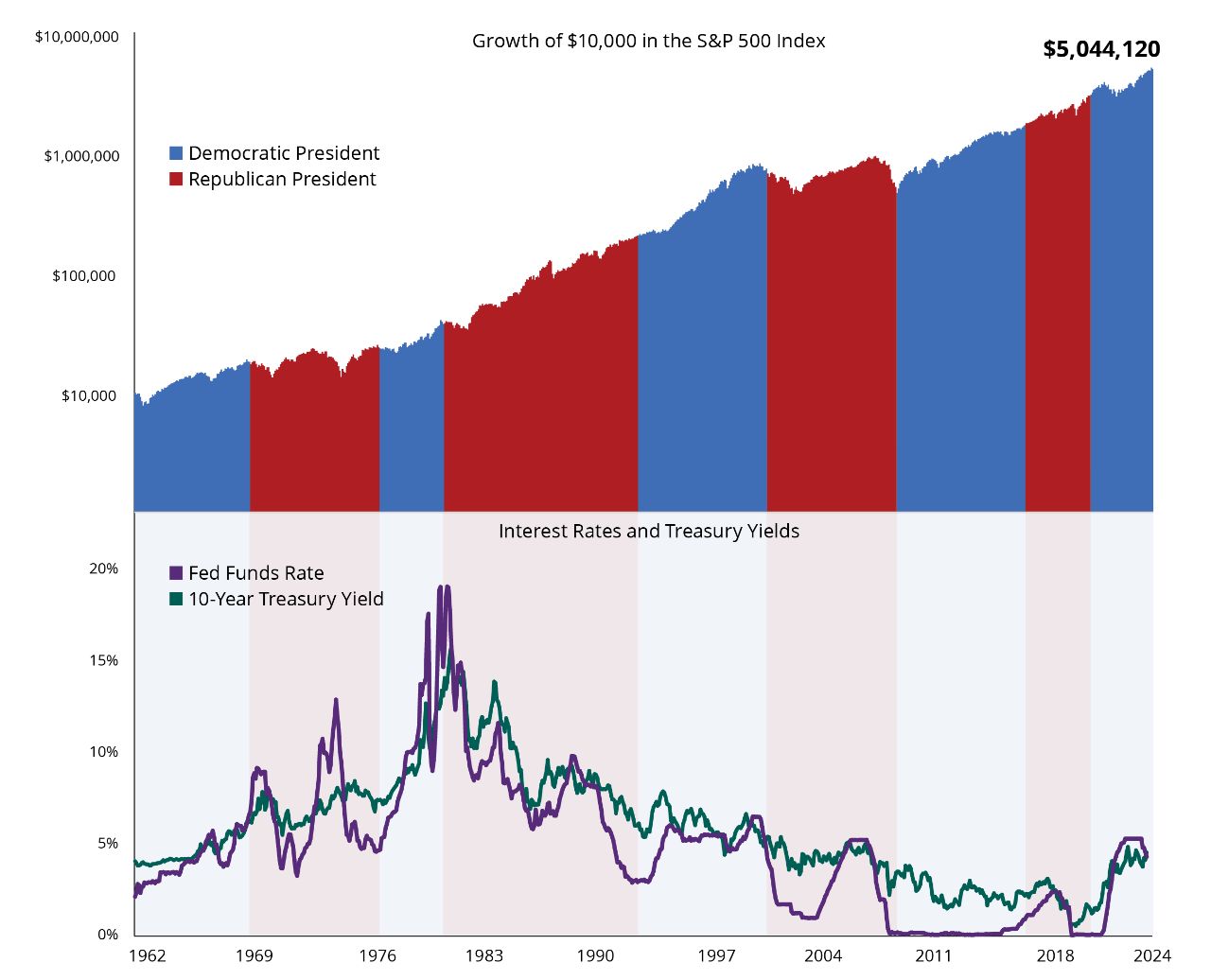

Changes in the White House and changes to interest rates can be two of the most unsettling things that investors face. But through presidents from both parties and countless interest-rate changes, the stock market has been resilient and has taken these changes in stride.

The Stock Market Marches on Despite Changes in the White House and Interest Rates

Chart data as of 1962–2024. Past performance does not guarantee future results. Indices are unmanaged and not available for direct investment. Data Sources: Morningstar and FRED, 3/25.

A financial professional can help you stay focused on your goals, despite market uncertainty.

S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks.

The federal funds rate is the target interest rate set by the Federal Open Market Committee. This target is the rate at which commercial banks borrow and lend their excess reserves to each other overnight.

Important Risks: Investing involves risk, including the possible loss of principal. • Fixed income security risks include credit, liquidity, call, duration, and interest-rate risk. As interest rates rise, bond prices generally fall.

All information provided is for informational and educational purposes only and is not intended to provide investment, tax, accounting, or legal advice. As with all matters of an investment, tax, or legal nature, you should consult with a qualified tax or legal professional regarding your specific legal or tax situation, as applicable. The preceding is not intended to be a recommendation or advice. Tax laws and regulations are complex and subject to change.