As a financial professional, you know prospecting is a fundamental part of a thriving practice. Yet many financial professionals, whether new or veterans of the business, avoid it. This is often due to fear of rejection or a lack of a strategy. But what if you approached existing clients?

Prospecting existing clients sounds counterintuitive, maybe even ridiculous. But have you tapped all opportunities in those relationships? Or are they on cruise control, even stagnant?

Segment Your Clients Using The 80/20 Rule

In a related article, we illustrated how a disproportionate amount of your business (typically 80%) is generated by relatively few of your clients (about 20%).

As explained in the first two articles in this series, doing an 80/20 analysis of your business will help you to:

- Play defense: Retain your biggest and best client relationships and acquire new ones

- Play offense: Deepen and also replicate those top revenue-generating relationships

Now, we’re going to focus on the MVPs in your business—your Most Valuable Prospects.

Determine Who Your MVPs Are

To segment the MVPs in your book of business, apply 80/20 math to the bottom 80% of your clients. The top 20% of that 80% are your MVPs. This is the group you'll focus your prospecting efforts on.

Filters will guide this determination. You can highlight names and create a numbered list. Do whatever you need to do to make a mental checklist of sorts to determine growth potential.

Now, assess this group using criteria other than asset level. View them through the lenses of:

- Likeability

- Is this a mutually beneficial relationship? Do you enjoy working together?

- Referability

- Even if they’re not a top client, have they referred one to you? Do they have the potential to? Are they a good center of influence?”

- Growth potential

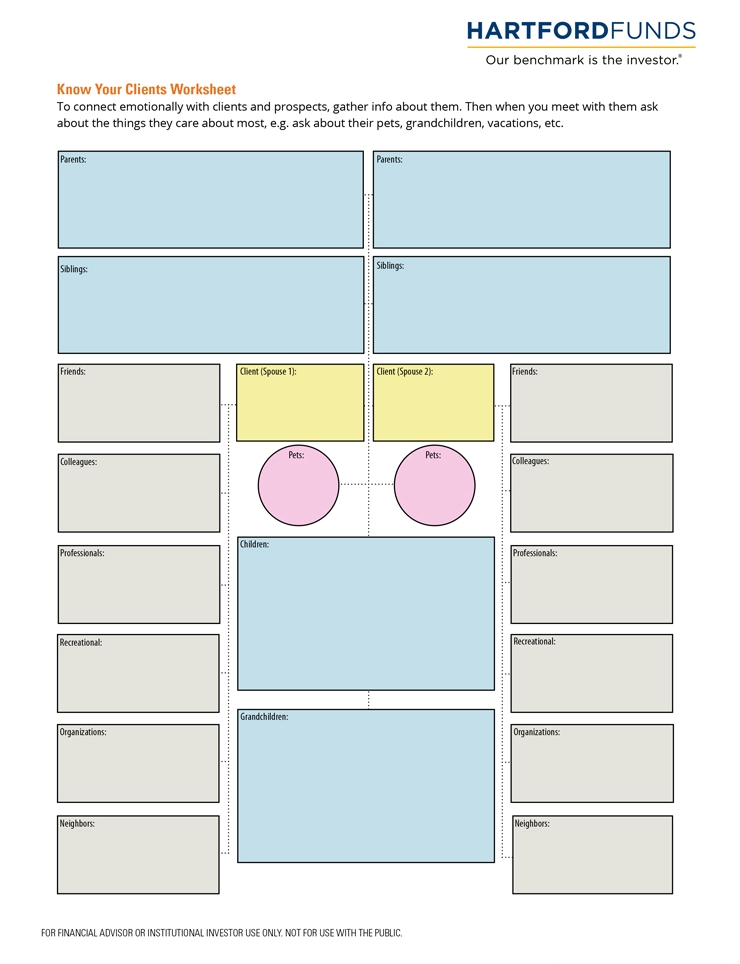

- Ever hear the expression “Your network is your net worth?” We, and our clients, tend to spend time with people similar to ourselves. To get a sense of who your clients know or associate with, consider the following questions:

Educate—Where were they educated (college, vocational school, armed services)?

Recreate—Where do they recreate? (What do they like to do?)

Congregate—Where do they congregate? (Where do they socialize?)

Donate—Where do they donate (time, talent, or money)?

- Ever hear the expression “Your network is your net worth?” We, and our clients, tend to spend time with people similar to ourselves. To get a sense of who your clients know or associate with, consider the following questions:

- The 50/50 test:

- If you have clients who are over the age of 50, but have less than $50,000 in assets with you, there’s probably some sort of disconnect and you need to get to the bottom of it. It's probably time to have what is called “the talk,” which goes something like this:

“While I certainly appreciate the $40,000 you've entrusted with my firm, I wonder if I’m a relevant part of your overall financial picture. What are your thoughts on us growing that part of our relationship?"

If you don't have the talk, the answer is always no. If you do, your client either agrees to grow the business relationship or you gain clarity in knowing why they can't or aren't interested in growing the relationship. It brings you one of two things: more business or clarity.

What About Your Clients Who Aren't MVPs?

Your MVPs may not be your biggest and best relationships, but that doesn't mean those relationships are void of potential.

In the end, if these relationships don't rise to a much higher level, you can still allocate your time and energy to these relationships proportionately with the complexity of their financial situation. This will enable you to spend 80% of time with 20% of clients who are generating 80% of your business.

Next Steps

| 1 | Download the Precision Prospecting: Define your ideal client and get results you want financial professional worksheet below |

| 2 | Fill in the grid to identify commonalities among your top clients and uncover opportunities among your MVP list |

| 3 | Contact your Hartford Funds advisor consultant about tailoring your marketing message to your most valuable prospects |