| 1 | There are millions of millionaires – That’s not just a figure of speech—there are 24.5 million millionaires in the US, making up about 9.4% of the population. Globally, the number climbs to 62.5 million, with 41% living in the US, 10.3% in China, and 5.9% in Japan.1 A millionaire is someone with a net worth (assets minus liabilities) of $1 million or more. |

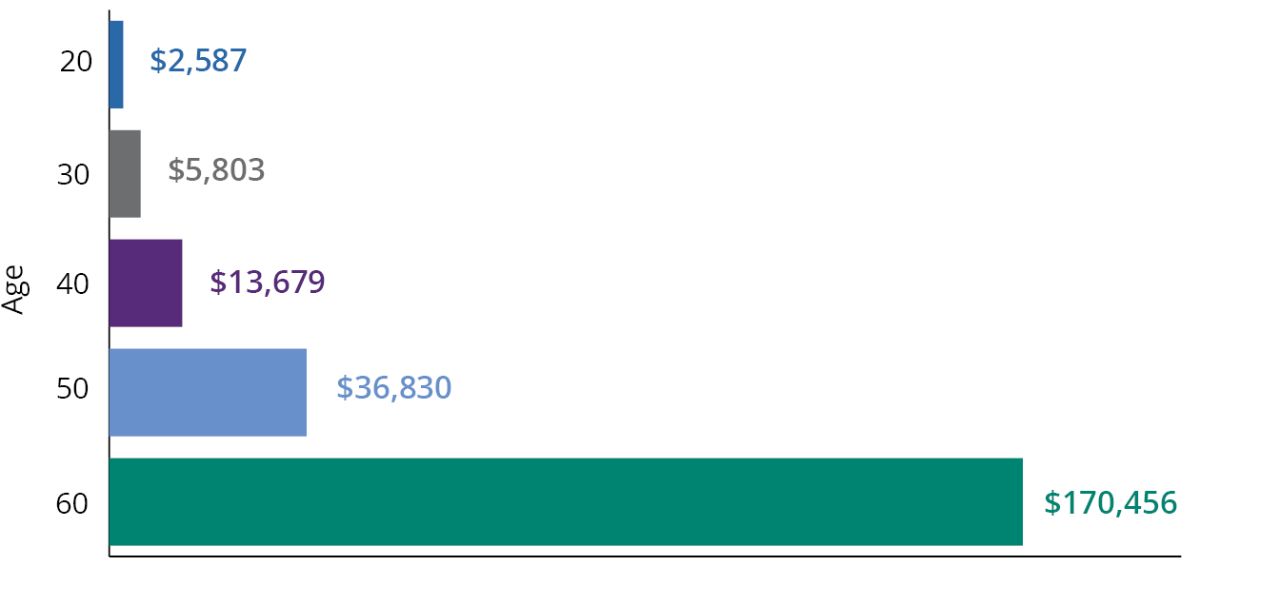

| 2 | 17% is the magic number – According to Fidelity, the average 401(k) millionaire has been investing for 26 years and contributes 17% of their income annually (including employer match). Diligently investing over decades is a tried-and-true method to get rich slow (FIGURE 1).2 |

| 3 | Good things come to those who wait – Millionaire status isn’t usually an overnight success story. Two-thirds are between 60–79 years old, and 23% are 50–59. The takeaway? Wealth is often the result of decades of saving, investing, and career growth.3 |

| 4 | The millionaire next door – Forget the flashy cars and designer labels. Most millionaires are surprisingly low-key. They live in modest homes, drive used cars, and prioritize financial freedom over flexing. Most track their expenses and stick to a budget.4 |

| 5 | The inherited wealth myth – Born rich? Think again. The vast majority of millionaires—79%—didn’t inherit a dime. They built their wealth through discipline, saving, and smart investing—not trust funds.5 |

| 6 | The Ivy League myth? – Elite degrees aren’t a prerequisite for wealth. While many millionaires are college graduates, few attended top-tier schools. Financial literacy and good money habits matter far more.6 |

| 7 | Who are the 1%? – To join the top 1% of US wage earners, you need to earn at least $550,000 a year. Many get there by owning regional businesses—think auto dealerships, dental practices, and beverage distributors.7 |

| 8 | It can pay to think small – Approximately 15% of small business owners in the US are millionaires. Think tech entrepreneurs (app developers, software, or IT services), doctors (often by owning a private practice), tax consultants, and small investment firms.8 |

| 9 | A million dollars isn't what it used to be – Back in the ‘80s, a million bucks meant private jets and champagne dreams (remember Lifestyles of the Rich and Famous?). Today, thanks to inflation, you’d need more than $3 million to match the buying power of $1 million in 1985.9 |

| 10 | What can I do for you? – Millionaires aren’t just about making money—they’re also big on giving back. 91% donated to charity last year, and 51% volunteered or fundraised. Donor-advised funds are a favorite tool for their philanthropy.10 |

FIGURE 1

Becoming a Millionaire Can Be Easier if You Start Early

Amount of Annual Savings Needed to Reach $1 Million by Age 65

This compounding example is a hypothetical example that assumes an 8% annual return. The example doesn’t represent any particular investment and is for illustrative purposes only to show the mathematical concept of compounding. It does not account for inflation, and the rate is not guaranteed. Taxes are not included in the calculations. Investments are subject to risk, including the loss of principal. Source: Hartford Funds, 6/25.

Contact a financial professional to discuss how to achieve your financial goals.

1 Source: World Population Review, “Millionaires by Country 2025.”

2 Source: Morningstar, “401(k) Millionaires Surged 43% in the Past Year—Here’s How Long it Took Them to Reach $1 Million,” 5/25/24.

3 Source: Millennial Money, Millionaire Statistics for 2025, 4/9/24.

4 Source: The Millionaire Next Door: The Surprising Secrets of America’s Wealthy, Thomas J. Stanley and William D. Danko.

5 Source: Ramsey Solutions, “The National Study of Millionaires,” 10/3/24.

6 Source: Bank of America 2024 Wealth Survey.

7 Source: The Wall Street Journal, “Meet the ‘Stealthy Wealthy’ Who Make Their Money the Boring Way,” 5/28/25.

8 Source: Go Banking Rates, “5 Industries Making the Most Millionaires in 2025,” 5/19/25.

9 Source: Bureau of Labor Statistics CPI Inflation Calculator value of $1 million in April 1985 vs. April 2025.

10 Source: Investopedia, “Donor-Advised Funds: Benefits and Drawbacks,” 2/11/25.

Important Risks: Investing involves risk, including the possible loss of principal.

This information should not be considered investment advice or a recommendation to buy/sell any security or tax advice. In addition, it does not take into account the specific investment objectives, tax, and financial condition of any specific person. Investors should consult with their own financial professional for additional information.

This information has been prepared from sources believed reliable but the accuracy and completeness of the information cannot be guaranteed.

This material and/or its contents are current at the time of writing and are subject to change without notice.