Consider that, from July 2022 through early September 2024, the yield on the 2-year Treasury exceeded the yield on the 10-year Treasury, producing an inversion that suggested an imminent risk-off environment. Yet, during this period, the S&P 500 Index delivered a cumulative return of 46.37%. This divergence between signal and outcome reveals one of today’s central investment challenges: Even well-known and trusted economic barometers can be misleading from time to time.

Today, the yield curve has reasserted its typical upward slope, with the spread1 between 2-year and 10-year Treasuries widening to 55 basis points (bps)2 by late September and hitting 60 bps at various times in recent weeks. Many analysts expect the yield curve to continue steepening as the Federal Reserve (Fed) continues to cut short-term interest rates. For investors who need to make fixed-income allocation decisions for their portfolios, a closer look at different yield curve shapes and their meanings could prove helpful.

Yield Curve Shapes

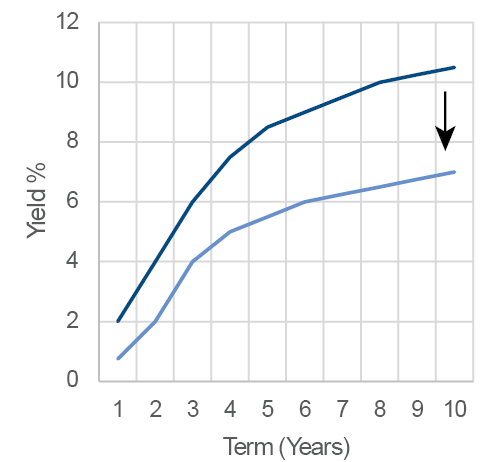

Normal (Upward-Sloping)

Long-term bonds yield more than short-term bonds. In this environment, lenders often demand a premium for longer commitments.

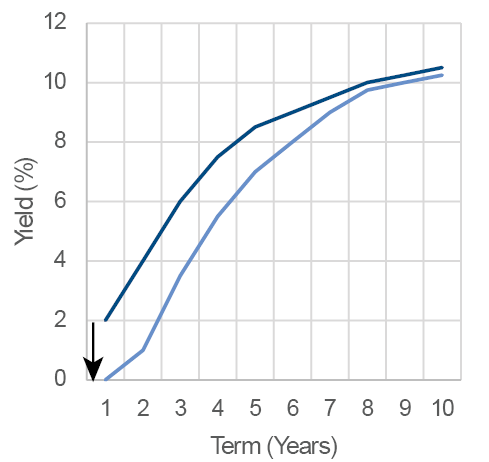

Inverted (Downward-Sloping)

Short-term yields are higher than long-term yields—often interpreted as a possible warning sign of recession as investors seek the safety of longer-dated maturities.

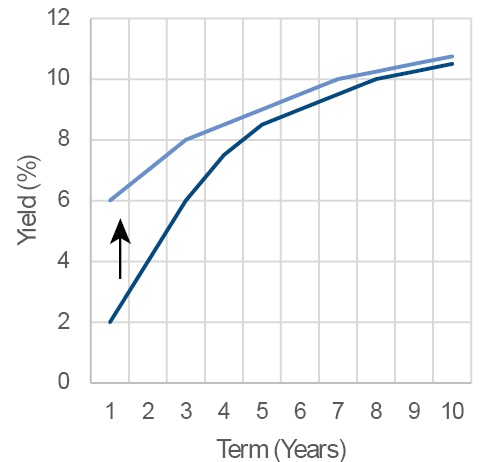

Flat

When yields across maturities are similar, the curve is “flat.” This often signals an inflection point, or a period of uncertainty.

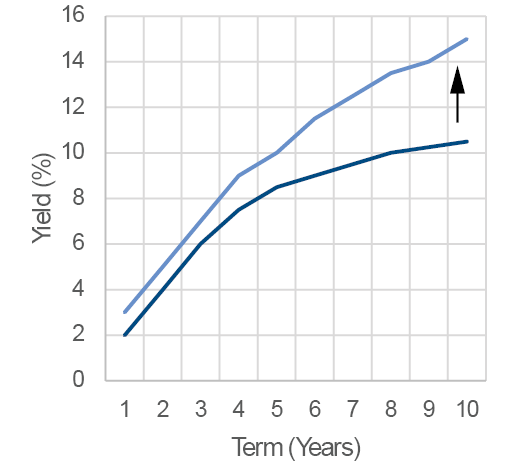

Steep

A pronounced spread between short and long maturities reflects expectations of future growth or inflation.

Humped or Kinked

When intermediate yields exceed yields on the short and long ends, this is often due to supply-demand quirks, regulatory issues, or technical factors. These curve shapes are typically transitory and, possibly, a sign of inconclusive data.