Speaker of the House Mike Johnson (R-LA) and Majority Leader Chuck Schumer (D-NY) have been able to reach a compromise on topline federal-spending numbers that track Fiscal Responsibility Act (FRA) mandated defense and non-defense spending figures set back in the spring of 2023. Non-defense domestic spending is $772 billion, and defense spending held firm at $886 billion. While Schumer and Democrats notched a victory on keeping domestic spending roughly the same as agreed to in the FRA, Johnson was able to find approximately $30 billion in cuts and kept a number of policy riders in play.

Hardline conservatives in the Freedom Caucus aren’t buying the compromise, so Johnson will have his work cut out for him when it’s time to move the spending measures forward on the House floor. Lastly, border-security negotiations could upend the bipartisan budget compromise as hardliners are also threatening a government shutdown if border security isn’t included in the final agreement.

Foreign Assistance

The Biden administration requested approximately $110 billion in a foreign-assistance supplemental spending package back in November: $61.4 billion for Ukraine; $14.3 billion for Israel; $14 billion for border security; and the remaining amount targeted to Indo-Pacific and humanitarian aid. While the crisis at the border is critical and in dire need of action, the Biden administration made a tactical mistake in tying the most vexing issue in Washington to the broader foreign-policy debate with overseas assistance in global hotspots drying up rapidly. The White House and a bipartisan group in the Senate continue to grind on a border compromise, but progress has been incremental.

Speaker Johnson doubled down on the House Republican supplemental approach insisting that strong border-security provisions must be included in any deal, boxing in Biden and the Democrats. We hope we’re wrong, but as long as they remain tethered, we don’t see much foreign-aid movement anytime soon.

Bipartisan Spotlight

One bright bipartisan spot in the Washington maelstrom is the passage of the National Defense Authorization Act that authorizes annual funding and sets the policy agenda for the Department of Defense. An $886 billion agreement was reached on the defense measure that makes significant investment in the military and defense capabilities, and ensures the US remains competitive with global adversaries. Passage of the federal-budget agreement is the final impediment.

We expect the Biden administration to complete its review of Trump-era tariffs on China in the first few months of the year. Prevailing wisdom is that the administration won’t alter the tariffs much and instead will make some adjustments: raising tariffs on electric vehicles and other high-tech products and lowering tariffs on consumer products in the manufacturing supply chain. Congress could move other trade legislation before the summer, and members of the House Ways and Means Committee may prod the administration into action by unveiling an Indo-Pacific trade bill in late January or February.

We could see some bipartisan collaboration throughout the year on legislation aimed at China, but partisan fissures and electioneering could stymie that effort. Look for hawks on both sides of the aisle to press hard for a vote to repeal China’s “permanent normal trade” status (a legal designation certifying free trade between the US and a foreign nation); this could put Biden in the hot seat in the middle of the presidential campaign.

In regards to tax policy, we could see some bipartisan efforts around the Childcare Tax Credit. The deal would be coupled with three business tax breaks: research and development, phaseout of the bonus depreciation rate, and deduction for business interest expenses. This debate is likely to be a precursor to the 2025 expiration of the more significant 2017 Tax Cut and Jobs Act.

Slim Margins

Speaker Johnson’s majority in the House is about to be slimmed down by two. Former Speaker of the House Kevin McCarthy (R-CA) resigned effective January 1, and Bill Johnson (R-OH) will be resigning on January 21. Until special elections are held for both open seats, Johnson will need near total cooperation when attempting to pass party-line measures, or he’ll need to appeal to some of those on the Democratic side of the aisle. On the policy front, we think the latter scenario will be in play given resistance to compromise that is prevalent within Johnson’s far-right flank.

Schumer is also working with a very slim majority in the Senate—a whopping one seat. Vice President Kamala Harris surpassed an almost 200-year-old record last year by casting the most tie-breaking votes in the history of the Senate (#33 and #34).

To make legislating even more challenging this year, the election-year calendar is designed to allot Congress more time away to campaign in their home districts and states. This means more time away from the Capitol, longer holiday breaks, and recesses during the entire months of August and October.

Race for the White House

The stage is set, but not assured, for a likely Biden-Trump rematch. Coming off a stronger economy in 2023 than expected, President Joe Biden has been gifted with favorable economic indicators that many politicians would envy. But he’s been hard-pressed to assimilate that sentiment and dispel voter’s concerns about his age and abilities—both of which are reflected in his abysmal poll numbers. Former President Donald Trump has a firmer grip on the Republican Party, but having to split his time between rallies and the courtroom could prove troublesome to his campaign. Barring a surprise ruling from the Supreme Court in February or March, Trump could have the Republican nomination wrapped up by Super Tuesday on March 5.

The Supremes

We turn our attention to the Supreme Court as the nine justices are now poised to resolve disputes with potentially massive election consequences as the presidential primary season gets underway. A closely divided Colorado Supreme Court disqualified Trump from the state’s primary ballot, ruling Trump engaged in insurrection against the Constitution and triggered the Fourteenth Amendment prohibition on insurrectionist office holders.

