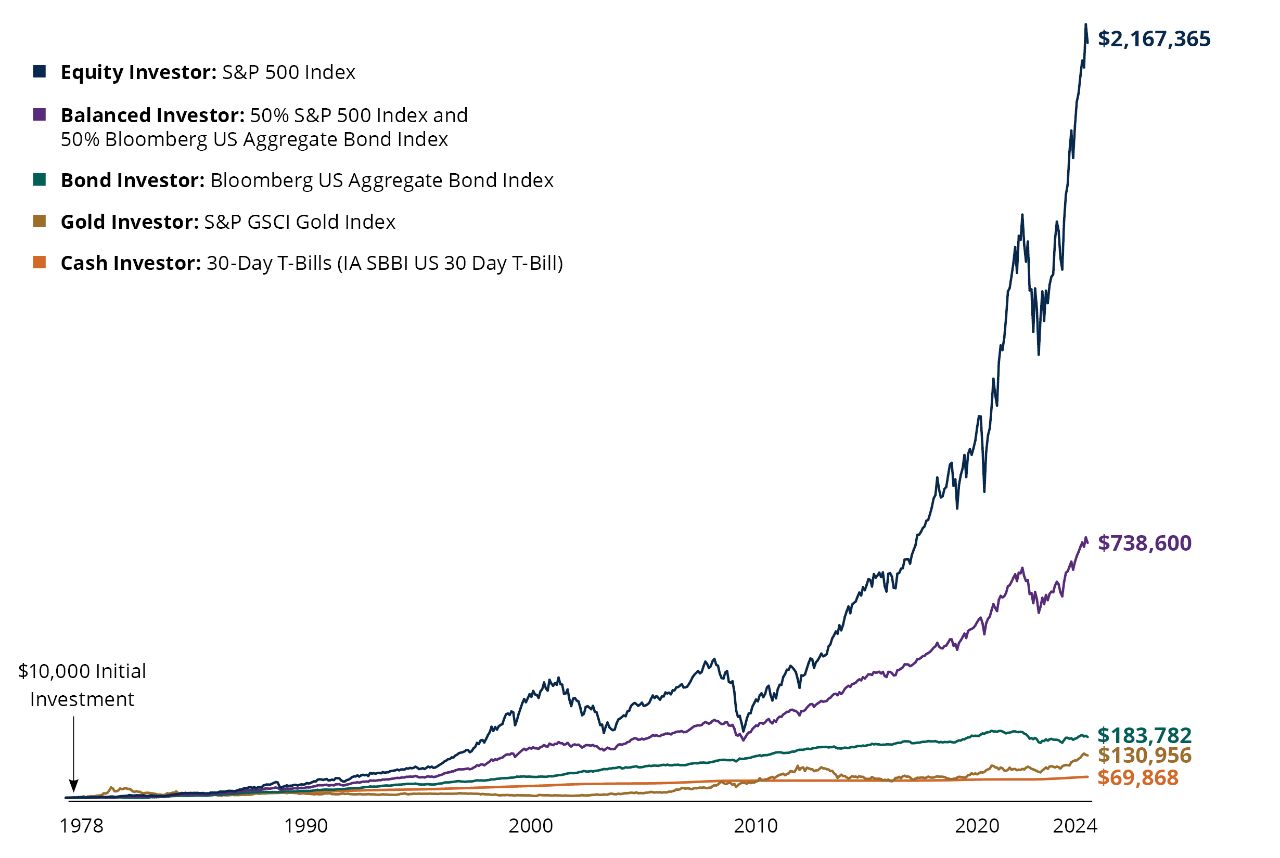

Asset classes have often traded periods of outperformance as market conditions change. And while investors may appreciate the relative stability of investments such as gold and cash, their return potential has historically lagged equity and balanced investors over the long term. For investors worried about market turbulence, diversifying among asset classes may help provide a smoother ride without sacrificing growth potential.

