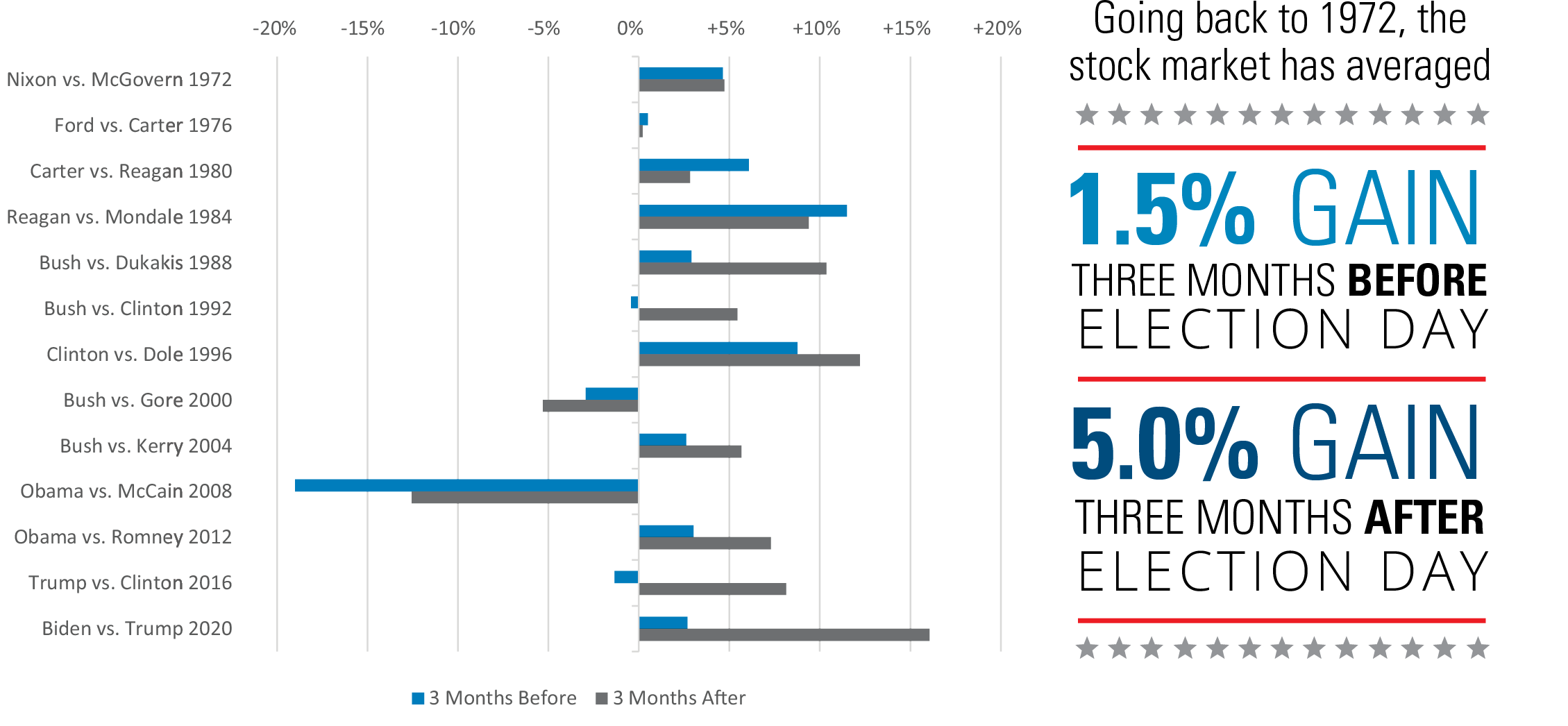

Are you tempted to change your investment strategy because of the 2024 Presidential Election? You’re not alone. In a recent survey, the potential impact of the election on portfolios concerned investors even more than economic worries.1 History suggests that changing investments based on election concerns may be unwise. For the past 13 presidential elections, the S&P 500 Index has generally been positive 90 days before and after Election Day.

Market Performance Tends to Be Positive 3 Months Before and After Presidential Elections

S&P 500 Index (% Returns)

As of 12/23. Past performance does not guarantee future results. The Index is unmanaged and not available for direct investment. For illustrative purposes only. Source: Morningstar, 1/24.

There are some notable exceptions. In 2008, the market sold off sharply due to the Global Financial Crisis. And in 2000, the market sold off by 4.1% from Election Day until December 12, when the Supreme Court handed down its ruling in the contested election between George W. Bush and Al Gore.2

Bottom line: Market returns are more dependent on the outlook for the economy than on the outcome of an election.

A financial professional can help you build a diversified portfolio that’s right for you despite the uncertainty surrounding the election.

1 Morningstar, “Presidential Election Years Are Usually Winners for US Stocks,” 12/23

2 Morningstar, Hartford Funds, 1/24

The S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks.

Investing involves risk, including the possible loss of principal. This material is provided for educational purposes only.