The Supreme Court has yet to address the insurrection provision of the Fourteenth Amendment, but there’s no relevant High Court precedent. In the end, the Court could craft a defensible opinion that upholds or reverses the decision by the Colorado Supreme Court. Until oral arguments are presented on February 8, outcome predictions, no matter how logical, are pure guesswork. The Court has granted the petition for review and put the case on a fast track. Separately, a decision awaits on whether he’s immune from prosecution for actions he took while president.

House and Senate

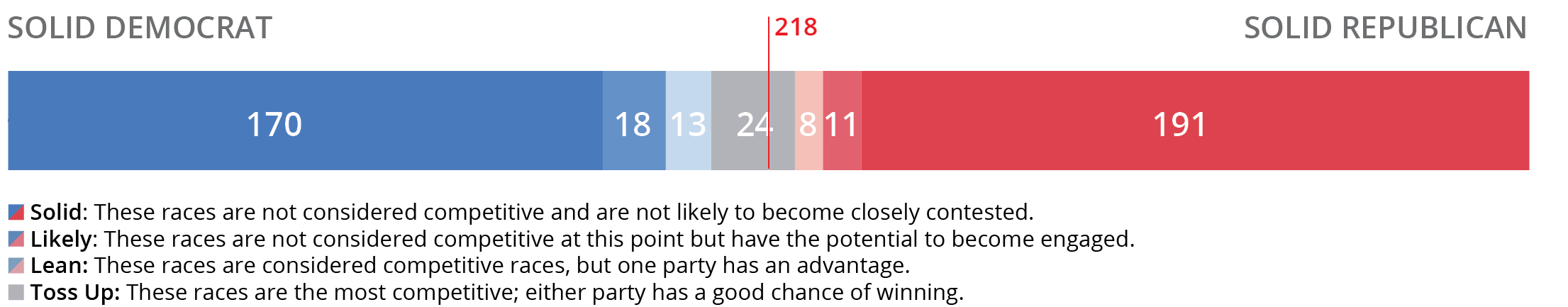

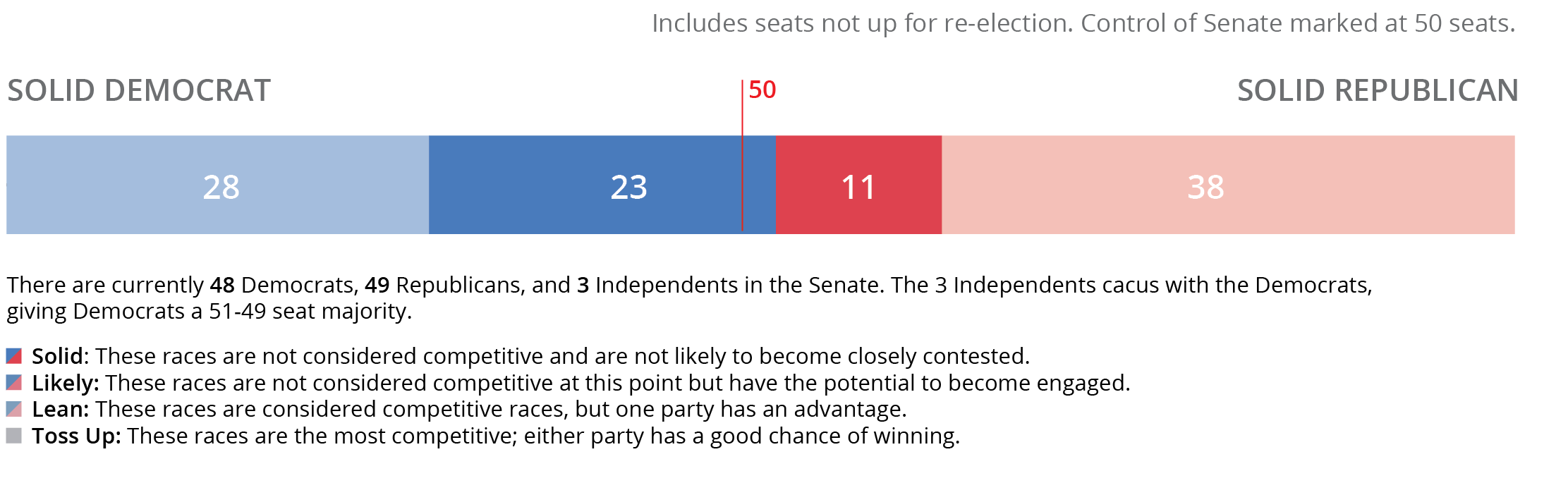

Unless there’s a significant shift, we’re currently looking at a potential flip in both chambers: the House from Republican to Democrat and the Senate from Democrat to Republican, with more confidence in the Senate scenario. There are only 24 “toss-up” seats in the House with 14 of those seats held by Republicans and 10 by Democrats (FIGURE 1). In the Senate, 34 seats are up for grabs. Twenty-three of those seats are held by Democrats and 11 by Republicans with Democrats playing defense in red states such as Montana, Arizona, and Ohio (FIGURE 2).