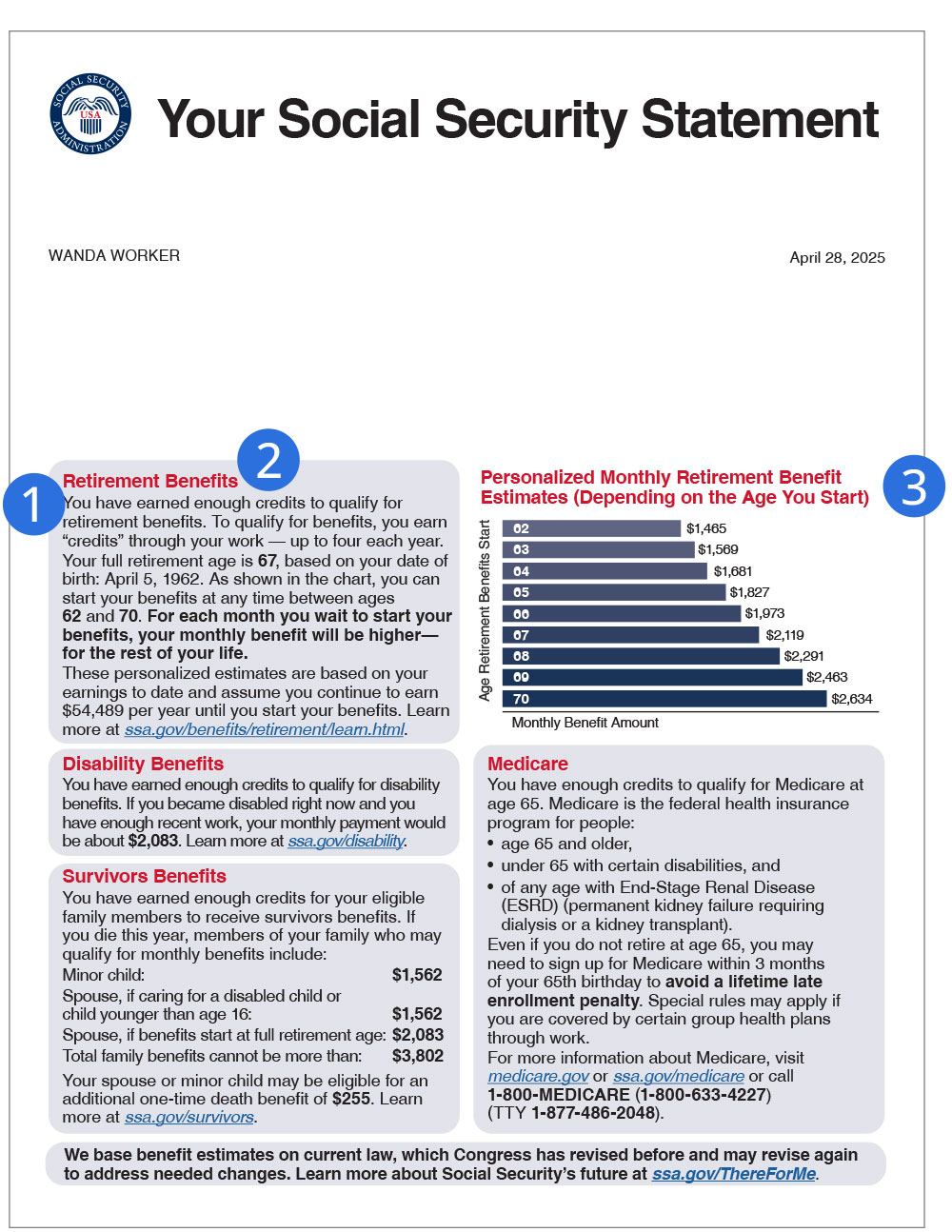

Social Security Statements provide a personalized estimate of how much you will receive from Social Security when you retire or if you become disabled, and how much your family members might be eligible for if you pass.

The Statement Includes 3 Must-Understand Points:

Retirement Benefits—Your estimated monthly earnings during retirement

Work Credits –Your eligibility status based on your earnings and taxes paid to Social Security

Earnings Record – Your progress toward your Social Security benefits

Getting a clear understanding of your benefits can help you recognize your other income needs and sources for retirement.

To view your Social Security Statement, visit www.ssa.gov/myaccount to create an account and review your benefits. You can also utilize the Social Security calculator to estimate your benefits, manage your direct deposit, and more.

The following pages highlight key portions of the Social Security statement based on a hypothetical person referred to as Wanda Worker.

Work credits: These are based on your total wages and self-employment income for the year. You must earn at least 40 work credits to be eligible for benefits. You earn these credits when you work and pay SS taxes.

Retirement Benefits: This is where you can find out your full retirement age (FRA). FRA is the age at which you are eligible to receive full, unreduced benefits.

Monthly Retirement Estimate: Shows you how much of a benefit you can expect, assuming you continue to earn a similar level of income per year until you start your benefits. It does not show your FRA.

Earnings Record: This is the history of your progress towards your benefits. Your earnings are tracked so you can be paid the benefits you’ve earned over your lifetime. For this reason, it is important you check your earnings record for any discrepancies.

Source: Your Social Security Statement, SSA.Gov, 2024

Next Step: Go to ssa.gov to sign up to get your statements online.

1Nationwide Financial, Knowledge gaps highlight the need for better Social Security Planning, 08/23

All information provided is for informational and educational purposes only and is not intended to provide investment, tax, accounting or legal advice. As with all matters of an investment, tax, or legal nature, you should consult with a qualified tax or legal professional regarding your specific legal or tax situation, as applicable.