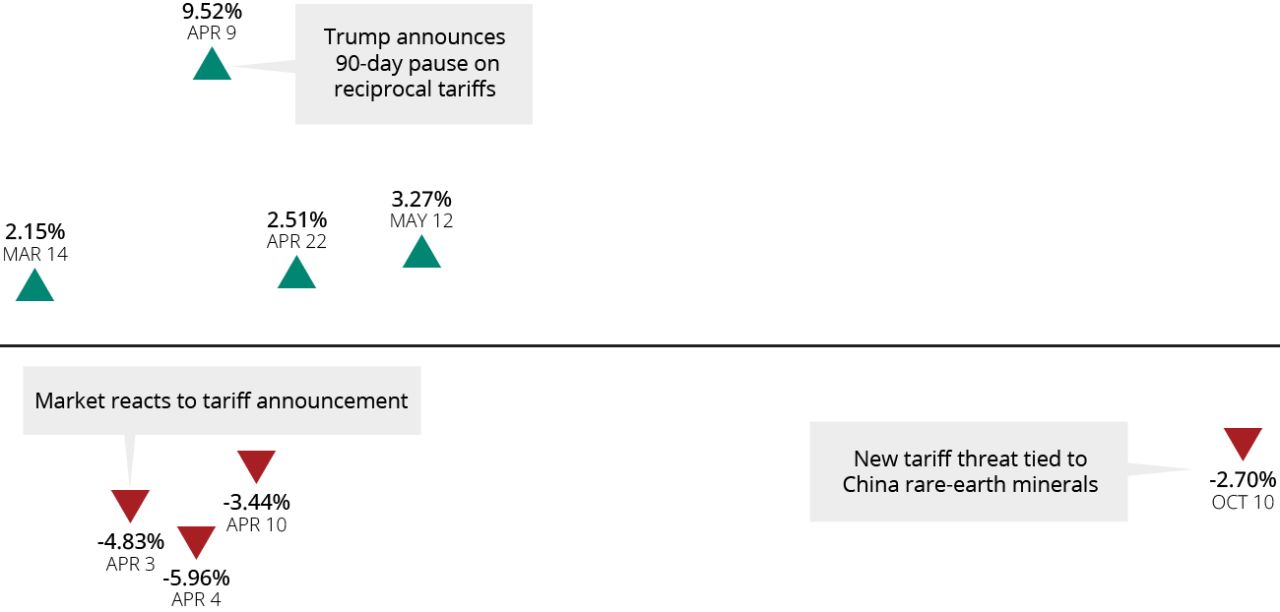

Most of 2025’s Best and Worst Days Were Close Together

Past performance does not guarantee future results. Indices are unmanaged and not available for direct investment. Sources: DataTrek Research and Morningstar, 1/26.

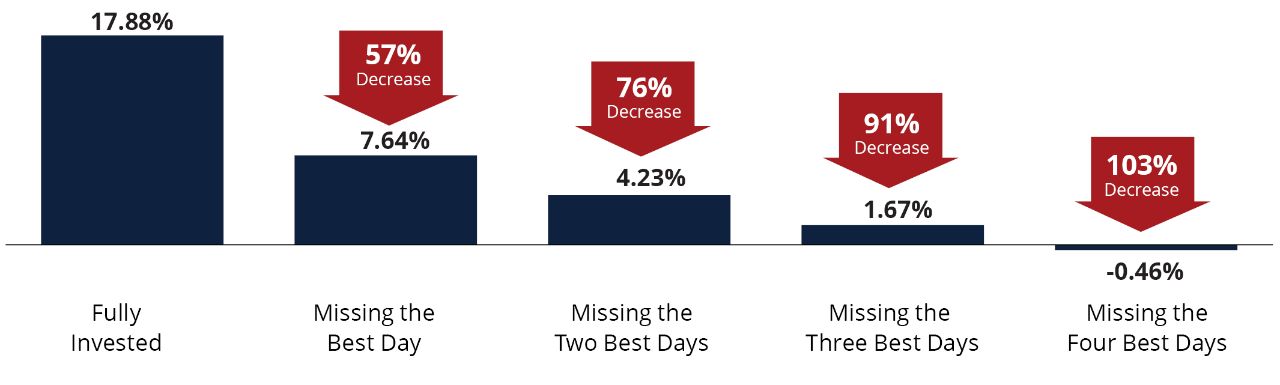

Missing the Market’s Best Days in 2025 Was Costly

S&P 500 Index Average Annual Total Returns

Past performance does not guarantee future results. For illustrative purposes only. Investors cannot invest directly in indices. Data Sources: Ned Davis Research, Morningstar, and Hartford Funds, 1/26.

