1. The Power of Compounding

Einstein said, “compound interest is the eighth wonder of the world.” By saving early in your career, you can put the power of compounding to work for you.

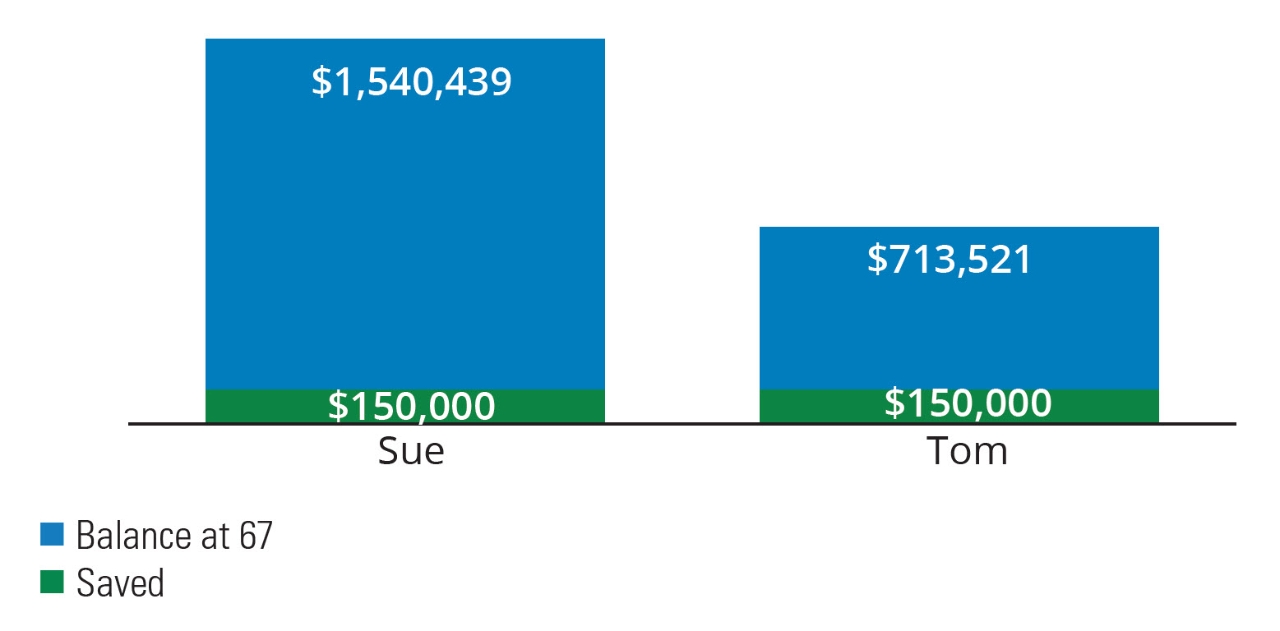

Sue starts saving at age 25 but Tom waits to start until age 35. Even though they both saved the same amount of money over the same number of years, Sue accumulates more than twice as much as Tom when they both reach age 67.1

