Representative indices from Figure 5:

US IG Corporates are represented by the Bloomberg US Corporate Bond Index, which measures the performance of US dollar-denominated, IG corporate bonds issued by industrial, utility, and financial companies. US High-Yield Corporates are represented by the Bloomberg US Corporate High Yield Bond Index, which measures the performance of US dollar-denominated, below-IG corporate bonds issued by industrial, utility, and financial companies. Emerging-Market Debt is represented by the J.P. Morgan EMBI Global Diversified Index, a broad-based, unmanaged index which tracks liquid, US dollar emerging-market fixed- and floating-rate debt instruments issued by sovereign and quasi-sovereign entities. MBS is represented by the Bloomberg US MBS Index, which tracks fixed-rate agency mortgage backed passthrough securities guaranteed by Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC). Bank Loans are represented by the Morningstar/LSTA US Leveraged Loan Index, which is a market-value-weighted index that is designed to measure the performance of the US leveraged loan market based upon market weightings, spreads, and interest payments.

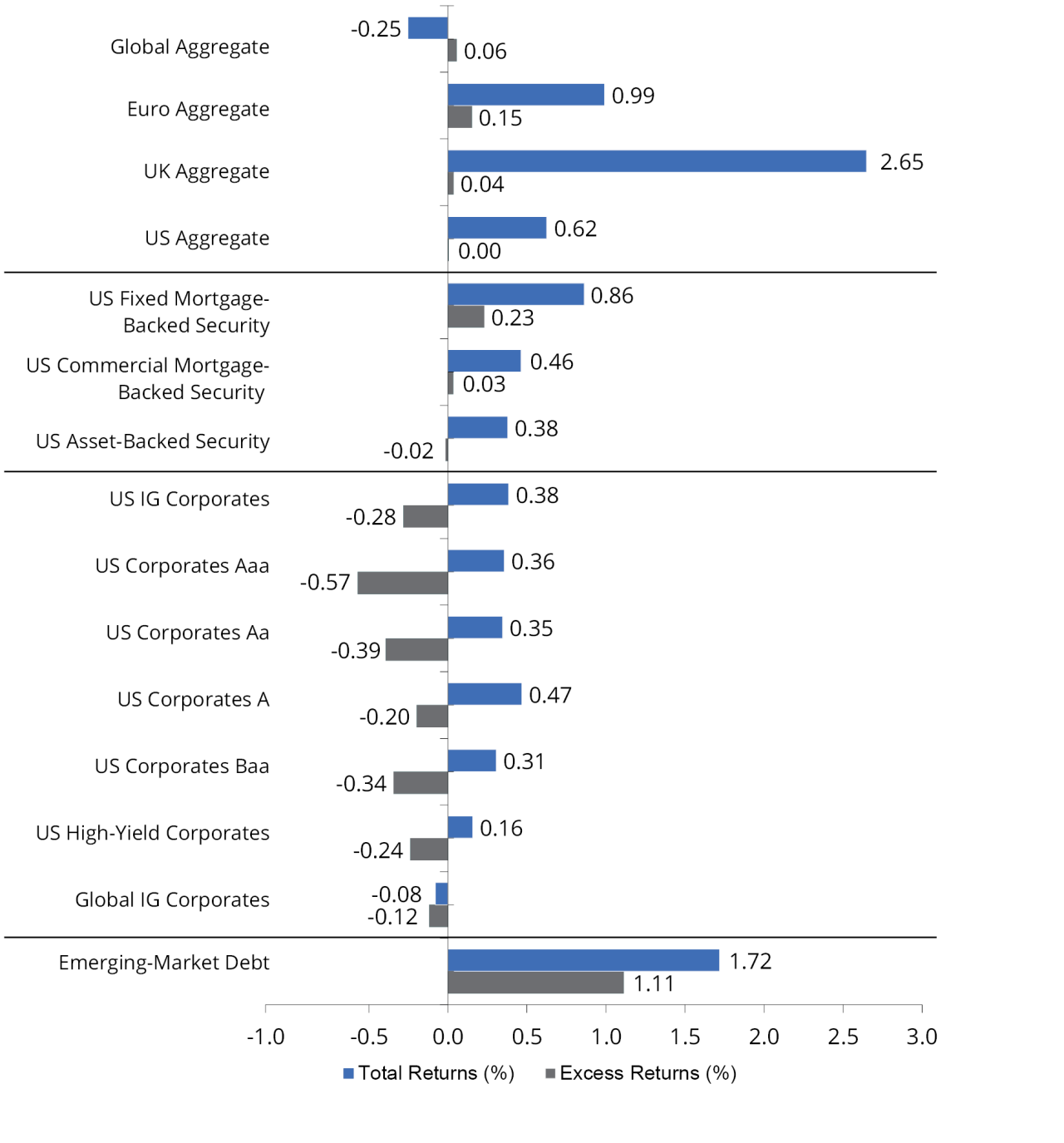

Representative indices from Figure 6:

Global Aggregate is represented by the Bloomberg Global Aggregate Bond Index, which is a broad-based measure of the global IG fixed-rate debt markets. Euro Aggregate is represented by the Bloomberg Global Aggregate Bond Index - European Euro, which includes fixed-rate, IG Euro denominated bonds. UK Aggregate is represented by the Bloomberg Global Aggregate Bond Index - United Kingdom, includes fixed-rate, IG sterling-denominated bonds. US Aggregate is represented by the Bloomberg US Aggregate Bond Index, which is composed of securities that cover the US IG fixed-rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. US Fixed MBS is represented by the Bloomberg US MBS Index, which tracks fixed-rate agency mortgage backed passthrough securities guaranteed by Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC). US