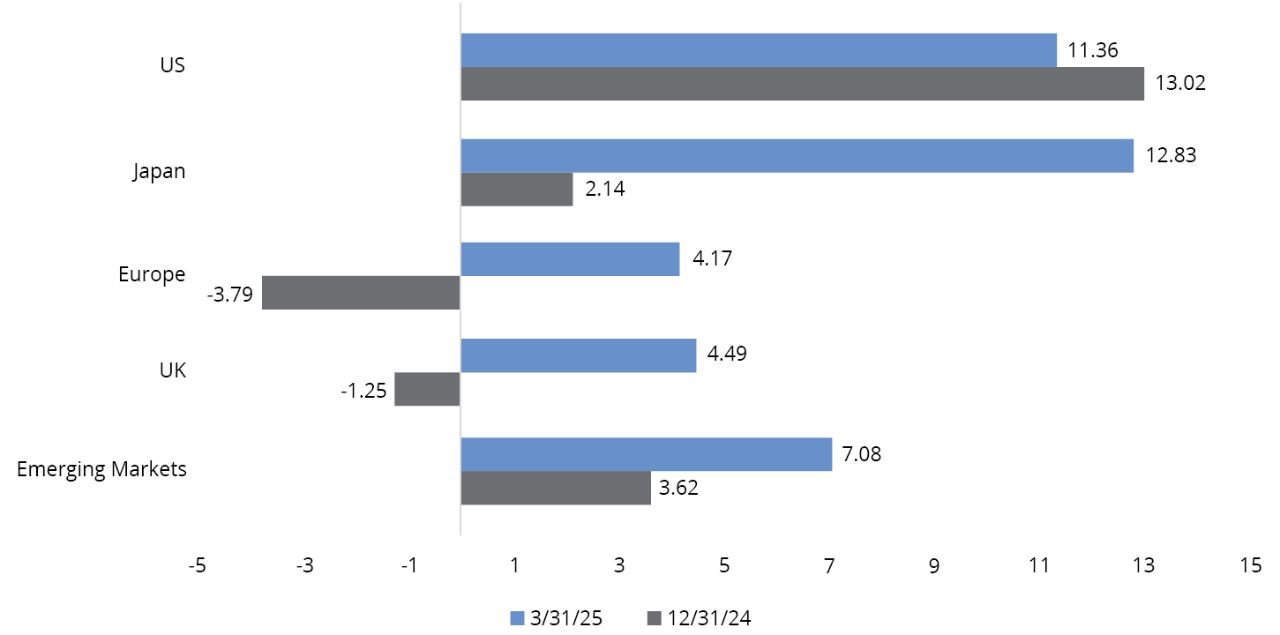

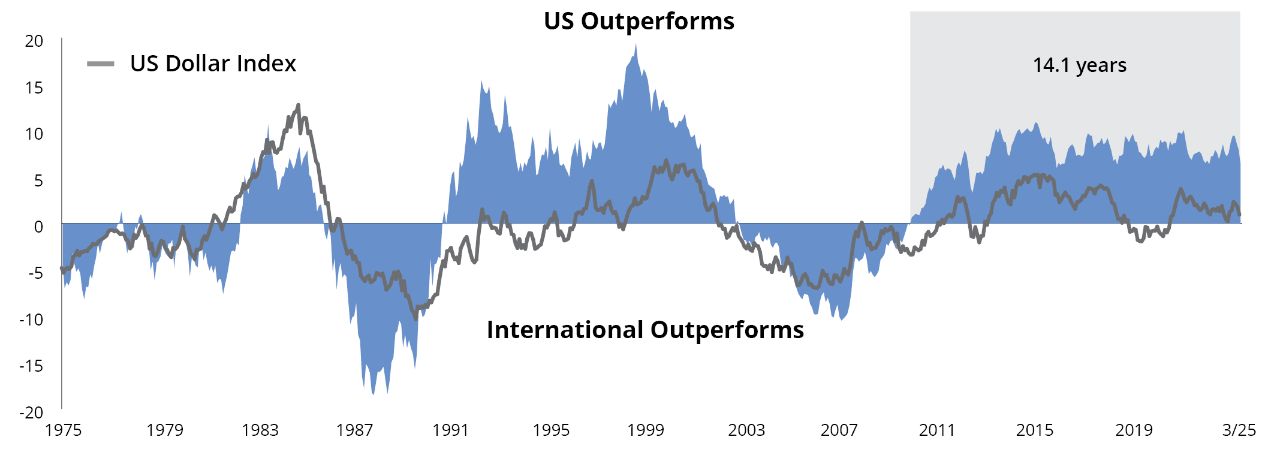

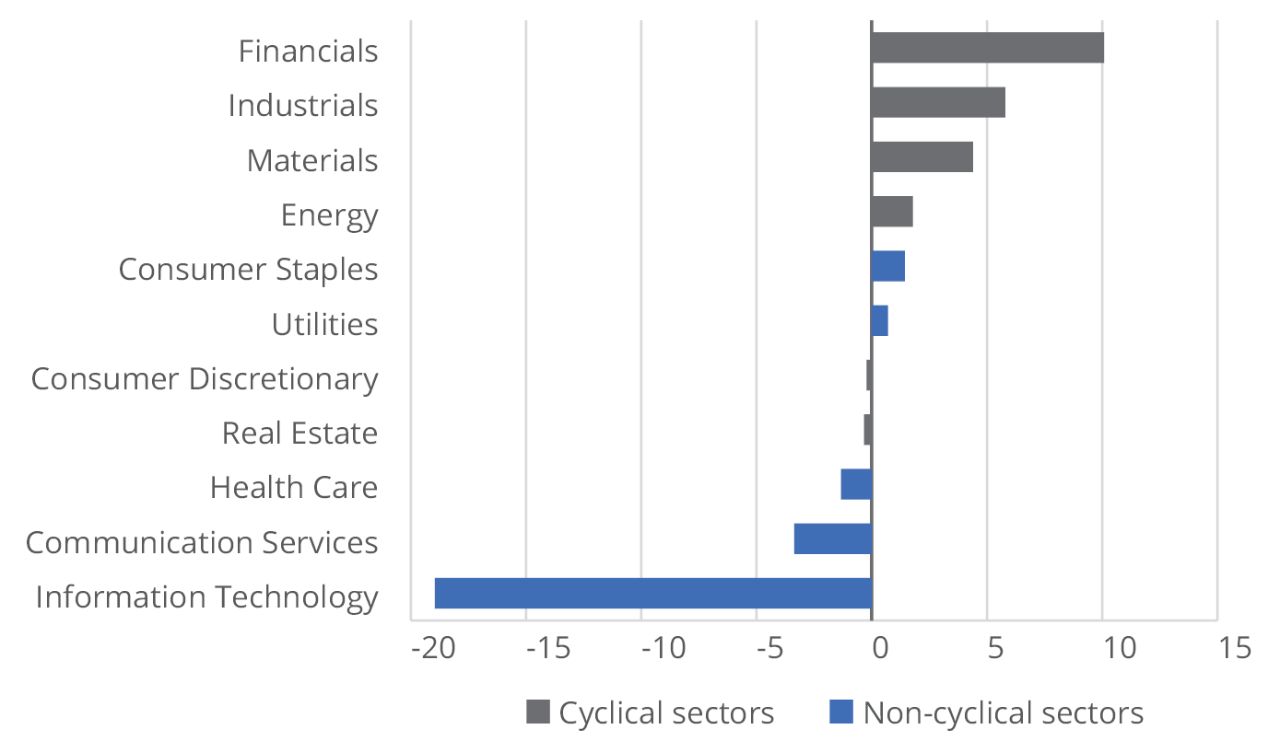

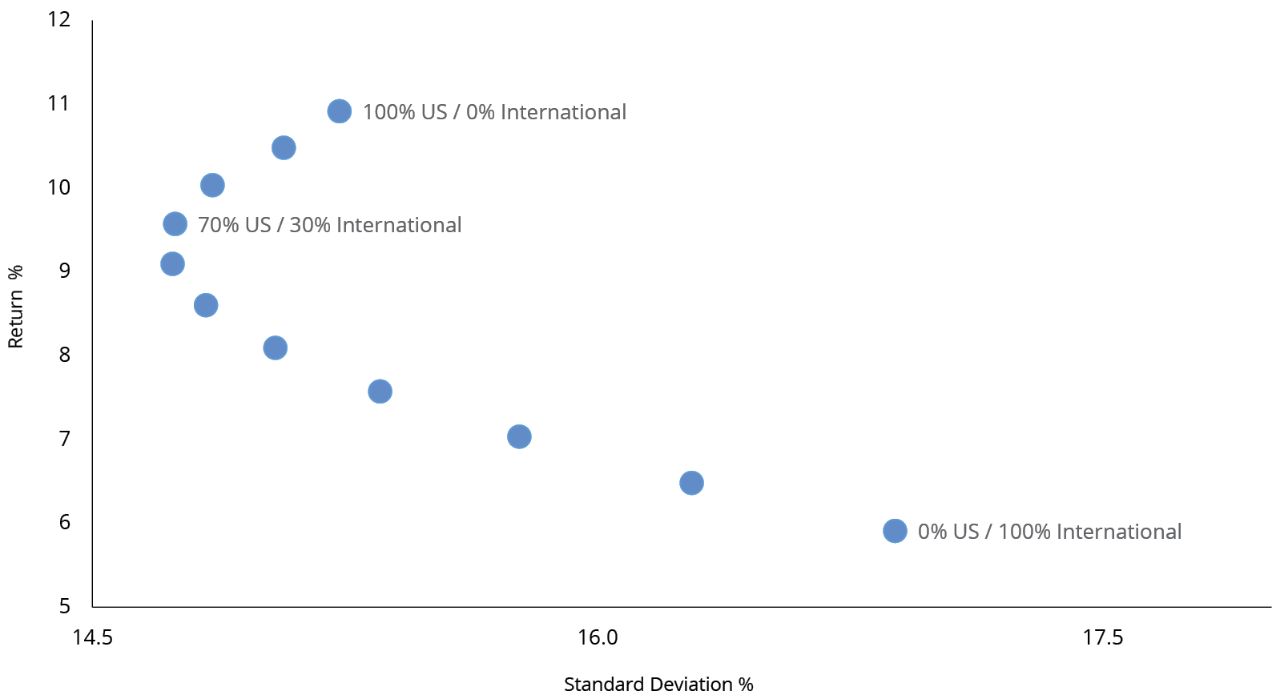

After an extended period of US stock exceptionalism, the guidebook for investors seemed clear: steer toward domestic equities. But the early 2025 stumble for US equities broadened the map and served as a reminder of why we diversify—because no market is invincible. As ongoing economic uncertainty leaves US equities open to a period of potentially extended volatility, now is an especially salient time to consider reevaluating portfolio diversification.

