Municipal, or “muni,” bonds are issued by state or local governments to finance public works and infrastructure projects. What makes munis a unique fixed-income instrument is that they’re generally exempt from federal taxes and often exempt from state and local taxes, although investors may be subject to the federal Alternative Minimum Tax.

This potential advantage is more pronounced in higher tax brackets, which is why muni bonds have earned a reputation as an investment geared toward wealthier individuals.

But as we see it, muni bonds aren’t just an investment option for investors in the highest tax brackets. Here are five reasons investors may want to consider investing in muni bonds:

1. Muni bonds tend to be high-quality investments. The average five-year cumulative default rate for investment-grade muni bonds was only 0.04% from 1970-2024.1

2. Supply and demand are both healthy. New issuance hit records in both 2024 and 2025. At the same time, demand is still strong for high-quality munis as investors continue to look for avenues to reduce taxes while seeking to maintain stability.

3. Muni bonds can help diversify your portfolio. Muni bonds are domestically focused, while many stocks have global exposure and are more sensitive to macroeconomic developments.

4. Muni bonds may be well positioned for a variety of economic backdrops. It’s common for muni bonds to back essential services, such as sewer, water, and garbage collection. If recession strikes and money is tight, consumers may give up discretionary services but not basic necessities.

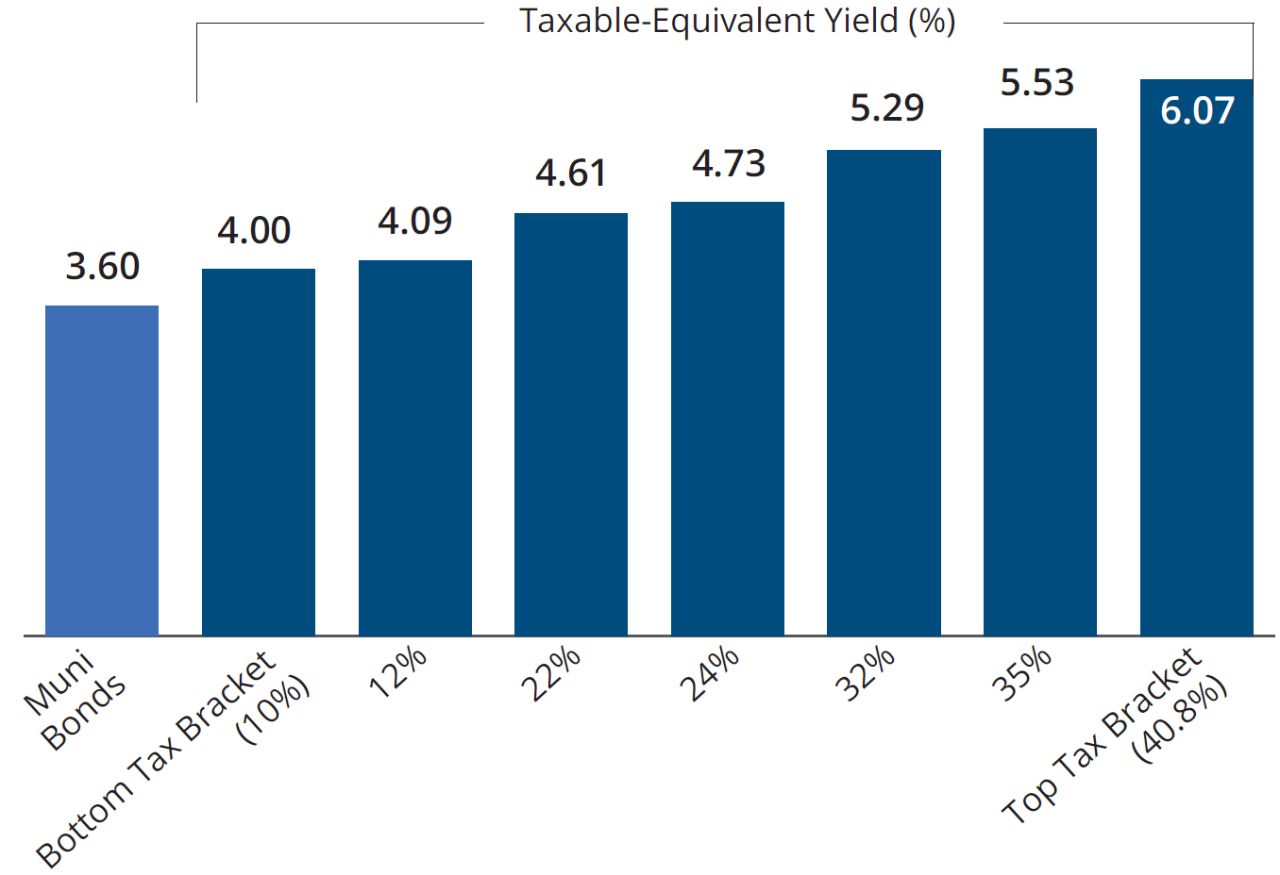

5. Muni bonds could help investors keep more of their returns on an absolute basis. As of December 31, 2025, muni bonds were yielding 3.60%. But their taxable-equivalent yield (the return required on a taxable bond to make it equal to the return of a tax-exempt bond) would increase to 4.00% for investors in the lowest tax bracket and 6.07% for investors in the highest tax bracket.