Starting Early Can Result in a Much Larger Nest Egg

2. Max the Match

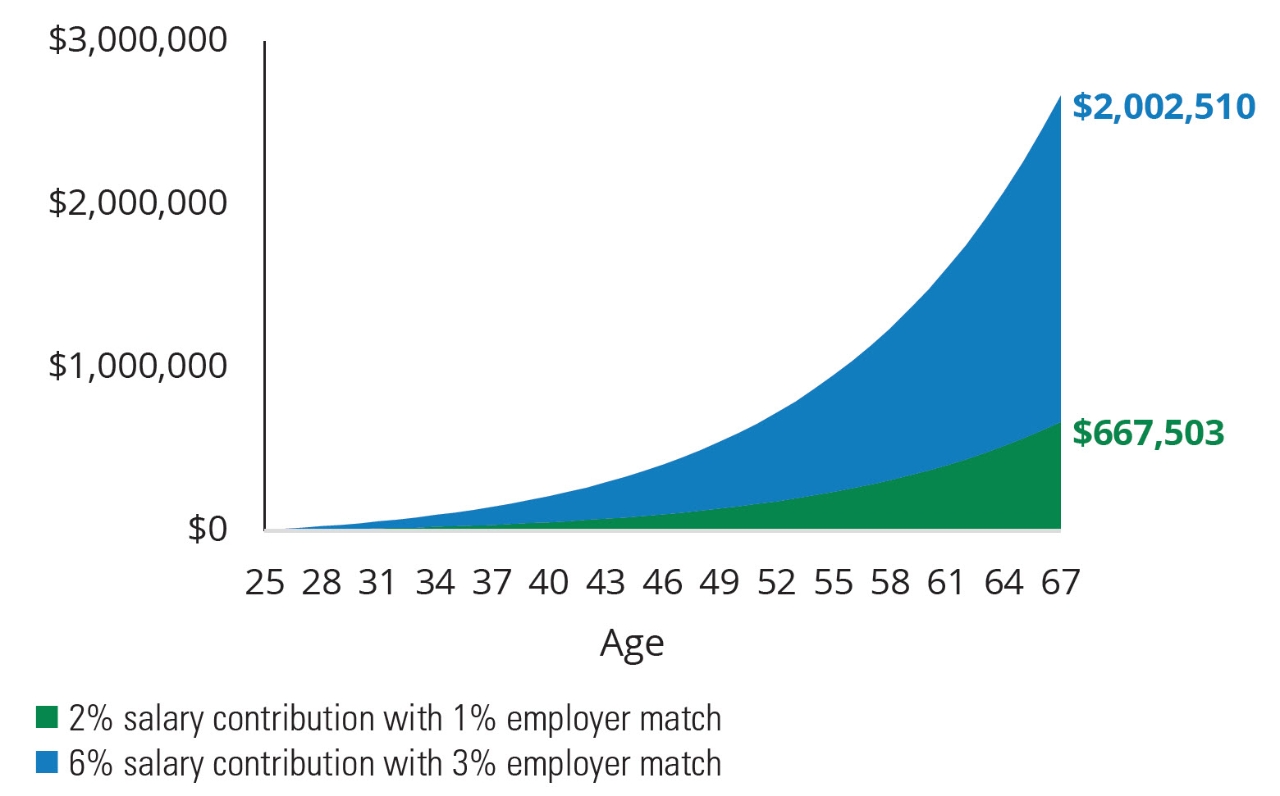

If your employer’s 401(k) plan offers a company match, this can significantly boost your retirement savings over the long term.

Taking advantage of your employer’s maximum 401(k) matching contribution allows you to accumulate three times more money than if you’d only contributed enough to receive the minimum matching contribution. 2,3

Maximizing Your Company’s Matching Contribution Could Triple Your Ending Account Value

This hypothetical illustration assumes an annual contribution of $5,000 investment and an annual 8% return. The illustration doesn’t represent any particular investment; only to show the mathematical concept of compounding. It doesn’t account for inflation or taxes, and the rate isn’t guaranteed.

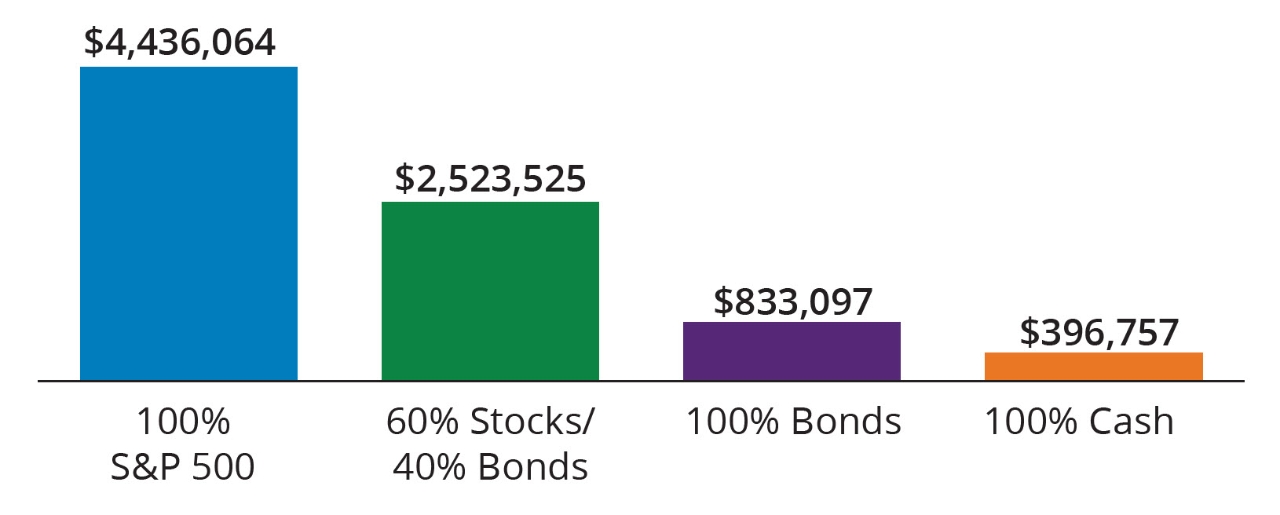

3. Consider Alternatives to Cash

While cash has performed well lately, it hasn’t historically created wealth over the long term relative to other asset classes. Depending on your time horizon and risk level, consider allocating to equities, fixed income, or a combination of both.