The same uncertainty that held US stocks back has also provided a momentum boost for international equities. This performance may have room to grow for a variety of reasons, placing international equities in their most favorable position in more than a decade.

Given the current environment, here are three reasons why international equities may remain an attractive source of diversification.

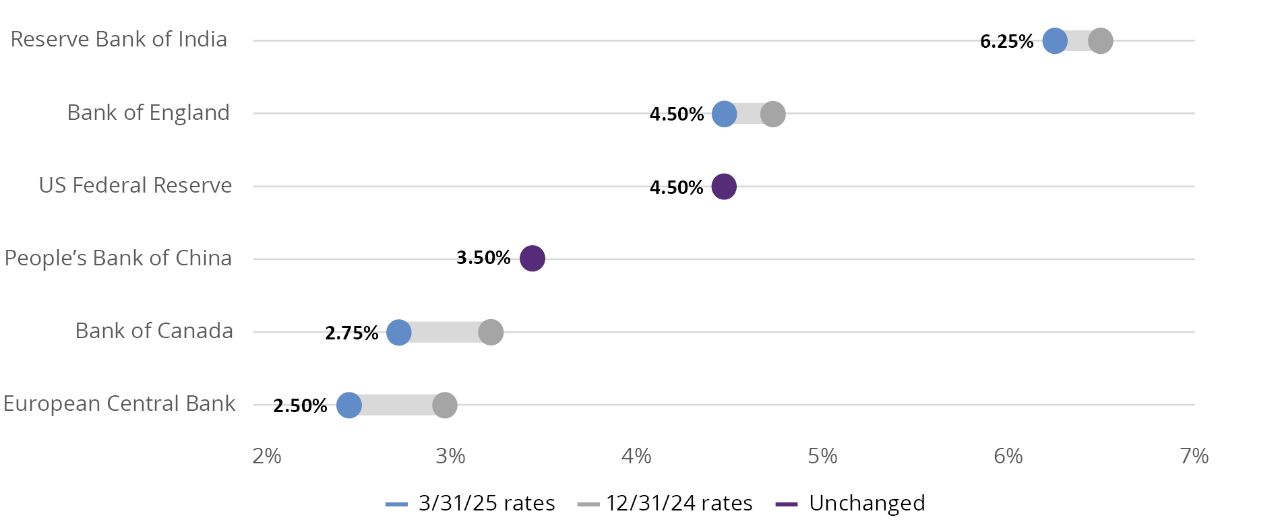

1. Access to a Variety of Economic Environments

As the US government seeks ways to cut the federal budget and rein in spending, other nations are embarking on plans to ramp up their fiscal spending. Germany, for example, passed major reforms to unlock its formerly strict spending limits, allotting billions toward ramping up its military and improving aging infrastructure.

Additionally, changing tariff policies are widely considered more harmful to the US economy than foreign competition (FIGURE 1), and higher product costs directly impact US consumers. The on-again-off-again discussion around tariff policy is already impacting consumer spending and confidence: Retail sales slowed significantly in April,1 and consumer sentiment hit its fourth-lowest reading on record in May.2 With or without the threat of recession, uncertainty is damaging.