CMBS is represented by the Bloomberg CMBS ERISA Eligible Index, which measures the performance of IG commercial mortgage-backed securities, which are classes of securities that represent interests in pools of commercial mortgages. The index includes only CMBS that are Employee Retirement Income Security Act of 1974. US ABS is represented by the Bloomberg Asset-Backed Securities Index, which is the ABS component of the Bloomberg US Aggregate Index. It has three subsectors: credit and charge cards, autos, and utility. US IG Corporates is represented by the Bloomberg US Corporate Bond Index, which measures the performance of US dollar-denominated, IG corporate bonds issued by industrial, utility, and financial companies. US Corporates Aaa is represented by the Bloomberg Aaa Corporate Bond Index, which is designed to measure the performance of IG corporate bonds that have a credit rating of Aaa. US Corporates Aa is represented by the Bloomberg Aa Corporate Bond Index which is designed to measure the performance of IG corporate bonds that have a credit rating of Aa. US Corporates A is represented by the Bloomberg A Corporate Index, which is designed to measure the performance of IG corporate bonds that have a credit rating of A. US Corporates Baa is represented by the Bloomberg Baa Corporate Bond Index, which is designed to measure the performance of IG corporate bonds that have a credit rating of Baa. US High-Yield Corporates is represented by the Bloomberg US Corporate High Yield Bond Index, which measures the performance of US dollar-denominated, below-IG corporate bonds issued by industrial, utility, and financial companies. Global IG Corporates is represented by the Bloomberg Global Credit - Corporate Bond Index, which is an unmanaged index considered representative of fixed rate, non-IG debt of companies in the US, developed markets, and emerging markets. Emerging-Market Debt is represented by the Bloomberg Emerging Markets Hard Currency Bond Index, which includes USD-denominated debt from sovereign, quasi-sovereign, and corporate EM issuers.