Equities and Fixed Income Have Historically Grown Wealth Much Faster Than Cash

Past performance does not guarantee future results. Stock returns are for the S&P 500 Index; Bond returns are for the Bloomberg US Aggregate Bond Index; Cash returns are for the IA SBBI US 30 Day Tbill TR USD. Indices are unmanaged and not available for direct investment. Data Source: Morningstar, 1981-2023.

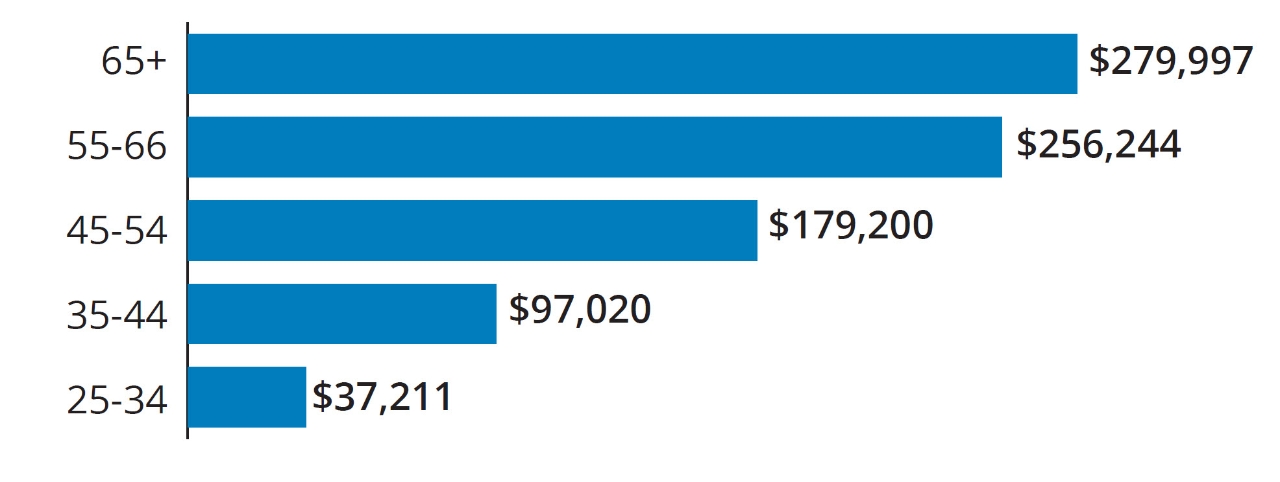

How Do You Compare?

If you haven’t made saving for retirement a priority, it’s never too late to start. See how your savings match up against others in your age group, then commit to increasing your retirement savings rate by one or two percent each time you get a raise.

Average Retirement Savings by Age

Source: Source: Western & Southern Financial Group

Talk to your financial professional today to see if your retirement savings plan is on track.

This material is provided for educational purposes only. This information should not be considered investment advice or a recommendation to buy/sell any security. In addition, it does not take into account the specific investment objectives, tax, and financial condition of any specific person. As with all matters of an investment, tax, or legal nature, you should consult with a qualified tax or legal professional regarding your or your specific situation as applicable.

This information has been prepared from sources believed reliable but the accuracy and completeness of the information cannot be guaranteed. This material and/or its contents are current at the time of writing and are subject to change without notice.

“Bloomberg®” and any Bloomberg Index are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the indices (collectively, “Bloomberg”) and have been licensed for use for certain purposes by Hartford Funds. Bloomberg is not affiliated with Hartford Funds, and Bloomberg does not approve, endorse, review, or recommend any Hartford Funds product. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to Hartford Fund products.

Past performance does not guarantee future results.

Important Risks: Investing involves risk, including the possible loss of principal. • Fixed income security risks include credit, liquidity, call, duration, event and interest-rate risk. As interest rates rise, bond prices generally fall.

Indices are unmanaged and not available for direct investment. S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks. IA SBBI US Intermediate-Term Government Bond Index measures the performance of five-year maturity US Treasury Bonds. Bloomberg US Aggregate Bond Index is composed of securities that covers the US investment-grade fixed-rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

1 Assumes an annual contribution of $5,000 for 30 years and a hypothetical annual return on investment of 8%. The example doesn’t represent any particular investment and is for illustrative purposes only to show the mathematical concept of compounding. It doesn’t account for inflation, and the rate isn’t guaranteed. Taxes aren’t included in the calculations.

2 Assumes a starting salary of $50,000 that increases annually by 2.5% until age 67 and a hypothetical annual return on investment of 8%.

3 The company match in this example $0.50 for every dollar up to 6%. A deferral rate of 2% would qualify for the minimum employer match of 1%, while a deferral rate of 6% would qualify for the full 3% employer match.