Long-Term Returns for Different Asset Classes

Growth of $10,000 (1978-2024)

As of 12/31/24. Past performance does not guarantee future results. Indices are unmanaged and not available for direct investment. Bloomberg US Aggregate Bond Index is composed of securities that cover the US investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. The IA SBBI US 30 Day T-Bill Index measures the performance of a single issue of outstanding Treasury Bill which matures closest to, but not beyond, one month from the rebalancing date. The issue is purchased at the beginning of the month and held for a full month; at the end of the month that issue is sold and rolled into a newly selected issue. The Index is calculated by Morningstar and the raw data is from WSJ. S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks. S&P GSCI Gold Index is a sub-index of the S&P GSCI that provides investors with a reliable and publicly available benchmark tracking the COMEX gold future. For illustrative purposes only. Data Source: Morningstar, 4/25.

Historical Performance of Asset Classes

Average Annual Returns (as of 12/31/24)

| Stocks | 50% Stock/ 50% Bonds |

Bonds | Gold | Cash | |

| Average Annual Total Returns (%) | |||||

| 1 Year | 25.02 | 13.14 | 1.25 | 26.62 | 5.37 |

| 5 Year | 14.53 | 7.28 | -0.33 | 10.42 | 2.42 |

| 10 Year | 13.10 | 7.38 | 1.35 | 7.39 | 1.71 |

| 20 Year | 10.35 | 7.06 | 3.01 | 8.46 | 1.56 |

Risk-and-Reward Trade-Off for Asset Classes

Rolling Returns (1978-2024)

| Stocks | 50% Stock/ 50% Bonds |

Bonds | Gold | Cash | |

| Rolling 1-Year Return (%) | |||||

| Best | 61.18 | 45.04 | 35.21 | 192.35 | 15.20 |

| Worst | -43.32 | -21.20 | -15.68 | -36.27 | 0.01 |

| % Positive | 82% | 87% | 86% | 58% | 100% |

| Rolling 5-Year Return (%) | |||||

| Best | 29.63 | 22.78 | 20.28 | 22.64 | 11.13 |

| Worst | -6.63 | -0.69 | -0.54 | -15.96 | 0.03 |

| % Positive | 90% | 99% | 98% | 65% | 100% |

| Rolling 10-Year Return (%) | |||||

| Best | 19.49 | 16.31 | 14.68 | 19.97 | 9.17 |

| Worst | -3.43 | 1.75 | 0.74 | -5.98 | 0.27 |

| % Positive | 95% | 100% | 100% | 71% | 100% |

| Rolling 20-Year Return (%) | |||||

| Best | 18.26 | 14.63 | 11.16 | 9.51 | 7.29 |

| Worst | 4.79 | 5.46 | 2.81 | -4.14 | 1.14 |

| % Positive | 100% | 100% | 100% | 85% | 100% |

As of 12/31/24. Past performance does not guarantee future results. % Positive in the chart is the percentage of time each asset class had a positive return based on rolling monthly returns for the time periods shown; results may be rounded. For illustrative purposes only. Data Sources: Morningstar and Hartford Funds, 3/25.

Talk to your financial professional about how diversification can help you build a stronger portfolio.

Important Risks: Investing involves risk, including the possible loss of principal. • Fixed income security risks include credit, liquidity, call, duration, and interest-rate risk. As interest rates rise, bond prices generally fall. • Investments linked to prices of commodities may be considered speculative. Significant exposure to commodities may be subject to greater volatility than traditional investments. The value of such instruments may be volatile and fluctuate widely based on a variety of factors. Diversification does not ensure a profit or protect against a loss in a declining market.

All information provided is for informational and educational purposes only and is not intended to provide investment, tax, accounting, or legal advice. As with all matters of an investment, tax, or legal nature, you should consult with a qualified tax or legal professional regarding your specific legal or tax situation, as applicable. The preceding is not intended to be a recommendation or advice. Tax laws and regulations are complex and subject to change.