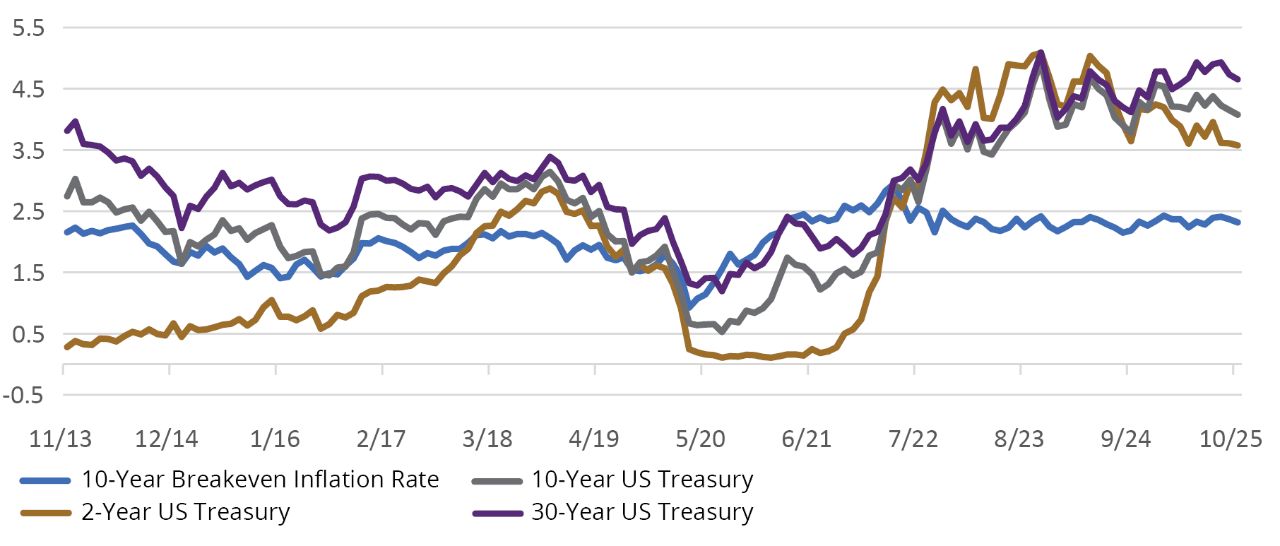

1 A basis point is equal to 1/100th of 1% and is used to express small changes in interest rates, yields, and financial indices.

2 The federal funds rate is the target interest rate set by the Federal Open Market Committee. This target is the rate at which commercial banks borrow and lend their excess reserves to each other overnight.

3 Quantitative tightening is a monetary policy strategy where a central bank reduces the size of its balance sheet—typically by selling government bonds or letting them mature—thereby decreasing liquidity in the financial system.

4 Duration is a measure of the sensitivity of an investment’s price to nominal interest-rate movement.

5 The Secured Overnight Financing Rate (SOFR) reflects the cost of overnight borrowing using U.S. Treasury bonds as collateral. It's a risk-free rate based on actual market transactions.