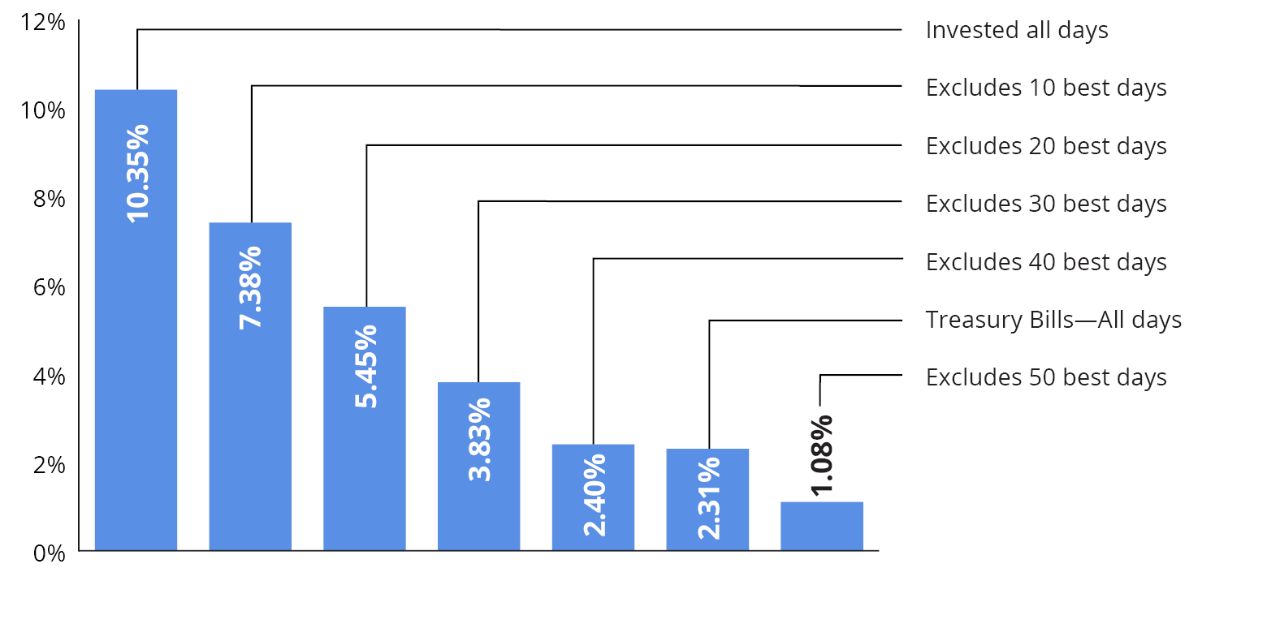

2025 Wasn’t an Anomaly: Penalties of Missing the Market’s Best Days

S&P 500 Index Average Annual Total Returns (1996-2025)

Past performance does not guarantee future results. For illustrative purposes only. Indices are unmanaged and not available for direct investment. Data Sources: Ned Davis Research and Hartford Funds, 1/26.

Talk to your financial professional about how to help prepare your portfolio for volatility.

Investing involves risk, including the possible loss of principal.

S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks.

This material is provided for educational purposes only.This information has been prepared from sources believed reliable but the accuracy and completeness of the information cannot be guaranteed. This material and/or its contents are current at the time of writing and are subject to change without notice.

This information should not be considered investment advice or a recommendation to buy/sell any security or tax advice. In addition, it does not take into account the specific investment objectives, tax, and financial condition of any specific person. Investors should consult with their own financial professional for additional information.