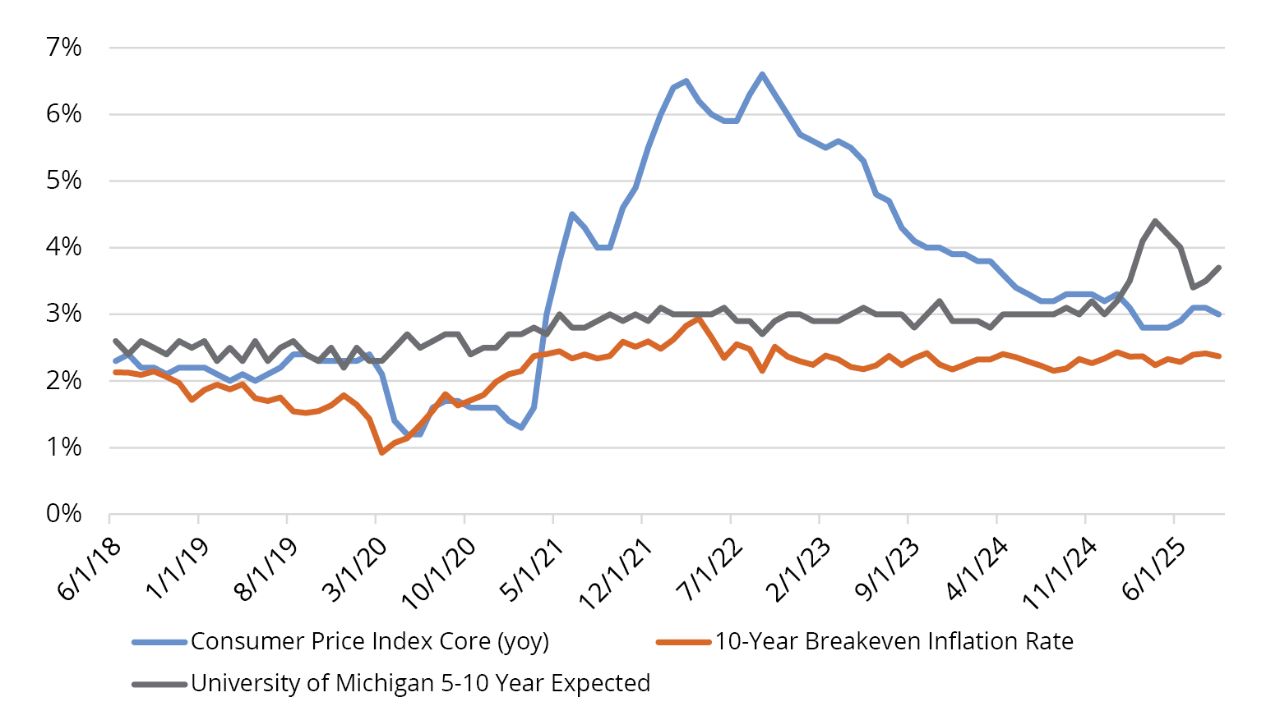

6 The Consumer Price Index is a measure of change in consumer prices as determined by the US Bureau of Labor Statistics.

7 Owners’ equivalent rent is the amount of rent that would have to be paid in order to substitute a currently owned house as a rental property.

8 Treasury Inflation-Protected Securities are Treasury bonds that are adjusted to eliminate the effects of inflation on interest and principal payments, as measured by the CPI.

9 The BIS 50% Rule restricts US exports to any company that is 50% or more owned by a sanctioned entity, even if that company itself isn’t explicitly listed.

10 The Exchange Stabilization Fund is a US Treasury reserve account used to manage currency stability and respond to financial crises, giving the Treasury flexibility to intervene in foreign exchange markets and support global financial stability without needing Congressional approval.

11 A swap line is an agreement between two central banks to exchange currencies, allowing one to access foreign currency liquidity, typically US dollars, to stabilize markets and support domestic financial institutions during times of stress.

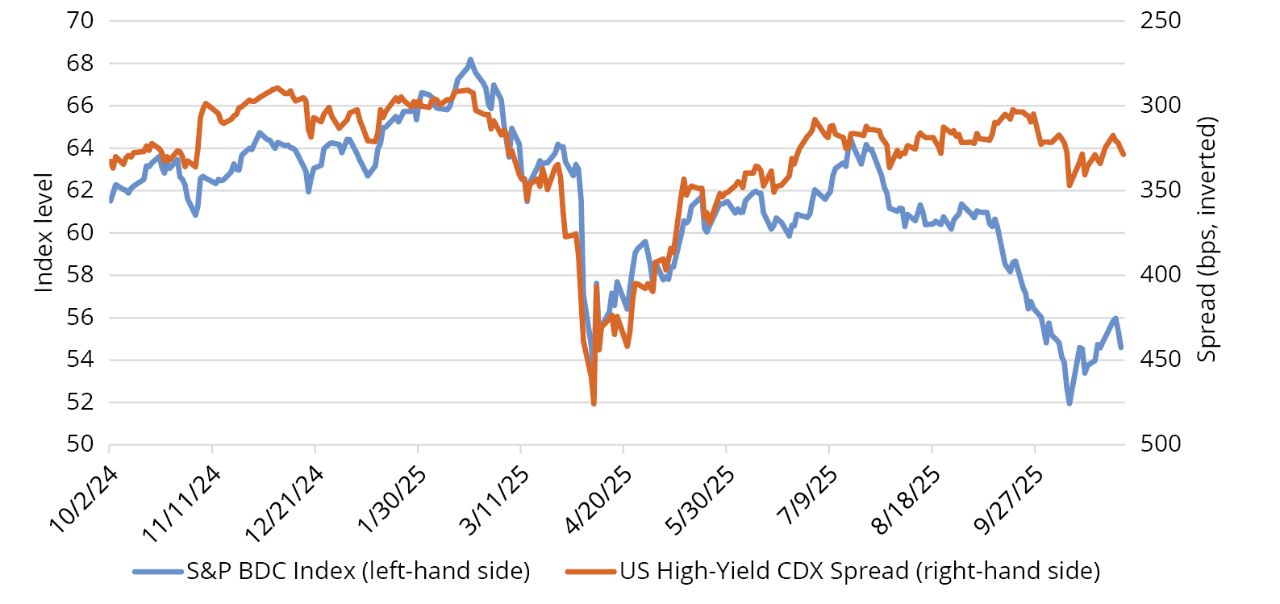

12 Business development companies are publicly traded investment firms that provide financing to small and mid-sized private companies, often through direct lending, and offer retail investors access to private credit markets with higher yield potential and higher risk.

13 Interval funds are a type of closed-end fund that allows investors to buy shares anytime but only permit redemptions at set intervals, such as quarterly, rather than daily.

14 Total return is the actual rate of return of an investment over a given evaluation period, including interest, capital gains, dividends, and distributions realized during that time.

15 Go-anywhere strategies are benchmark-agnostic and can invest across sectors, credit qualities, currencies, and countries without preset limits, unlike core-bond-plus strategies, which allow flexibility but impose caps on below-IG, non-US, or sector-specific exposures.

16 Core/core plus strategies typically invest in a baseline of IG bonds such as government, corporate, and securitized debt. Core-plus funds can take that baseline and add additional sectors such as corporate high-yield, emerging-market debt, or non-US currency exposures to enhance returns.

17 As of 10/31/25. US high yield is represented by the Bloomberg US High Yield Index, a benchmark tracking US dollar-denominated, below- IG corporate bonds issued in the US market (YTW: 7.16%). Global high yield is represented by the Bloomberg Global High Yield Index, a multi-currency benchmark tracking below-IG corporate bonds issued in major markets worldwide, including the US, Europe, and EMs (YTW: 6.68%). Yield to worst refers to the minimum yield that can be received on a bond assuming the issuer does not default on any payments.

18 Spreads are the difference in yields between two fixed-income securities with the same maturity but originating from different investment sectors.

19 Leveraged loans are loans made to companies with below-IG credit ratings, typically carrying higher interest rates and secured by collateral to compensate for their greater default risk.

20 Subordinated structures are debt or securities that rank below senior obligations in repayment priority, meaning they carry higher risk because they are paid only after senior claims in the event of default.

Important Risks: Investing involves risk, including the possible loss of principal. • Fixed income security risks include credit, liquidity, call, duration, and interest-rate risk. As interest rates rise, bond prices generally fall. • Investments in high-yield (“junk”) bonds involve greater risk of price volatility, illiquidity, and default than higher-rated debt securities. • Mortgage-related and asset-backed securities’ risks include credit, interest-rate, prepayment, and extension risk. The value of the underlying real estate of real estate related securities may go down due to various factors, including but not limited to strength of the economy, amount of new construction, laws and regulations, costs of real estate, availability of mortgages, and changes in interest rates. • Loans can be difficult to value and less liquid than other types of debt instruments; they are also subject to nonpayment, collateral, bankruptcy, default, extension, prepayment and insolvency risks. • Foreign investments may be more volatile and less liquid than US investments and are subject to the risk of currency fluctuations and adverse political, economic and regulatory developments. These risks may be greater, and include additional risks, for investments in emerging markets. • The risks associated with mortgage-related and asset-backed securities as well as collateralized loan obligations (CLOs) include credit, interest-rate, prepayment, liquidity, default, and extension risk.

The views expressed herein are those of Wellington Management, are for informational purposes only, and are subject to change based on prevailing market, economic, and other conditions. The views expressed may not reflect the opinions of Hartford Funds or any other sub-adviser to our funds. They should not be construed as research or investment advice nor should they be considered an offer or solicitation to buy or sell any security. This information is current at the time of writing and may not be reproduced or distributed in whole or in part, for any purpose, without the express written consent of Wellington Management or Hartford Funds.